Frontier Communications 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

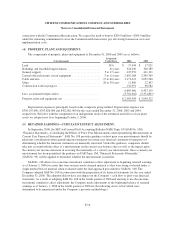

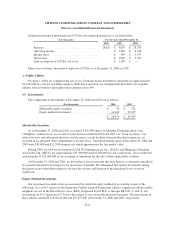

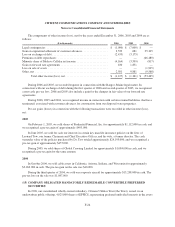

Summarized financial information for CCUSA (discontinued operations) is set forth below:

($ in thousands) For the years ended December 31,

2006 2005 2004

Revenue ...................................... (Sold) $ 4,607 $ 24,558

Operating income .............................. $ 1,489 $ 8,188

Income taxes .................................. $ 449 $ 2,957

Net income ................................... $ 1,040 $ 5,231

Gain on disposal of CCUSA, net of tax ............. $ 1,167 $ —

There was no balance sheet data to report for CCUSA as of December 31, 2006 or 2005.

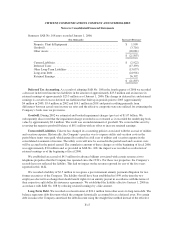

(c) Public Utilities

On April 1, 2004, we completed the sale of our Vermont electric distribution operations for approximately

$13,992,000 in cash, net of selling expenses. With that transaction, we completed the divestiture of our public

utilities services business pursuant to plans announced in 1999.

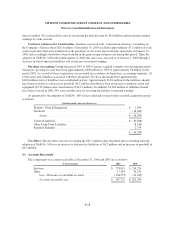

(9) Investments:

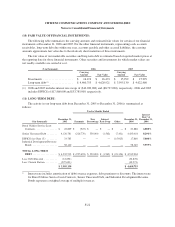

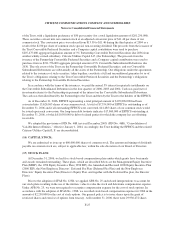

The components of investments at December 31, 2006 and 2005 are as follows:

($ in thousands) 2006 2005

Marketable equity securities ..................... $ 30 $ 122

Equity method investments ...................... 16,444 15,877

$ 16,474 $ 15,999

Marketable Securities

As of December 31, 2006 and 2005, we owned 3,059,000 shares of Adelphia Communications Corp.

(Adelphia) common stock. As a result of write downs recorded in 2002 and 2001, our “book cost basis” was

reduced to zero and subsequent increases and decreases, except for those deemed other than temporary, are

included in accumulated other comprehensive income (loss). Unrealized holding gains at December 31, 2006 and

2005 were $30,000 and $122,000 respectively which approximates the fair market value.

During 2004, we sold our investments in D & E Communications, Inc. (D & E) and Hungarian Telephone

and Cable Corp. (HTCC) for approximately $13,300,000 and $13,200,000 in cash, respectively. We recorded net

realized gains of $12,066,000 in our statement of operations for the sale of these marketable securities.

At December 31, 2006 and 2005, we did not have any investments that have been in a continuous unrealized

loss position deemed to be temporary for more than 12 months. We determined that market fluctuations during

the period are not other than temporary because the severity and duration of the unrealized losses were not

significant.

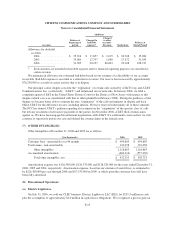

Equity Method Investments

Our investments in entities that are accounted for under the equity method of accounting consist of the

following: (1) a 16.8% interest in the Fairmount Cellular Limited Partnership which is engaged in cellular mobile

telephone service in the Rural Service Area (RSA) designated by the FCC as Georgia RSA No. 3; and (2) our

investments in CU Capital and CU Trust with relation to our convertible preferred securities. The investments in

these entities amounted to $16,444,000 and $15,877,000 at December 31, 2006 and 2005, respectively.

F-21