Dish Network 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

36

litigation with respect to technology on which we would depend, including litigation involving claims of

patent infringement, which claims have been growing rapidly in the wireless services industry.

x Wireless services and our wireless spectrum licenses are subject to government regulation. Wireless

services and our wireless spectrum licenses are subject to regulation by the FCC and other federal, state and

local, as well as international, governmental authorities. These governmental authorities could adopt

regulations or take other actions that would adversely affect our business prospects. The licensing,

construction, operation, sale and interconnection arrangements of wireless telecommunications systems are

regulated by the FCC and, depending on the jurisdiction, other federal and international, state and local

regulatory agencies. In particular, the FCC imposes significant regulation on licensees of wireless

spectrum with respect to how radio spectrum is used by licensees, the nature of the services that licensees

may offer and how the services may be offered, and resolution of issues of interference between spectrum

bands. The FCC grants wireless licenses for terms of generally ten years that are subject to renewal or

revocation. There can be no assurances that our wireless spectrum licenses will be renewed. Failure to

comply with FCC requirements in a given license area could result in revocation of the license for that

license area. For further information related to our licenses and build-out requirements related to our 700

MHz and 2 GHz wireless spectrum licenses, see other Risk Factors above.

Our Blockbuster business faces risks, including, among other things, operational challenges and increasing

competition from video rental kiosks and streaming and mail order businesses that may negatively impact the

business, financial condition or results of operations of Blockbuster.

On April 26, 2011, we completed the Blockbuster Acquisition. During 2012, we closed approximately 700

domestic retail stores, leaving us with approximately 800 domestic retail stores as of December 31, 2012. In January

2013, we announced the closing of approximately 300 additional domestic retail stores. Blockbuster’s retail store

operations involve the management and distribution of product inventories, and we have limited experience in

operating retail stores. Factors that are unique to the Blockbuster business, compared to our existing businesses,

include, among other things, maintaining adequate inventory, controlling shrinkage due to theft and loss, managing

excess inventory, product fulfillment and operating losses. If we are unable to successfully address these challenges

and risks, our Blockbuster business, financial condition or results of operations will likely suffer.

In addition, our Blockbuster business faces increasing competition from video rental kiosks, streaming and mail

order businesses. These competitive pressures have contributed to weak store-level financial performance at many

of our Blockbuster retail stores.

We continue to evaluate the impact of certain factors, including, among other things, competitive pressures, the

ability of significantly fewer Blockbuster domestic retail stores to continue to support corporate administrative costs,

and other issues impacting the store-level financial performance of our Blockbuster domestic retail stores. These

factors, or other reasons, could lead us to close additional Blockbuster domestic retail stores. There is no assurance

that we will achieve the expected benefits from the Blockbuster Acquisition.

Blockbuster Entertainment Limited and Blockbuster GB Limited, our Blockbuster operating subsidiaries in the

United Kingdom (collectively, the “Blockbuster UK Operating Entities”), entered into administration proceedings in

the United Kingdom on January 16, 2013 (the “Administration”). Administrators have been appointed by the

English courts to sell or liquidate the assets of the Blockbuster UK Operating Entities for the benefit of their

creditors. Since we no longer exercise control and the administrator now exercises control over all operating

decisions for the Blockbuster UK Operating Entities, we will be required to deconsolidate our Blockbuster entities in

the United Kingdom (collectively, “Blockbuster UK”) during the first quarter 2013.

As a result of the Administration, we have written down the assets of Blockbuster UK to their estimated net

realizable value on our Consolidated Balance Sheets as of December 31, 2012, and we recorded a charge to “Cost of

sales - equipment, merchandise, services, rental and other” of $21 million during the year ended December 31, 2012

on our Consolidated Statements of Operations and Comprehensive Income (Loss). Furthermore, we have

intercompany receivables due from Blockbuster UK of approximately $37 million that are eliminated in

consolidation on our Consolidated Balance Sheets as of December 31, 2012. Upon deconsolidation of Blockbuster

UK in the first quarter 2013, these intercompany receivables will no longer be eliminated in consolidation. We

37

37

currently believe that we will not receive the entire amount for these intercompany receivables in the

Administration. Accordingly, we recorded a $25 million impairment charge related to these intercompany

receivables, to adjust this amount to their estimated net realizable value for the year ended December 31, 2012. This

impairment charge was recorded in “Other, net” within “Other Income (Expense)” on our Consolidated Statements

of Operations and Comprehensive Income (Loss) and the resulting liability was recorded in “Other accrued

expenses” on our Consolidated Balance Sheets as of December 31, 2012. The $25 million impairment liability will

be offset against the intercompany receivables that will be recorded upon deconsolidation in the first quarter 2013.

In total, we recorded charges described above totaling approximately $46 million on a pre-tax basis on our

Consolidated Statements of Operations and Comprehensive Income (Loss) for the year ended December 31, 2012

related to the Administration. The proceeds that we actually receive from the Administration and the actual

impairment charge may differ from our estimates.

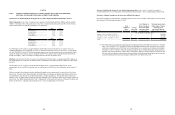

As of December 31, 2012, Blockbuster UK had total assets and liabilities as follows (in thousands):

Cash.......................................................................... 14,072$

Trade accounts receivable........................................ 1,153

Inventory.................................................................. 34,937

Other current assets.................................................. 10,243

Restricted cash and marketable securities................ 484

Property and equipment........................................... 186

Trade accounts payable............................................ (13,081)

Intercompany payable.............................................. (36,676)

Deferred revenue and other...................................... (1,369)

Other accrued expenses............................................ (9,949)

Total net assets...................................................... -$

Upon deconsolidation in the first quarter 2013, the above amounts will be combined into one net asset and the

intercompany receivables of $37 million, net of the impairment liability of $25 million described above, will be

recorded in “Other noncurrent assets, net” on our Consolidated Balance Sheets as a component of our investment in

Blockbuster UK.

For the years ended December 31, 2012 and 2011, Blockbuster UK had $293 million and $242 million of revenue,

respectively. In addition, for the years ended December 31, 2012 and 2011, Blockbuster UK had an operating loss

of $31 million and operating income of $16 million, respectively. Upon deconsolidation in the first quarter 2013,

the revenue and expenses related to Blockbuster UK will no longer be recorded in our Consolidated Financial

Statements.

We may pursue acquisitions and other strategic transactions to complement or expand our business that may not

be successful and we may lose up to the entire value of our investment in these acquisitions and transactions.

Our future success may depend on opportunities to buy other businesses or technologies that could complement,

enhance or expand our current business or products or that might otherwise offer us growth opportunities. To

pursue this strategy successfully, we must identify attractive acquisition or investment opportunities and

successfully complete transactions, some of which may be large and complex. We may not be able to identify or

complete attractive acquisition or investment opportunities due to, among other things, the intense competition for

these transactions. If we are not able to identify and complete such acquisition or investment opportunities, our

future results of operations and financial condition may be adversely affected.

We may be unable to obtain in the anticipated timeframe, or at all, any regulatory approvals required to complete

proposed acquisitions and other strategic transactions. Furthermore, the conditions imposed for obtaining any

necessary approvals could delay the completion of such transactions for a significant period of time or prevent them

from occurring at all. We may not be able to complete such transactions and such transactions, if executed, pose

significant risks and could have a negative effect on our operations. Any transactions that we are able to identify

and complete may involve a number of risks, including: