Dish Network 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

decisions for the Blockbuster UK Operating Entities, we will be required to deconsolidate our Blockbuster entities

in the United Kingdom (collectively, “Blockbuster UK”) during the first quarter 2013.

As a result of the Administration, we have written down the assets of Blockbuster UK to their estimated net

realizable value on our Consolidated Balance Sheets as of December 31, 2012, and we recorded a charge to “Cost of

sales - equipment, merchandise, services, rental and other” of $21 million during the year ended December 31, 2012

on our Consolidated Statements of Operations and Comprehensive Income (Loss). Furthermore, we have

intercompany receivables due from Blockbuster UK of approximately $37 million that are eliminated in

consolidation on our Consolidated Balance Sheets as of December 31, 2012. Upon deconsolidation of Blockbuster

UK in the first quarter 2013, these intercompany receivables will no longer be eliminated in consolidation. We

currently believe that we will not receive the entire amount for these intercompany receivables in the

Administration. Accordingly, we recorded a $25 million impairment charge related to these intercompany

receivables, to adjust this amount to their estimated net realizable value for the year ended December 31, 2012.

This impairment charge was recorded in “Other, net” within “Other Income (Expense)” on our Consolidated

Statements of Operations and Comprehensive Income (Loss) and the resulting liability was recorded in “Other

accrued expenses” on our Consolidated Balance Sheets as of December 31, 2012. The $25 million impairment

liability will be offset against the intercompany receivables that will be recorded upon deconsolidation in the first

quarter 2013. In total, we recorded charges described above totaling approximately $46 million on a pre-tax basis

on our Consolidated Statements of Operations and Comprehensive Income (Loss) for the year ended December 31,

2012 related to the Administration. The proceeds that we actually receive from the Administration and the actual

impairment charge may differ from our estimates.

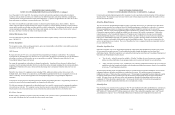

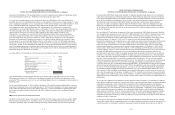

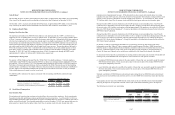

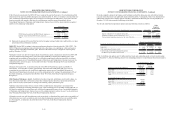

As of December 31, 2012, Blockbuster UK had total assets and liabilities as follows (in thousands):

Cash.......................................................................... 14,072$

Trade accounts receivable........................................ 1,153

Inventory.................................................................. 34,937

Other current assets.................................................. 10,243

Restricted cash and marketable securities................ 484

Property and equipment........................................... 186

Trade accounts payable............................................ (13,081)

Intercompany payable.............................................. (36,676)

Deferred revenue and other...................................... (1,369)

Other accrued expenses............................................ (9,949)

Total net assets...................................................... -$

Upon deconsolidation in the first quarter 2013, the above amounts will be combined into one net asset and the

intercompany receivables of $37 million, net of the impairment liability of $25 million described above, will be

recorded in “Other noncurrent assets, net” on our Consolidated Balance Sheets as a component of our investment in

Blockbuster UK.

For the years ended December 31, 2012 and 2011, Blockbuster UK had $293 million and $242 million of revenue,

respectively. In addition, for the years ended December 31, 2012 and 2011, Blockbuster UK had an operating loss

of $31 million and operating income of $16 million, respectively. Upon deconsolidation in the first quarter 2013,

the revenue and expenses related to Blockbuster UK will no longer be recorded in our Consolidated Financial

Statements.

DBSD North America and TerreStar Transactions

On March 2, 2012, the FCC approved the transfer of 40 MHz of 2 GHz wireless spectrum licenses held by DBSD

North America and TerreStar to us. On March 9, 2012, we completed the DBSD Transaction and the TerreStar

Transaction, pursuant to which we acquired, among other things, certain satellite assets and wireless spectrum

F-32

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

licenses held by DBSD North America and TerreStar. In addition, during the fourth quarter 2011, we and Sprint

entered into a mutual release and settlement agreement (the “Sprint Settlement Agreement”) pursuant to which all

issues then being disputed relating to the DBSD Transaction and the TerreStar Transaction were resolved between

us and Sprint, including, but not limited to, issues relating to costs allegedly incurred by Sprint to relocate users

from the spectrum then licensed to DBSD North America and TerreStar. Pursuant to the Sprint Settlement

Agreement, we made a net payment of approximately $114 million to Sprint. The total consideration to acquire

these assets was approximately $2.860 billion. This amount includes $1.364 billion for the DBSD Transaction,

$1.382 billion for the TerreStar Transaction, and the net payment of $114 million to Sprint pursuant to the Sprint

Settlement Agreement.

Our consolidated FCC applications for approval of the license transfers from DBSD North America and TerreStar

were accompanied by requests for waiver of the FCC’s Mobile Satellite Service (“MSS”) “integrated service” and

spare satellite requirements and various technical provisions. The FCC denied our requests for waiver of the

integrated service and spare satellite requirements but did not initially act on our request for waiver of the various

technical provisions. On March 21, 2012, the FCC released a Notice of Proposed Rule Making (“NPRM”)

proposing the elimination of the integrated service, spare satellite and various technical requirements attached to the

2 GHz licenses. On December 11, 2012, the FCC approved rules that eliminated these requirements and gave

notice of its proposed modification of our 2 GHz authorizations to, among other things, allow us to offer single-

mode terrestrial terminals to customers who do not desire satellite functionality. On February 15, 2013, the FCC

issued an order, which will become effective on March 7, 2013, modifying our 2 GHz licenses to add terrestrial

operating authority. The FCC’s order of modification has imposed certain limitations on the use of a portion of this

spectrum, including interference protections for other spectrum users and power and emission limits that we

presently believe could render 5 MHz of our uplink spectrum effectively unusable for terrestrial services and limit

our ability to fully utilize the remaining 15 MHz of our uplink spectrum for terrestrial services. These limitations

could, among other things, impact the finalization of technical standards associated with our wireless business, and

may have a material adverse effect on our ability to commercialize these licenses. The new rules also mandate

certain interim and final build-out requirements for the licenses. By March 2017, we must provide terrestrial signal

coverage and offer terrestrial service to at least 40% of the aggregate population represented by all of the areas

covered by the licenses (the “2 GHz Interim Build-out Requirement”). By March 2020, we must provide terrestrial

signal coverage and offer terrestrial service to at least 70% of the population in each area covered by an individual

license (the “2 GHz Final Build-out Requirement”). If we fail to meet the 2 GHz Interim Build-out Requirement,

the 2 GHz Final Build-out Requirement will be accelerated by one year, from March 2020 to March 2019. If we

fail to meet the 2 GHz Final Build-out Requirement, our terrestrial authorization for each license area in which we

fail to meet the requirement will terminate. In addition, the FCC is currently considering rules for a spectrum band

that is adjacent to our 2 GHz licenses, known as the “H Block.” If the FCC adopts rules for the H block that do not

adequately protect our 2 GHz licenses, there could be a material adverse effect on our ability to commercialize the 2

GHz licenses.

As a result of the completion of the DBSD Transaction and the TerreStar Transaction, we will likely be required to

make significant additional investments or partner with others to, among other things, finance the commercialization

and build-out requirements of these licenses and our integration efforts including compliance with regulations

applicable to the acquired licenses. Depending on the nature and scope of such commercialization, build-out, and

integration efforts, any such investment or partnership could vary significantly. Additionally, recent consolidation

in the wireless telecommunications industry, may, among other things, limit our available options, including our

ability to partner with others. There can be no assurance that we will be able to develop and implement a business

model that will realize a return on these spectrum licenses or that we will be able to profitably deploy the assets

represented by these spectrum licenses, which may affect the carrying value of these assets and our future financial

condition or results of operations.

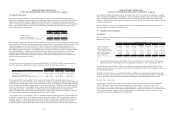

For the purposes of acquisition accounting, management determined that the DBSD Transaction and the TerreStar

Transaction, together with the net payment pursuant to the Sprint Settlement Agreement, should be accounted for as

a single transaction. In reaching this conclusion, management considered, among other things, the fact that the

F-33