Dish Network 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

72

72

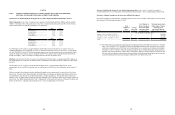

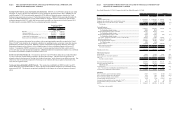

Pay-TV subscribers. DISH lost approximately 166,000 net Pay-TV subscribers during the year ended December

31, 2011, compared to a gain of approximately 33,000 net new Pay-TV subscribers during the same period in 2010.

The change versus the prior year primarily resulted from a decline in gross new Pay-TV subscriber activations.

During the year ended December 31, 2011, DISH added approximately 2.576 million gross new Pay-TV subscribers

compared to approximately 3.052 million gross new Pay-TV subscribers during the same period in 2010, a decrease

of 15.6%.

Our gross activations and net Pay-TV subscriber additions were negatively impacted during the year ended

December 31, 2011 compared to the same period in 2010 as a result of increased competitive pressures, including

aggressive marketing and the effectiveness of certain competitors’ promotional offers, which included an increased

level of programming discounts. In addition, telecommunications companies continue to grow their respective

customer bases. Our gross activations and net Pay-TV subscriber additions continue to be adversely affected during

the year ended December 31, 2011 by sustained economic weakness and uncertainty, including, among other things,

the weak housing market in the United States combined with lower discretionary spending.

Our Pay-TV churn rate for the year ended December 31, 2011 was 1.63%, compared to 1.76% for the same period

in 2010. While our Pay-TV churn rate improved compared to the same period in 2010, our Pay-TV churn rate

continues to be adversely affected by the increased competitive pressures discussed above. In general, our Pay-TV

churn rate is impacted by the quality of Pay-TV subscribers acquired in past quarters, our ability to provide

outstanding customer service, and our ability to control piracy.

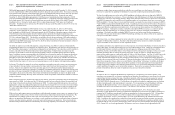

Subscriber-related revenue. DISH “Subscriber-related revenue” totaled $12.976 billion for the year ended December

31, 2011, an increase of $432 million or 3.4% compared to the same period in 2010. This change was primarily

related to the increase in “ARPU” discussed below.

ARPU. “Average monthly revenue per subscriber” was $76.93 during the year ended December 31, 2011 versus

$73.32 during the same period in 2010. The $3.61 or 4.9% increase in ARPU was primarily attributable to price

increases during the past year, higher hardware related revenue and fees earned from our in-home service operations,

partially offset by decreases in premium and pay per view revenue.

Equipment and merchandise sales, rental and other revenue. “Equipment and merchandise sales, rental and other

revenue” totaled $1.036 billion for the year ended December 31, 2011, an increase of $976 million compared to the

same period in 2010. This increase was primarily driven by revenue from the rental of movies and video games, the

sale of previously rented titles, and other merchandise sold to customers including movies, video games and other

accessories related to our Blockbuster operations which commenced April 26, 2011.

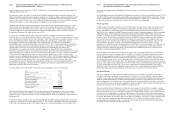

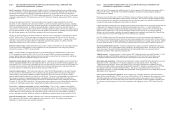

Subscriber-related expenses. “Subscriber-related expenses” totaled $6.846 billion during the year ended December

31, 2011, an increase of $169 million or 2.5% compared to the same period in 2010. The increase in “Subscriber-

related expenses” was primarily attributable to higher programming costs and an increase in customer retention

expense, partially offset by reduced costs related to our call centers. The increase in programming costs was driven by

rate increases in certain of our programming contracts, including the renewal of certain contracts at higher rates.

“Subscriber-related expenses” represented 52.8% and 53.2% of “Subscriber-related revenue” during the year ended

December 31, 2011 and 2010, respectively. The improvement in this expense to revenue ratio primarily resulted from

an increase in “Subscriber-related revenue,” partially offset by higher programming costs, discussed above.

Cost of sales – equipment, merchandise, services, rental and other. “Cost of sales – equipment, merchandise,

services, rental and other” totaled $449 million for the year ended December 31, 2011, an increase of $372 million

compared to the same period in 2010. This increase is primarily associated with the cost of rental title purchases or

revenue sharing to studios, packaging and on-line delivery costs as well as the cost of merchandise sold such as

movies, video games and other accessories related to our Blockbuster operations which commenced April 26, 2011.

Subscriber acquisition costs. “Subscriber acquisition costs” totaled $1.505 billion for the year ended December 31,

2011, a decrease of $148 million or 9.0% compared to the same period in 2010. This decrease was primarily

attributable to a decline in gross new subscriber activations.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

73

73

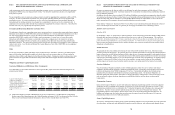

SAC. SAC was $771 during the year ended December 31, 2011 compared to $776 during the same period in 2010, a

decrease of $5 or 0.6%. This decrease was primarily attributable to an increase in the percentage of redeployed

receivers that were installed.

During the years ended December 31, 2011 and 2010, the amount of equipment capitalized under our lease program

for new subscribers totaled $480 million and $716 million, respectively. This decrease in capital expenditures under

our lease program for new subscribers resulted primarily from a decrease in gross new subscriber activations and an

increase in the percentage of redeployed receivers that were installed.

Capital expenditures resulting from our equipment lease program for new subscribers were partially mitigated by the

redeployment of equipment returned by disconnecting lease program subscribers. To remain competitive we

upgrade or replace subscriber equipment periodically as technology changes, and the costs associated with these

upgrades may be substantial. To the extent technological changes render a portion of our existing equipment

obsolete, we would be unable to redeploy all returned equipment and consequently would realize less benefit from

the SAC reduction associated with redeployment of that returned lease equipment.

Our SAC calculation does not reflect any benefit from payments we received in connection with equipment not

returned to us from disconnecting lease subscribers and returned equipment that is made available for sale or used in

our existing customer lease program rather than being redeployed through our new customer lease program. During

the years ended December 31, 2011 and 2010, these amounts totaled $96 million and $108 million, respectively.

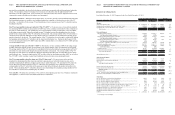

General and administrative expenses. “General and administrative expenses” totaled $1.234 billion during the year

ended December 31, 2011, a $609 million increase compared to the same period in 2010. This increase was primarily

due to an increase in personnel, building and maintenance and other administrative costs associated with our

Blockbuster operations which commenced April 26, 2011.

Litigation expense. “Litigation expense” totaled a negative $317 million during the year ended December 31, 2011,

a reduction in expense of $542 million compared to the same period in 2010. See Note 20 in the Notes to our

Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for further discussion.

Depreciation and amortization. “Depreciation and amortization” expense totaled $922 million during the year ended

December 31, 2011, a $62 million or 6.3% decrease compared to the same period in 2010. This change in

“Depreciation and amortization” expense was primarily due to a decrease in depreciation on equipment leased to

subscribers principally related to less equipment capitalization during 2011 compared to the same period in 2010 and

less equipment write-offs from disconnecting subscribers. This decrease was partially offset by an increase in

depreciation on satellites as a result of EchoStar XIV and EchoStar XV being placed into service during the second and

third quarters 2010, respectively.

Interest expense, net of amounts capitalized. “Interest expense, net of amounts capitalized” totaled $558 million

during the year ended December 31, 2011, an increase of $103 million or 22.7% compared to the same period in 2010.

This change primarily resulted from an increase in interest expense related to the issuance of our 6 3/4% Senior

Notes due 2021 during the second quarter 2011 and a decrease in the amount of interest capitalized, partially offset

by a decrease in interest expense as a result of the repurchases and redemptions of our 6 3/8% Senior Notes due

2011.