Dish Network 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

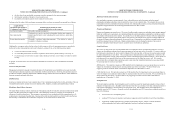

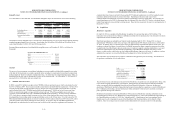

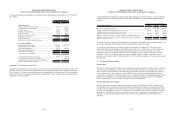

Intangible Assets

As of December 31, 2012 and 2011, our identifiable intangibles subject to amortization consist of the following:

Intangible Accumulated Intangible Accumulated

Assets Amortization Assets Amortization

Technology-based..................... 39,066$ (8,345)$ 8,890$ (607)$

Trademarks............................... 18,236 (3,907) 13,340 (1,199)

Contract-based.......................... 11,275 (10,127) 14,538 (6,448)

Customer relationships............. 6,974 (5,736) 5,580 (1,948)

Total ...................................... 75,551$ (28,115)$ 42,348$ (10,202)$

As of

December 31, 2012 December 31, 2011

(In thousands)

Amortization of these intangible assets is recorded on a straight line basis over an average finite useful life primarily

ranging from approximately one to ten years. Amortization was $16 million, $10 million and $3 million for the

years ended December 31, 2012, 2011 and 2010, respectively.

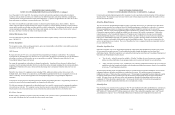

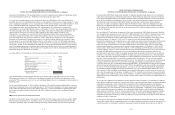

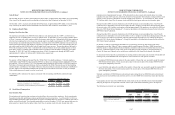

Estimated future amortization of our identifiable intangible assets as of December 31, 2012 is as follows (in

thousands):

For the Years Ended December 31,

2013............................................................ 12,740$

2014............................................................ 9,871

2015............................................................ 9,150

2016............................................................ 8,362

2017............................................................ 3,138

Thereafter................................................... 4,175

Total ....................................................... 47,436$

Goodwill

The excess of our investments in consolidated subsidiaries over net tangible and identifiable intangible asset value

at the time of the investment is recorded as goodwill and is not subject to amortization but is subject to impairment

testing annually or whenever indicators of impairment arise. In conducting our annual impairment test in 2012, we

determined that the fair value is substantially in excess of the carrying value. As of December 31, 2012 and 2011,

our goodwill was $126 million and zero, respectively.

9. 700 MHz Wireless Licenses

In 2008, we paid $712 million to acquire certain 700 MHz wireless spectrum licenses, which were granted to us by

the FCC in February 2009. These licenses mandate certain interim and final build-out requirements. By June 2013,

we must provide signal coverage and offer service to at least 35% of the geographic area in each area covered by

each individual license (the “700 MHz Interim Build-out Requirement”). By the end of our license term (June

2019), we must provide signal coverage and offer service to at least 70% of the geographic area in each area

covered by each individual license (the “700 MHz Final Build-out Requirement”). We have recently notified the

FCC of our plans to commence signal coverage in select cities within certain of these areas, but we have not yet

developed plans for providing signal coverage and offering service in all of these areas. If we fail to meet the 700

MHz Interim Build-out Requirement, the term of our licenses will be reduced, from June 2019 to June 2017, and we

could face possible fines and the reduction of license area(s). If we fail to meet the 700 MHz Final Build-out

Requirement, our authorization for each license area in which we fail to meet the requirement will terminate. To

F-30

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

commercialize these licenses and satisfy the associated FCC build-out requirements, we will be required to make

significant additional investments or partner with others. Depending on the nature and scope of such

commercialization and build-out, any such investment or partnership could vary significantly. In conducting our

annual impairment test in 2012, we determined that the estimated fair value of the FCC licenses, calculated using a

market based approach, exceeded their carrying amount. Based on this assessment, this asset was not impaired as of

December 31, 2012.

10. Acquisitions

Blockbuster Acquisition

On April 26, 2011, we completed the Blockbuster Acquisition for a net purchase price of $234 million. This

transaction was accounted for as a business combination and therefore the purchase price was allocated to the assets

acquired based on their estimated fair value.

Blockbuster operations are included in our financial results beginning April 26, 2011. During 2012, we closed

approximately 700 domestic retail stores, leaving us with approximately 800 domestic retail stores as of December

31, 2012. In January 2013, we announced the closing of approximately 300 additional domestic retail stores. We

continue to evaluate the impact of certain factors, including, among other things, competitive pressures, the ability

of significantly fewer Blockbuster domestic retail stores to continue to support corporate administrative costs, and

other issues impacting the store-level financial performance of our Blockbuster domestic retail stores. These

factors, or other reasons, could lead us to close additional Blockbuster domestic retail stores. In addition, to reduce

administrative expenses, we moved the Blockbuster headquarters to Denver during June 2012.

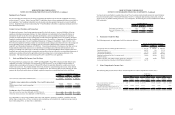

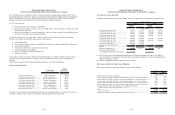

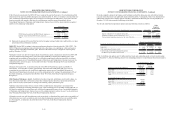

This transaction was accounted for as a business combination using purchase price accounting. The allocation of

the purchase consideration is in the table below.

Purchase

Price

Allocation

(In thousands)

Cash................................................ 107,061$

Current assets.................................. 153,258

Property and equipment.................. 28,663

Acquisition intangibles................... 17,826

Other noncurrent assets.................. 12,856

Current liabilities............................ (86,080)

Total purchase price....................... 233,584$

The pro forma revenue and earnings associated with the Blockbuster Acquisition are not included in this filing. Due

to the material ongoing modifications of the business, management has determined that insufficient information

exists to accurately develop meaningful historical pro forma financial information. Moreover, the historical

operations of Blockbuster materially changed during the periods preceding the acquisition as a result of Blockbuster

Inc.’s bankruptcy proceedings, and any historical pro forma information would not prove useful in assessing our

post acquisition earnings and cash flows.

Blockbuster Entertainment Limited and Blockbuster GB Limited, our Blockbuster operating subsidiaries in the

United Kingdom (collectively, the “Blockbuster UK Operating Entities”), entered into administration proceedings in

the United Kingdom on January 16, 2013 (the “Administration”). Administrators have been appointed by the

English courts to sell or liquidate the assets of the Blockbuster UK Operating Entities for the benefit of their

creditors. Since we no longer exercise control and the administrator now exercises control over all operating

F-31