Dish Network 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

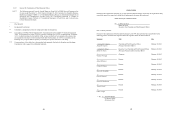

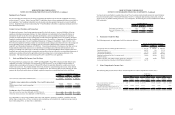

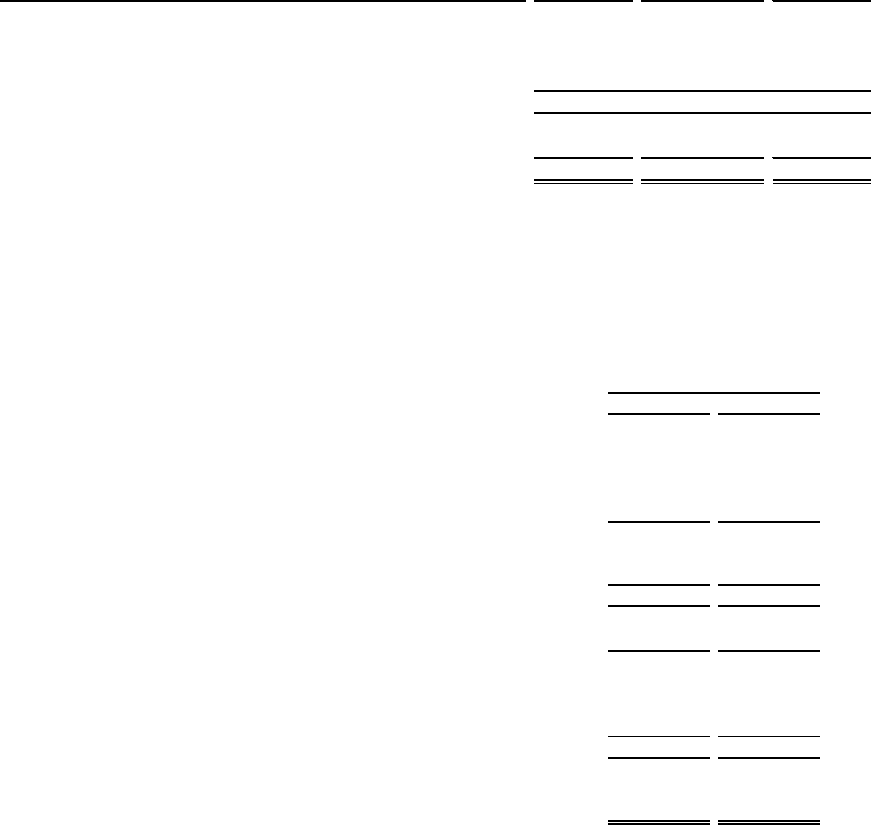

The “Accumulated other comprehensive income (loss)” is detailed in the following table.

Foreign Unrealized /

Currency Recognized

Translation Gains

Accumulated Other Comprehensive Income (Loss) Adjustment (Losses) Total

(In thousands)

Balance as of December 31, 2010.......................................................... -$ 93,357$ 93,357$

Current period activity............................................................................. (9,139) (2,175) (11,314)

Tax (expense) benefit............................................................................... - - -

Balance as of December 31, 2011.......................................................... (9,139)$ 91,182$ 82,043$

Current period activity............................................................................. 4,106 115,546 119,652

Tax (expense) benefit............................................................................... - (12,892) (12,892)

Balance as of December 31, 2012.......................................................... (5,033)$ 193,836$ 188,803$

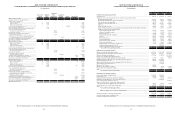

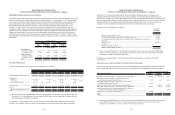

6. Marketable Investment Securities, Restricted Cash and Cash Equivalents, and Other Investment

Securities

Our marketable investment securities, restricted cash and cash equivalent, and other investment securities consist of the

following:

As of December 31,

2012 2011

(In thousands)

Marketable investment securities:

Current marketable investment securities - VRDNs............................................. 130,306$ 160,555$

Current marketable investment securities - strategic............................................. 1,261,015 360,052

Current marketable investment securities - other.................................................. 2,240,316 911,138

Total current marketable investment securities.............................................. 3,631,637 1,431,745

Restricted marketable investment securities (1).................................................... 51,366 65,843

Noncurrent marketable investment securities - ARS and other (2)....................... 106,172 109,327

Total marketable investment securities....................................................... 3,789,175 1,606,915

Restricted cash and cash equivalents (1).......................................................... 83,044 66,592

Other investment securities:

Other investment securities - cost method (2)....................................................... 12,879 2,805

Investment in DBSD North America.................................................................... - 1,297,614

Total other investment securities.................................................................. 12,879 1,300,419

Total marketable investment securities, restricted cash

and cash equivalents, and other investment securities................................. 3,885,098$ 2,973,926$

(1) Restricted marketable investment securities and restricted cash and cash equivalents are included in “Restricted

cash and marketable investment securities” on our Consolidated Balance Sheets.

(2) Noncurrent marketable investment securities – auction rate securities (“ARS”) and other investment securities are

included in “Marketable and other investment securities” on our Consolidated Balance Sheets.

F-18

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

Marketable Investment Securities

Our marketable investment securities portfolio consists of various debt and equity instruments, all of which are

classified as available-for-sale, except as specified below (see Note 2).

Current Marketable Investment Securities – VRDNs

Variable rate demand notes (“VRDNs”) are long-term floating rate municipal bonds with embedded put options that

allow the bondholder to sell the security at par plus accrued interest. All of the put options are secured by a pledged

liquidity source. Our VRDN portfolio is comprised mainly of investments in municipalities, which are backed by

financial institutions or other highly rated obligors that serve as the pledged liquidity source. While they are

classified as marketable investment securities, the put option allows VRDNs to be liquidated generally on a same

day or on a five business day settlement basis.

Current Marketable Investment Securities – Strategic

Our current strategic marketable investment securities include strategic and financial investments in public

companies that are highly speculative and have experienced and continue to experience volatility. As of December

31, 2012, our strategic investment portfolio consisted of securities of a small number of issuers, and as a result the

value of that portfolio depends on the value of those issuers. In addition, a significant portion of the value of these

investments is concentrated in the debt securities of a single issuer. The adjusted cost basis of the securities of that

single issuer as of December 31, 2012 and 2011 was $751 million and $16 million, respectively. The fair value of

the securities of that single issuer as of December 31, 2012 and 2011 was $951 million and $17 million,

respectively. These debt securities have a call option, held by the issuer, upon 30 days notice after December 1,

2012. The call option price is less than the fair market value of these debt securities and, if exercised, proceeds

would be less than our recorded fair market value and therefore, reduce our unrealized gains recorded as a separate

component of “Accumulated other comprehensive income (loss)” within “Total stockholders’ equity (deficit),” on

our Consolidated Balance Sheets. This potential reduction in our unrealized gain related to the call option on these

debt securities would have no impact on our results of operations. In addition, this single issuer has indicated that it

will need substantial additional capital to meet its business and financial obligations beyond the next 12 months.

The fair value of certain of the debt securities in our investment portfolio, including those of that single issuer, can

be adversely impacted by, among other things, the issuers’ respective performance and ability to obtain any

necessary additional financing on acceptable terms, or at all.

Current Marketable Investment Securities – Other

Our current marketable investment securities portfolio includes investments in various debt instruments including

corporate and government bonds.

Restricted Cash and Marketable Investment Securities

As of December 31, 2012 and 2011, our restricted marketable investment securities, together with our restricted

cash, included amounts required as collateral for our letters of credit or surety bonds and for litigation (See Note

16).

Noncurrent Marketable Investment Securities – ARS and Other Investment Securities

We have investments in ARS and other investment securities which are either classified as available-for-sale

securities or are accounted for under the fair value method. Previous events in the credit markets reduced or

eliminated current liquidity for certain of our ARS and other investment securities. As a result, we classify these

investments as noncurrent assets, as we intend to hold these investments until they recover or mature. See below for

further discussion on the July 1, 2010 fair value election on certain ARS investments.

F-19