Dish Network 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

Equipment Lease Programs

Pay-TV subscribers have the choice of leasing or purchasing the satellite receiver and other equipment necessary to

receive our pay-TV service. Most of our new Pay-TV subscribers choose to lease equipment and thus we retain title to

such equipment. New broadband subscribers lease the modem and other equipment necessary to receive broadband

services. Equipment leased to new and existing Pay-TV and broadband subscribers is capitalized and depreciated over

their estimated useful lives.

Foreign Currency Translation and Transactions

The functional currency of our foreign operations generally is the local currency. Assets and liabilities of foreign

operations (including intercompany balances for which settlement is not anticipated in the foreseeable future) are

translated at the spot rate in effect at the applicable reporting date, and our consolidated statements of operations

generally are translated at the average exchange rates in effect during the applicable period. The resulting unrealized

cumulative translation adjustment, net of applicable income taxes, is recorded as a component of “Accumulated other

comprehensive income (loss)” in our Consolidated Statements of Changes in Stockholders’ Equity (Deficit). Cash

flows from our operations in foreign countries are translated at actual exchange rates when known or at the average rate

for the applicable period. The effect of exchange rates on cash balances held in foreign currencies are separately

reported in our Consolidated Statements of Cash Flows. Transactions denominated in currencies other than our or our

foreign operations functional currencies are recorded based on exchange rates at the time such transactions arise.

Changes in exchange rates with respect to amounts recorded in our Consolidated Balance Sheets related to these non-

functional currency transactions result in transaction gains and losses that are reflected in our consolidated statement of

operations as unrealized (based on the applicable period end exchange rates) or realized upon settlement of the

transactions. Net transaction gains (losses) during 2012, 2011 and 2010 were not significant.

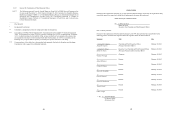

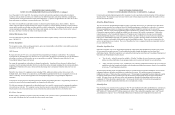

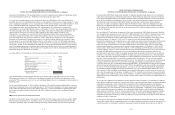

3. Basic and Diluted Net Income (Loss) Per Share

We present both basic earnings per share (“EPS”) and diluted EPS. Basic EPS excludes potential dilution and is

computed by dividing “Net income (loss) attributable to DISH Network” by the weighted-average number of

common shares outstanding for the period. Diluted EPS reflects the potential dilution that could occur if stock

awards were exercised. The potential dilution from stock awards was computed using the treasury stock method

based on the average market value of our Class A common stock. The following table presents earnings per share

amounts for all periods and the basic and diluted weighted-average shares outstanding used in the calculation.

2012 2011 2010

Net income (loss) attributable to DISH Network............................................................ $ 636,687 $ 1,515,907 $ 984,729

Weighted-average common shares outstanding - Class A and B common stock:

Basic............................................................................................................................... 450,264 445,434 445,865

Dilutive impact of stock awards outstanding.................................................................. 2,635 1,431 732

Diluted............................................................................................................................ 452,899 446,865 446,597

Earnings per share - Class A and B common stock:

Basic net income (loss) per share attributable to DISH Network................................... $ 1.41 $ 3.40 $ 2.21

Diluted net income (loss) per share attributable to DISH Network................................ $ 1.41 $ 3.39 $ 2.20

For the Years Ended December 31,

(In thousands, except per share amounts)

As of December 31, 2012, 2011 and 2010, there were stock awards to purchase 2.5 million, 5.0 million and 10.8

million shares, respectively, of Class A common stock outstanding, not included in the weighted-average common

shares outstanding above, as their effect is antidilutive.

F-16

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

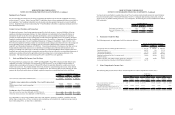

Vesting of options and rights to acquire shares of our Class A common stock granted pursuant to our performance

based stock incentive plans (“Restricted Performance Units”) is contingent upon meeting certain goals, some of

which are not yet probable of being achieved. As a consequence, the following are also not included in the diluted

EPS calculation.

201220112010

Performance based options.......................... 7,929 9,549 10,979

Restricted Performance Units...................... 1,185 1,285 1,494

Total........................................................ 9,114 10,834 12,473

As of December 31,

(In thousands)

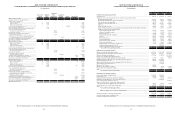

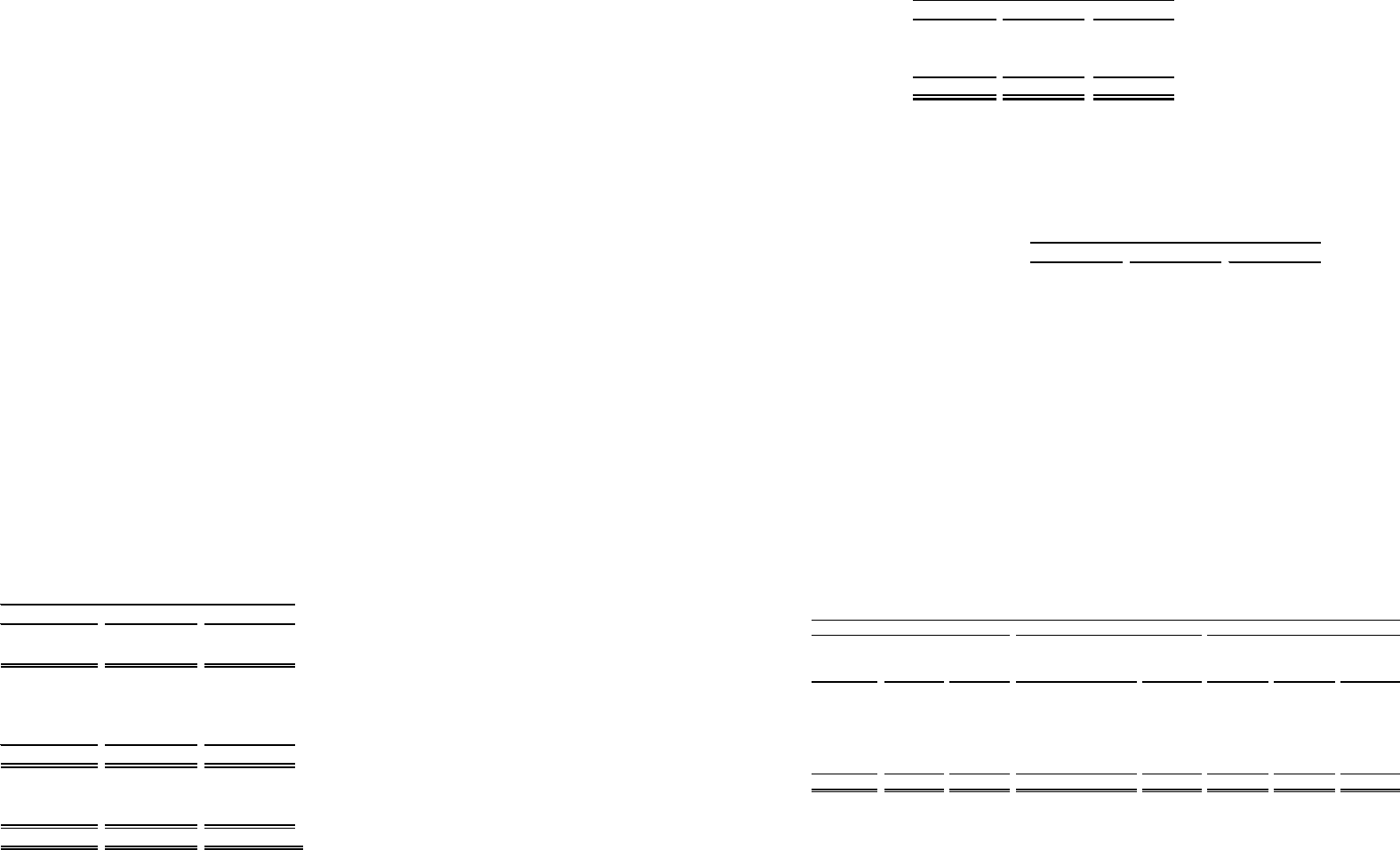

4. Statements of Cash Flow Data

The following presents our supplemental cash flow statement disclosure.

2012 2011 2010

Cash paid for interest (including capitalized interest)............................................... $ 539,359 $ 545,406 $ 472,586

Capitalized interest................................................................................................... 106,323 120 17,139

Cash received for interest......................................................................................... 92,770 37,502 36,853

Cash paid for income taxes....................................................................................... 272,266 38,761 525,028

Employee benefits paid in Class A common stock................................................... 22,280 24,804 29,127

Vendor financing...................................................................................................... - - 40,000

Satellites and other assets financed under capital lease obligations.......................... 6,707 10,548 5,282

Assets contributed from EchoStar to DISH Digital Holding LLC............................ 44,712 - -

For the Years Ended December 31,

(In thousands)

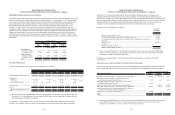

5. Other Comprehensive Income (Loss)

The following table presents the tax effects on each component of “Other comprehensive income (loss).”

Before Tax Net Before Tax Net Before Tax N et

Tax (Expense) of Tax Tax (Expense) of Tax Tax (Expense) of Tax

Amount Benefit Amount Amount Benefit Amount Amount Benefit Amount

Foreign currency translation adjustments.................................. 4,106$ -$ 4,106$ (9,139)$ -$ (9,139)$ (13,476)$ 5,067 (8,409)$

Unrealized holding gains (losses)

on available-for-sale securities............................................... 265,785 (12,892) 252,89 3 (1 3,96 5) - (13,965) 50,348 - 50,348

Recognition of previously unrealized (gains) losses on

available-for-sale securities included in net income (loss)...... (150,239) - (150,239) 11,790 - 11,790 (3,852) - (3,852)

Other comprehensive income (loss)........................................... 119,652$ (12,892)$ 106 ,760$ (11,314)$ -$ (11,314)$ 33,020$ 5,067$ 38,087$

2010

For the Years

Ended December 31,

(In thousands)

2012 2011

F-17