Dish Network 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

x maintenance expenditures to obtain future cash flows are not significant;

x FCC licenses are not technologically dependent; and

x we intend to use these assets indefinitely.

DBS FCC Licenses. We combine all of our indefinite lived DBS FCC licenses that we currently utilize or plan to

utilize in the future into a single unit of accounting. The analysis encompasses future cash flows from satellites

transmitting from such licensed orbital locations, including revenue attributable to programming offerings from

such satellites, the direct operating and subscriber acquisition costs related to such programming, and future capital

costs for replacement satellites. Projected revenue and cost amounts include projected subscribers. In conducting

our annual impairment test in 2012, we determined that the estimated fair value of the DBS FCC licenses, calculated

using a discounted cash flow analysis, exceeded their carrying amounts.

Wireless Spectrum Licenses. In conducting our annual impairment test in 2012 for our 700 MHz and 2 GHz

wireless spectrum licenses, we determined that the estimated fair value of these licenses exceeded their carrying

amount. The estimated fair value for the 700 MHz licenses was determined using the market approach and the

estimated fair value for the 2 GHz licenses was determined using a probability weighted analysis considering

estimated future cash flows discounted at a rate commensurate with the risk involved and the market approach.

Changes in circumstances or market conditions including significant changes in our estimates of future cash flows

or available market data could result in a write-down of any of these assets in the future.

Business Combinations

When we acquire a business, we allocate the purchase price to the various components of the acquisition based

upon the fair value of each component using various valuation techniques, including the market approach, income

approach and/or cost approach. The accounting standard for business combinations requires most identifiable

assets, liabilities, noncontrolling interests and goodwill acquired to be recorded at fair value. Transaction costs

related to the acquisition of the business are expensed as incurred. Costs associated with the issuance of debt associated

with a business combination are capitalized and included as a yield adjustment to the underlying debt’s stated rate.

Acquired intangible assets other than goodwill are amortized over their estimated useful lives unless the lives are

determined to be indefinite. Amortization of these intangible assets are recorded on a straight line basis over an average

finite useful life primarily ranging from approximately one to ten years or in relation to the estimated discounted cash

flows over the life of the intangible asset.

Other Investment Securities

Generally, we account for our unconsolidated equity investments under either the equity method or cost method of

accounting. Because these equity securities are generally not publicly traded, it is not practical to regularly estimate the

fair value of the investments; however, these investments are subject to an evaluation for other-than-temporary

impairment on a quarterly basis. This quarterly evaluation consists of reviewing, among other things, company

business plans and current financial statements, if available, for factors that may indicate an impairment of our

investment. Such factors may include, but are not limited to, cash flow concerns, material litigation, violations of debt

covenants and changes in business strategy. The fair value of these equity investments is not estimated unless there are

identified changes in circumstances that may indicate an impairment exists and these changes are likely to have a

significant adverse effect on the fair value of the investment. When impairments occur related to our foreign

investments, any cumulative translation adjustment associated with these investments will remain in “Accumulated

other comprehensive income (loss)” within “Total stockholders’ equity (deficit)” on our Consolidated Balance Sheets

until the investments are sold or otherwise liquidated; at which time, they will be recorded in our Consolidated

Statements of Operations and Comprehensive Income (Loss).

F-12

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

Long-Term Deferred Revenue, Distribution and Carriage Payments

Certain programmers provide us up-front payments. Such amounts are deferred and recognized as reductions to

“Subscriber-related expenses” on a straight-line basis over the relevant remaining contract term (generally up to ten

years). The current and long-term portions of these deferred credits are recorded in our Consolidated Balance

Sheets in “Deferred revenue and other” and “Long-term deferred revenue, distribution and carriage payments and

other long-term liabilities,” respectively.

Sales Taxes

We account for sales taxes imposed on our goods and services on a net basis in our Consolidated Statements of

Operations and Comprehensive Income (Loss). Since we primarily act as an agent for the governmental authorities,

the amount charged to the customer is collected and remitted directly to the appropriate jurisdictional entity.

Income Taxes

We establish a provision for income taxes currently payable or receivable and for income tax amounts deferred to

future periods. Deferred tax assets and liabilities are recorded for the estimated future tax effects of differences that

exist between the book and tax basis of assets and liabilities. Deferred tax assets are offset by valuation allowances

when we believe it is more likely than not that such net deferred tax assets will not be realized.

Accounting for Uncertainty in Income Taxes

From time to time, we engage in transactions where the tax consequences may be subject to uncertainty. We record

a liability when, in management’s judgment, a tax filing position does not meet the more likely than not threshold.

For tax positions that meet the more likely than not threshold, we may record a liability depending on management’s

assessment of how the tax position will ultimately be settled. We adjust our estimates periodically for ongoing

examinations by and settlements with various taxing authorities, as well as changes in tax laws, regulations and

precedent. We classify interest and penalties, if any, associated with our uncertain tax positions as a component of

“Interest expense, net of amounts capitalized” and “Other, net,” respectively.

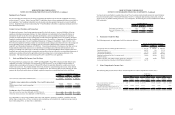

Fair Value Measurements

We determine fair value based on the exchange price that would be received for an asset or paid to transfer a

liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly

transaction between market participants. Market or observable inputs are the preferred source of values, followed

by unobservable inputs or assumptions based on hypothetical transactions in the absence of market inputs. We

apply the following hierarchy in determining fair value:

x Level 1, defined as observable inputs being quoted prices in active markets for identical assets, including

U.S. treasury notes;

x Level 2, defined as observable inputs other than quoted prices included in Level 1, including quoted prices

for similar assets and liabilities in active markets; quoted prices for identical or similar instruments in

markets that are not active; and model-derived valuations in which significant inputs and significant value

drivers are observable in active markets; and

x Level 3, defined as unobservable inputs for which little or no market data exists, consistent with reasonably

available assumptions made by other participants therefore requiring assumptions based on the best

information available.

F-13