Frontier Communications 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

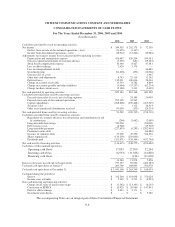

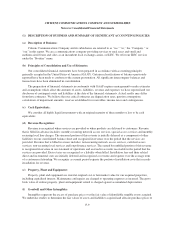

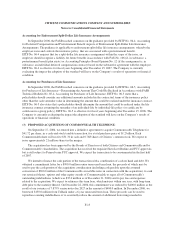

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For The Years Ended December 31, 2006, 2005 and 2004

($ in thousands)

2006 2005 2004

Cash flows provided by (used in) operating activities:

Net income ......................................................... $ 344,555 $ 202,375 $ 72,150

Deduct: Gain on sale of discontinued operations—(net) .................. (71,635) (1,167) —

Income from discontinued operations—(net) .......................... (18,912) (13,266) (15,086)

Adjustments to reconcile income to net cash provided by operating activities:

Depreciation and amortization expense ............................... 476,487 520,204 549,381

Gain on expiration/settlement of customer advance ..................... (3,539) (681) (25,345)

Stock based compensation expense .................................. 10,340 8,427 47,581

Loss on debt exchange ............................................ 2,420 3,175 —

Loss on extinguishment of debt ..................................... — — 66,480

Investment gains ................................................ (61,428) (492) (12,066)

Gain on sales of assets ............................................ — — 1,945

Other non-cash adjustments ........................................ 8,743 23,119 31,262

Deferred taxes .................................................. 132,031 100,636 24,016

Change in accounts receivable ...................................... 15,333 8,782 6,804

Change in accounts payable and other liabilities ........................ (3,064) (37,257) (62,234)

Change in other current assets ...................................... (2,148) 5,313 (3,639)

Net cash provided by operating activities ................................. 829,183 819,168 681,249

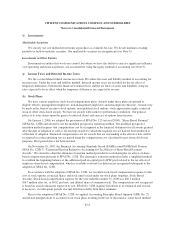

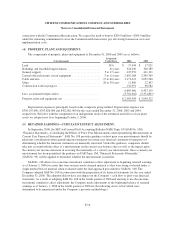

Cash flows provided from (used by) investing activities:

Proceeds from sales of assets, net of selling expenses .................... — 24,195 30,959

Proceeds from sale of discontinued operations ......................... 255,305 43,565 —

Capital expenditures .............................................. (268,806) (259,448) (263,949)

Securities sold .................................................. — 1,112 26,514

Other asset (purchased) distributions received ......................... 67,050 (139) (28,234)

Net cash provided from (used by) investing activities ........................ 53,549 (190,715) (234,710)

Cash flows provided from (used by) financing activities:

Repayment of customer advances for construction and contributions in aid

of construction ................................................ (264) (1,662) (2,089)

Long-term debt borrowings ........................................ 550,000 — 700,000

Debt issuance costs .............................................. (6,948) — (15,502)

Long-term debt payments ......................................... (227,693) (6,299) (1,202,403)

Premium to retire debt ............................................ — — (66,480)

Issuance of common stock ......................................... 27,200 47,550 544,562

Shares repurchased ............................................... (135,239) (250,000) —

Dividends paid .................................................. (323,671) (338,364) (832,768)

Net cash used by financing activities ..................................... (116,615) (548,775) (874,680)

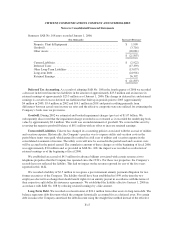

Cash flows of discontinued operations:

Operating cash flows ...................................... 17,833 27,500 32,294

Investing cash flows ....................................... (6,593) (11,388) (14,820)

Financing cash flows ...................................... — (134) (11,618)

11,240 15,978 5,856

Increase (decrease) in cash and cash equivalents ........................... 777,357 95,656 (422,285)

Cash and cash equivalents at January 1, .................................. 263,749 168,093 590,378

Cash and cash equivalents at December 31, ............................... $ 1,041,106 $ 263,749 $ 168,093

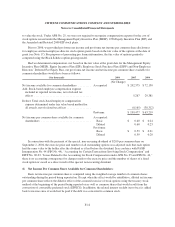

Cash paid during the period for:

Interest ........................................................ $ 332,204 $ 318,638 $ 370,128

Income taxes (refunds) ............................................ $ 5,365 $ 4,711 $ (4,901)

Non-cash investing and financing activities:

Change in fair value of interest rate swaps ............................ $ (1,562) $ (13,193) $ (6,135)

Conversion of EPPICS ............................................ $ 15,925 $ 29,980 $ 147,991

Debt-for-debt exchange ........................................... $ 2,433 $ 2,171 $ —

Investment write-downs ........................................... $ — $ — $ 5,286

The accompanying Notes are an integral part of these Consolidated Financial Statements.

F-8