Dish Network 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

58

58

domestic retail stores as of December 31, 2012. In January 2013, we announced the closing of approximately 300

additional domestic retail stores.

We continue to evaluate the impact of certain factors, including, among other things, competitive pressures, the

ability of significantly fewer Blockbuster domestic retail stores to continue to support corporate administrative costs,

and other issues impacting the store-level financial performance of our Blockbuster domestic retail stores. These

factors, or other reasons, could lead us to close additional Blockbuster domestic retail stores. In addition, to reduce

administrative expenses, we moved the Blockbuster headquarters to Denver during June 2012.

Our Blockbuster UK Operating Entities entered into Administration in the United Kingdom on January 16, 2013.

Administrators have been appointed by the English courts to sell or liquidate the assets of the Blockbuster UK

Operating Entities for the benefit of their creditors. Since we no longer exercise control and the administrator now

exercises control over all operating decisions for the Blockbuster UK Operating Entities, we will be required to

deconsolidate Blockbuster UK during the first quarter 2013.

As a result of the Administration, we have written down the assets of Blockbuster UK to their estimated net

realizable value on our Consolidated Balance Sheets as of December 31, 2012, and we recorded a charge to “Cost of

sales - equipment, merchandise, services, rental and other” of $21 million during the year ended December 31, 2012

on our Consolidated Statements of Operations and Comprehensive Income (Loss). Furthermore, we have

intercompany receivables due from Blockbuster UK of approximately $37 million that are eliminated in

consolidation on our Consolidated Balance Sheets as of December 31, 2012. Upon deconsolidation of Blockbuster

UK in the first quarter 2013, these intercompany receivables will no longer be eliminated in consolidation. We

currently believe that we will not receive the entire amount for these intercompany receivables in the

Administration. Accordingly, we recorded a $25 million impairment charge related to these intercompany

receivables, to adjust this amount to their estimated net realizable value for the year ended December 31, 2012. This

impairment charge was recorded in “Other, net” within “Other Income (Expense)” on our Consolidated Statements

of Operations and Comprehensive Income (Loss) and the resulting liability was recorded in “Other accrued

expenses” on our Consolidated Balance Sheets as of December 31, 2012. The $25 million impairment liability will

be offset against the intercompany receivables that will be recorded upon deconsolidation in the first quarter 2013.

In total, we recorded charges described above totaling approximately $46 million on a pre-tax basis on our

Consolidated Statements of Operations and Comprehensive Income (Loss) for the year ended December 31, 2012

related to the Administration. The proceeds that we actually receive from the Administration and the actual

impairment charge may differ from our estimates.

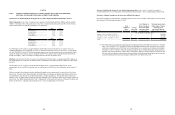

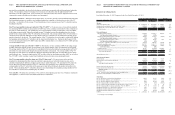

As of December 31, 2012, Blockbuster UK had total assets and liabilities as follows (in thousands):

Cash.......................................................................... 14,072$

Trade accounts receivable........................................ 1,153

Inventory.................................................................. 34,937

Other current assets.................................................. 10,243

Restricted cash and marketable securities................ 484

Property and equipment........................................... 186

Trade accounts payable............................................ (13,081)

Intercompany payable.............................................. (36,676)

Deferred revenue and other...................................... (1,369)

Other accrued expenses............................................ (9,949)

Total net assets...................................................... -$

Upon deconsolidation in the first quarter 2013, the above amounts will be combined into one net asset and the

intercompany receivables of $37 million, net of the impairment liability of $25 million described above, will be

recorded in “Other noncurrent assets, net” on our Consolidated Balance Sheets as a component of our investment in

Blockbuster UK.

For the years ended December 31, 2012 and 2011, Blockbuster UK had $293 million and $242 million of revenue,

respectively. In addition, for the years ended December 31, 2012 and 2011, Blockbuster UK had an operating loss

of $31 million and operating income of $16 million, respectively. Upon deconsolidation in the first quarter 2013,

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

59

59

the revenue and expenses related to Blockbuster UK will no longer be recorded in our Consolidated Financial

Statements.

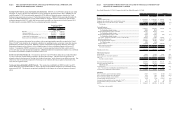

Our Consolidated Statements of Operations and Comprehensive Income (Loss) for the years ended December 31, 2012

and 2011 include the results of operations for Blockbuster for twelve months and eight months, respectively. We did

not have any Blockbuster activity during 2010 as we acquired Blockbuster on April 26, 2011. Therefore, our results

of operations for the years ended December 31, 2012, 2011 and 2010 are not comparable.

Wireless Spectrum

In 2008, we paid $712 million to acquire certain 700 MHz wireless spectrum licenses, which were granted to us by

the FCC in February 2009 subject to certain build-out requirements. On March 2, 2012, the FCC approved the

transfer of 40 MHz of 2 GHz wireless spectrum licenses held by DBSD North America and TerreStar to us. On

March 9, 2012, we completed the DBSD Transaction and the TerreStar Transaction, pursuant to which we acquired,

among other things, certain satellite assets and wireless spectrum licenses held by DBSD North America and

TerreStar. In addition, during the fourth quarter 2011, we and Sprint entered into the Sprint Settlement Agreement

pursuant to which all issues then being disputed relating to the DBSD Transaction and the TerreStar Transaction

were resolved between us and Sprint, including, but not limited to, issues relating to costs allegedly incurred by

Sprint to relocate users from the spectrum then licensed to DBSD North America and TerreStar. Pursuant to the

Sprint Settlement Agreement, we made a net payment of approximately $114 million to Sprint. The total

consideration to acquire these assets was approximately $2.860 billion. This amount includes $1.364 billion for the

DBSD Transaction, $1.382 billion for the TerreStar Transaction, and the net payment of $114 million to Sprint

pursuant to the Sprint Settlement Agreement. The financial results of DBSD North America and TerreStar are

included in our results beginning March 9, 2012.

We generated $1 million and less than $1 million of revenue for the years ended December 31, 2012 and 2011,

respectively from our wireless spectrum segment. In addition, we incurred a $64 million operating loss and less

than $1 million in operating income for the years ended December 31, 2012 and 2011, respectively. We incur

general and administrative expenses associated with certain satellite operations and regulatory compliance matters

from our wireless spectrum assets. We also incur depreciation and amortization expenses associated with certain

assets of DBSD North America and TerreStar. This depreciation and amortization expense is based on our estimate

of the fair value of these assets as disclosed in Note 10 in the Notes to the Consolidated Financial Statements in Item

15 of this Annual Report on Form 10-K. As we review our options for the commercialization of this wireless

spectrum, we may incur significant additional expenses and may have to make significant investments related to,

among other things, research and development, wireless testing and construction of a wireless network.

Operational Liquidity

Like many companies, we make general investments in property such as satellites, set-top boxes, information

technology and facilities that support our overall business. However, since we are primarily a subscriber-based

company, we also make subscriber-specific investments to acquire new subscribers and retain existing subscribers.

While the general investments may be deferred without impacting the business in the short-term, the subscriber-

specific investments are less discretionary. Our overall objective is to generate sufficient cash flow over the life of

each subscriber to provide an adequate return against the upfront investment. Once the upfront investment has been

made for each subscriber, the subsequent cash flow is generally positive.

There are a number of factors that impact our future cash flow compared to the cash flow we generate at a given

point in time. The first factor is how successful we are at retaining our current subscribers. As we lose subscribers

from our existing base, the positive cash flow from that base is correspondingly reduced. The second factor is how

successful we are at maintaining our subscriber-related margins. To the extent our “Subscriber-related expenses”

grow faster than our “Subscriber-related revenue,” the amount of cash flow that is generated per existing subscriber

is reduced. The third factor is the rate at which we acquire new subscribers. The faster we acquire new subscribers,

the more our positive ongoing cash flow from existing subscribers is offset by the negative upfront cash flow

associated with new subscribers. Finally, our future cash flow is impacted by the rate at which we make general

investments and any cash flow from financing activities.