Dish Network 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

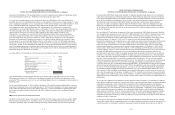

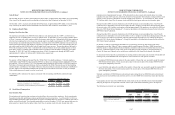

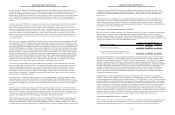

Stock-Based Compensation

During the year ended December 31, 2012 and December 31, 2010, we incurred $14 million and $3 million,

respectively, of additional non-cash, stock-based compensation expense in connection with the 2011 Stock Option

Adjustment and 2009 Stock Option Adjustment discussed previously. These amounts are included in the table

below. Total non-cash, stock-based compensation expense for all of our employees is shown in the following table

for the years ended December 31, 2012, 2011 and 2010 and was allocated to the same expense categories as the

base compensation for such employees:

2012 2011 2010

Subscriber-related................................................. 1,607$ 1,914$ 1,160$

General and administrative................................... 39,363 29,607 14,227

Total non-cash, stock-based compensation........... 40,970$ 31 ,521$ 15,387$

For the Years Ended December 31,

(In thousands)

As of December 31, 2012, our total unrecognized compensation cost related to our non-performance based unvested

stock awards was $20 million and includes compensation expense that we will recognize for EchoStar stock awards

held by our employees as a result of the Spin-off. This cost is based on an estimated future forfeiture rate of

approximately 4.0% per year and will be recognized over a weighted-average period of approximately two years.

Share-based compensation expense is recognized based on stock awards ultimately expected to vest and is reduced

for estimated forfeitures. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent

periods if actual forfeitures differ from those estimates. Changes in the estimated forfeiture rate can have a

significant effect on share-based compensation expense since the effect of adjusting the rate is recognized in the

period the forfeiture estimate is changed.

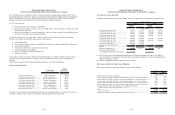

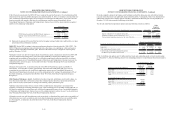

Valuation

The fair value of each stock option for the years ended December 31, 2012, 2011 and 2010 was estimated at the

date of the grant using a Black-Scholes option valuation model with the following assumptions:

Stock Options 2012 2011 2010

Risk-free interest rate.......................................................... 0.41% - 1.29% 0.36% - 3.18% 1.50% - 2.89%

Volatility factor.................................................................. 33.15% - 39.50% 31.74% - 45.56% 33.33% - 38.63%

Expected term of options in years....................................... 3.1 - 5.9 3.6 - 10.0 5.2 - 7.5

Weighted-average fair value of options granted................. $6.72 - $13.79 $8.73 - $14.77 $6.83 - $8.14

For the Years Ended December 31,

On December 28, 2012 and December 1, 2011, we paid a $1.00 and a $2.00 cash dividend per share on our

outstanding Class A and Class B common stock, respectively. While we currently do not intend to declare additional

dividends on our common stock, we may elect to do so from time to time. Accordingly, the dividend yield percentage

used in the Black-Scholes option valuation model is set at zero for all periods. The Black-Scholes option valuation

model was developed for use in estimating the fair value of traded stock options which have no vesting restrictions

and are fully transferable. Consequently, our estimate of fair value may differ from other valuation models.

Further, the Black-Scholes option valuation model requires the input of highly subjective assumptions. Changes in

the subjective input assumptions can materially affect the fair value estimate.

As discussed in Note 13, on December 2, 2012, we declared a dividend of $1.00 per share on our outstanding Class

A and Class B common stock. The dividend was paid in cash on December 28, 2012 to shareholders of record on

December 14, 2012. In light of such dividend, our Board of Directors and Executive Compensation Committee of

the Board of Directors, which administers our stock incentive plans, determined to adjust the exercise price of

certain stock options issued under the plans by decreasing the exercise price by $0.77 per share; provided, that the

F-52

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

exercise price of eligible stock options will not be reduced below $1.00. As a result of this adjustment, a majority

of the stock options outstanding as of December 31, 2012 were adjusted subsequent to the year ended December 31,

2012. This adjustment will result in additional incremental non-cash, stock-based compensation expense of $8

million, of which $5 million will be expensed during the first quarter 2013 and $3 million will be expensed over the

remaining vesting period.

We will continue to evaluate the assumptions used to derive the estimated fair value of our stock options as new

events or changes in circumstances become known.

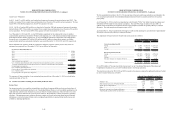

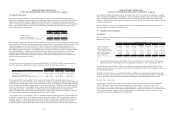

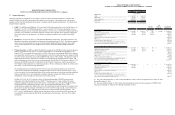

16. Commitments and Contingencies

Commitments

As of December 31, 2012, future maturities of our long-term debt, capital lease and contractual obligations are

summarized as follows:

Total 2013 2014 2015 2016 2017 Thereafter

Long-term debt obligations.................... 11,638,955$ 5 0 8,1 8 6$ 1,007,851$ 758,232$ 1,506,742$ 906,97 5$ 6,950,969$

Capital lease obligations......................... 249,145 29,515 26,672 27,339 30,024 32,958 102,637

Interest expense on long-term

debt and capital lease obligations........ 4,918,951 774,373 732,260 634,705 549,420 493,25 7 1,734,936

Satellite-related obligations.................... 2,259,436 355,154 321,479 301,109 253,144 24 2 ,77 7 785,773

Operating lease obligations (1)............... 245,630 85,482 51,499 32,055 22,878 8,541 45,175

Purchase obligations (1)......................... 3,508,013 1,810,3 6 4 520,462 436,396 314,589 16 5 ,059 261,143

Total....................................................... 22,820,130$ 3,56 3,074$ 2,660,223$ 2,189,836$ 2,676,797$ 1,849,567$ 9,880,633$

Payments due by period

(In th ou san ds)

(1) Contractual obligations related to Blockbuster UK are not included above. Our Blockbuster UK Operating

Entities entered into Administration in the United Kingdom on January 16, 2013, as discussed in Note 10.

In certain circumstances the dates on which we are obligated to make these payments could be delayed. These

amounts will increase to the extent we procure insurance for our satellites or contract for the construction, launch or

lease of additional satellites.

In addition, the table above does not include $347 million of liabilities associated with unrecognized tax benefits

which were accrued, as discussed in Note 12 and are included on our Consolidated Balance Sheets as of December

31, 2012. We do not expect any portion of this amount to be paid or settled within the next twelve months.

Satellites Under Construction

EchoStar XVIII. On September 7, 2012, we entered into a contract with SS/L for the construction of EchoStar

XVIII, a DBS satellite designed with spot beam technology for advanced television services such as HD

programming. This satellite is expected to be launched during 2015. Future commitments related to this satellite

are included in the table above under “Satellite related obligations,” except where noted below. As of December 31,

2012, we had not procured a launch contract and launch insurance for this satellite; therefore, these costs are not

included in our satellite-related obligations in the table above.

F-53