Frontier Communications 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

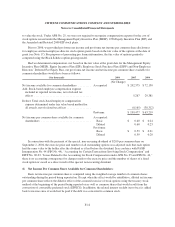

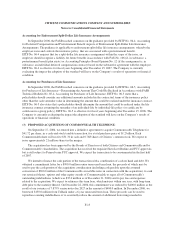

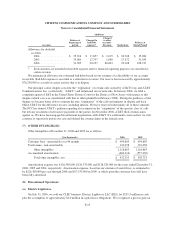

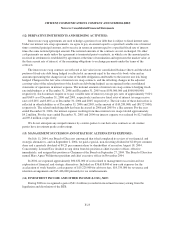

Additions

Accounts

Balance at

beginning of

period

Charged to

bad debt

expense*

Charged

to other

accounts -

Revenue Deductions

Balance at

End of Period

Allowance for doubtful

accounts

2004 ................. $ 35,916 $ 17,657 $ 2,215 $ 20,708 $ 35,080

2005 ................. 35,080 12,797 1,080 17,572 31,385

2006 ................. 31,385 20,257 80,003 23,108 108,537

* Such amounts are included in bad debt expense and for financial reporting purposes are classified as

contra-revenue.

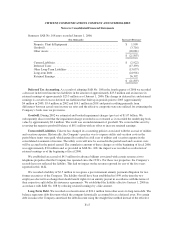

We maintain an allowance for estimated bad debts based on our estimate of collectibility of our accounts

receivable. Bad debt expense is recorded as a reduction to revenue. Our reserve has increased by approximately

$78,250,000 as a result of carrier activity that is in dispute.

Our principal carrier dispute concerns the “origination” of certain calls carried by AT&T Corp. and AT&T

Communications, Inc. (collectively, “AT&T”) and terminated on our networks. In January 2006, we filed a

complaint against AT&T in the United States District Court for the District of New Jersey with respect to this

dispute (which case was consolidated with that of other plaintiffs in February 2006). During the pendency of the

dispute we became better able to estimate the true “origination” of the calls and minutes in dispute and back

billed AT&T for the difference in rates, including interest. We have reserved substantially all of these amounts.

The FCC has denied AT&T’s petition regarding its treatment on the “origination” of the specific class of calls

but left any resolution of retroactive payments to the parties. In November 2006, AT&T filed counterclaims

against us. We have been engaged in settlement negotiations with AT&T. If a settlement is not reached, we will

continue to vigorously pursue our case and defend the counterclaims in the federal court.

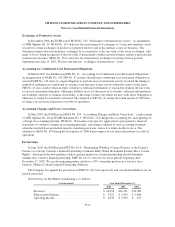

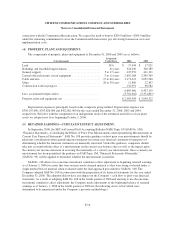

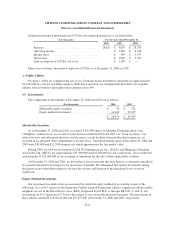

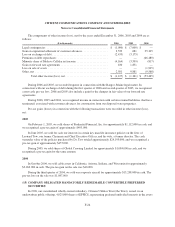

(7) OTHER INTANGIBLES:

Other intangibles at December 31, 2006 and 2005 are as follows:

($ in thousands) 2006 2005

Customer base - amortizable over 96 months ...................... $ 994,605 $ 994,605

Trade name - non-amortizable ................................. 122,058 122,058

Other intangibles ........................................ 1,116,663 1,116,663

Accumulated amortization .................................... (684,310) (557,930)

Total other intangibles, net ................................ $ 432,353 $ 558,733

Amortization expense was $126,380,000, $126,378,000 and $126,520,000 for the years ended December 31,

2006, 2005 and 2004, respectively. Amortization expense, based on our estimate of useful lives, is estimated to

be $126,380,000 per year through 2008 and $57,535,000 in 2009, at which point the customer base will have

been fully amortized.

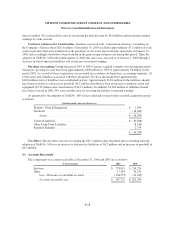

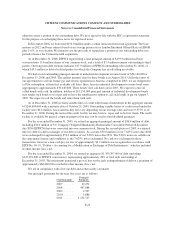

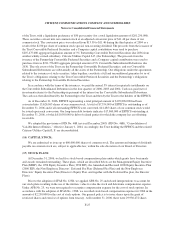

(8) Discontinued Operations:

(a) Electric Lightwave

On July 31, 2006, we sold our CLEC business, Electric Lightwave LLC (ELI), for $255.3 million in cash

plus the assumption of approximately $4.0 million in capital lease obligations. We recognized a pre-tax gain on

F-19