Dish Network 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-66

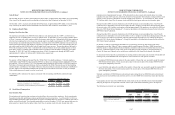

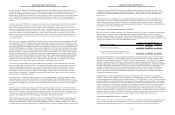

Geographic Information. Revenues are attributed to geographic regions based upon the location where the

products are delivered and services are provided. The following table summarizes revenue attributed to the United

States and foreign locations.

2012 2011 2010

Revenue:

United States............................................................. 13,751,675$ 13,637,945$ 12,640,744$

United Kingdom........................................................ 292,788 241,843 -

Mexico....................................................................... 168,362 117,123 -

Other.......................................................................... 53,667 51,482 -

Total revenue............................................................. 14,266,492$ 14,048,393$ 12,640,744$

For the Year Ended December 31,

(In thousands)

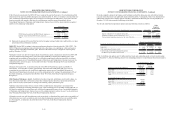

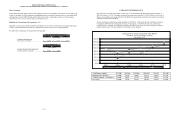

18. Valuation and Qualifying Accounts

Our valuation and qualifying accounts as of December 31, 2012, 2011 and 2010 are as follows:

Allowance for doubtful accounts

Balance at

Beginning

of Year

Char

g

ed to

Costs and

Expenses Deductions

Balance at

End of

Year

For the years ended:

December 31, 2012............................................. 15,773$ 124,610$ (123,438)$ 16,945$

December 31, 2011............................................. 29,650$ 100,321$ (114,198)$ 15,773$

December 31, 2010............................................. 16,372$ 115,478$ (102,200)$ 29,650$

(In thousands)

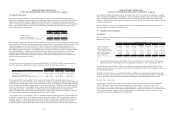

19. Quarterly Financial Data (Unaudited)

Our quarterly results of operations are summarized as follows:

March 31 June 30 September 30 December 31

Year ended December 31, 2012:

Total revenue.................................................................................................. 3,581,869$ 3,571,766$ 3,523,347$ 3,589,510$

Operating income (loss).................................................................................. 572,411 468,352 (273,029) 454,101

Net income (loss)............................................................................................ 360,126 225,596 (163,329) 203,347

Net income (loss) attributable to DISH Network............................................ 360,310 225,732 (158,461) 209,106

Basic net income (loss) per share attributable to DISH Network................... 0.81$ 0.50$ (0.35)$ 0.46$

Diluted net income (loss) per share attributable to DISH Network................ 0.80$ 0.50$ (0.35)$ 0.46$

Year ended December 31, 2011:

Total revenue.................................................................................................. 3,224,131$ 3,590,161$ 3,602,651$ 3,631,450$

Operating income (loss).................................................................................. 983,353 717,782 624,839 601,980

Net income (loss)............................................................................................ 549,326 334,838 318,978 312,436

Net income (loss) attributable to DISH Network............................................ 549,394 334,760 319,099 312,654

Basic net income (loss) per share attributable to DISH Network................... 1.24$ 0.75$ 0.72$ 0.70$

Diluted net income (loss) per share attributable to DISH Network................ 1.22$ 0.75$ 0.71$ 0.70$

(In thousands, except per share data)

For the Three Months Ended

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-67

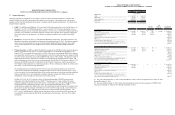

20. Related Party Transactions

Related Party Transactions with EchoStar

Following the Spin-off, EchoStar has operated as a separate public company, and we have no continued ownership

interest in EchoStar. However, a substantial majority of the voting power of the shares of both companies is owned

beneficially by Charles W. Ergen, our Chairman, or by certain trusts established by Mr. Ergen for the benefit of his

family.

EchoStar is our primary supplier of set-top boxes and digital broadcast operations and a key supplier of transponder

capacity. Generally, the amounts we pay EchoStar for products and services are based on pricing equal to

EchoStar’s cost plus a fixed margin (unless noted differently below), which will vary depending on the nature of the

products and services provided.

In connection with and following the Spin-off, we and EchoStar have entered into certain agreements pursuant to

which we obtain certain products, services and rights from EchoStar, EchoStar obtains certain products, services

and rights from us, and we and EchoStar have indemnified each other against certain liabilities arising from our

respective businesses. We also may enter into additional agreements with EchoStar in the future. The following is

a summary of the terms of our principal agreements with EchoStar that may have an impact on our financial

position and results of operations.

“Equipment sales - EchoStar”

Remanufactured Receiver Agreement. We entered into a remanufactured receiver agreement with EchoStar

pursuant to which EchoStar has the right, but not the obligation, to purchase remanufactured receivers and

accessories from us at cost plus a fixed margin, which varies depending on the nature of the equipment purchased.

In November 2012, we and EchoStar extended this agreement until December 31, 2013. EchoStar may terminate

the remanufactured receiver agreement for any reason upon at least 60 days notice to us. We may also terminate

this agreement if certain entities acquire us.

“Services and other revenue - EchoStar”

Professional Services Agreement. Prior to 2010, in connection with the Spin-off, we entered into various

agreements with EchoStar including the Transition Services Agreement, Satellite Procurement Agreement and

Services Agreement, which all expired on January 1, 2010 and were replaced by a Professional Services Agreement.

During 2009, we and EchoStar agreed that EchoStar shall continue to have the right, but not the obligation, to

receive the following services from us, among others, certain of which were previously provided under the

Transition Services Agreement: information technology, travel and event coordination, internal audit, legal,

accounting and tax, benefits administration, program acquisition services and other support services. Additionally,

we and EchoStar agreed that we shall continue to have the right, but not the obligation, to engage EchoStar to

manage the process of procuring new satellite capacity for us (previously provided under the Satellite Procurement

Agreement) and receive logistics, procurement and quality assurance services from EchoStar (previously provided

under the Services Agreement) and other support services. The Professional Services Agreement automatically

renewed on January 1, 2013 for an additional one-year period until January 1, 2014 and renews automatically for

successive one-year periods thereafter, unless terminated earlier by either party upon at least 60 days notice.

However, either party may terminate the Professional Services Agreement in part with respect to any particular

service it receives for any reason upon at least 30 days notice.

Management Services Agreement. We have a Management Services Agreement with EchoStar pursuant to which

we make certain of our officers available to provide services (which are primarily legal and accounting services) to

EchoStar. Specifically, Paul W. Orban remains employed by us, but also served as EchoStar’s Senior Vice

President and Controller through April 2012. In addition, R. Stanton Dodge remains employed by us, but also

served as EchoStar’s Executive Vice President, General Counsel and Secretary through November 2011. EchoStar

makes payments to us based upon an allocable portion of the personnel costs and expenses incurred by us with

respect to such officers (taking into account wages and fringe benefits). These allocations are based upon the