Dish Network 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

Cash Dividend

On December 28, 2012, we paid a cash dividend of $1.00 per share, or approximately $453 million, on our outstanding

Class A and Class B common stock to stockholders of record at the close of business on December 14, 2012.

On December 1, 2011, we paid a cash dividend of $2.00 per share, or approximately $893 million, on our outstanding

Class A and Class B common stock to shareholders of record at the close of business on November 17, 2011.

14. Employee Benefit Plans

Employee Stock Purchase Plan

Our employees participate in the DISH Network employee stock purchase plan (the “ESPP”), in which we are

authorized to issue 1.8 million shares of Class A common stock. At December 31, 2012, we had 0.2 million shares

of Class A common stock which remain available for issuance under this plan. Substantially all full-time employees

who have been employed by us for at least one calendar quarter are eligible to participate in the ESPP. Employee

stock purchases are made through payroll deductions. Under the terms of the ESPP, employees may not deduct an

amount which would permit such employee to purchase our capital stock under all of our stock purchase plans at a

rate which would exceed $25,000 in fair value of capital stock in any one year. The purchase price of the stock is

85% of the closing price of the Class A common stock on the last business day of each calendar quarter in which

such shares of Class A common stock are deemed sold to an employee under the ESPP. During the years ended

December 31, 2012, 2011 and 2010, employee purchases of Class A common stock through the ESPP totaled

approximately 0.1 million, 0.1 million and 0.1 million shares, respectively.

401(k) Employee Savings Plan

We sponsor a 401(k) Employee Savings Plan (the “401(k) Plan”) for eligible employees. Voluntary employee

contributions to the 401(k) Plan may be matched 50% by us, subject to a maximum annual contribution of $1,500

per employee. Effective January 1, 2013, the maximum annual contribution will increase to $2,500 per employee.

Forfeitures of unvested participant balances which are retained by the 401(k) Plan may be used to fund matching

and discretionary contributions. Our Board of Directors may also authorize an annual discretionary contribution to

the plan, subject to the maximum deductible limit provided by the Internal Revenue Code of 1986, as amended.

These contributions may be made in cash or in our stock.

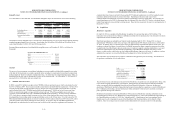

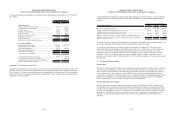

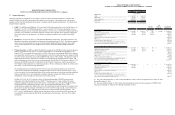

The following table summarizes the expense associated with our matching contributions and discretionary

contributions:

Expense Recognized Related to the 401(k) Plan 2012 2011 2010

Matching contributions, net of forfeitures....................... $ 3,323 $ 2,617 $ 1,598

Discretionary stock contributions, net of forfeitures....... $ 23,772 $ 22,331 $ 24,954

(In thousands)

For the Years Ended December 31,

15. Stock-Based Compensation

Stock Incentive Plans

We maintain stock incentive plans to attract and retain officers, directors and key employees. Stock awards under

these plans include both performance and non-performance based stock incentives. As of December 31, 2012, we

had outstanding under these plans stock options to acquire 16.4 million shares of our Class A common stock and 1.2

million restricted stock units. Stock options granted prior to and on December 31, 2012 were granted with exercise

prices equal to or greater than the market value of our Class A common stock at the date of grant and with a

F-46

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

maximum term of approximately ten years. While historically we have issued stock awards subject to vesting,

typically at the rate of 20% per year, some stock awards have been granted with immediate vesting and other stock

awards vest only upon the achievement of certain company-wide objectives. As of December 31, 2012, we had

72.7 million shares of our Class A common stock available for future grant under our stock incentive plans.

During December 2009, we paid a dividend in cash of $2.00 per share on our outstanding Class A and Class B

common stock to shareholders of record on November 20, 2009. In light of such dividend, during February 2010,

the exercise price of 20.6 million stock options, affecting approximately 700 employees, was reduced by $2.00 per

share (the “2009 Stock Option Adjustment”). Except as noted below, all information discussed below reflects the

2009 Stock Option Adjustment.

During December 2011, we paid a dividend in cash of $2.00 per share on our outstanding Class A and Class B

common stock to shareholders of record on November 17, 2011. In light of such dividend, during January 2012, the

exercise price of 21.2 million stock options, affecting approximately 600 employees, was reduced by $2.00 per

share (the “2011 Stock Option Adjustment”). Except as noted below, all information discussed below reflects the

2011 Stock Option Adjustment.

On January 1, 2008, we completed the distribution of our technology and set-top box business and certain

infrastructure assets (the “Spin-off”) into a separate publicly-traded company, EchoStar. DISH Network and

EchoStar operate as separate publicly-traded companies, and neither entity has any ownership interest in the other.

However, a substantial majority of the voting power of the shares of both companies is owned beneficially by

Charles W. Ergen, our Chairman, or by certain trusts established by Mr. Ergen for the benefit of his family.

In connection with the Spin-off, as permitted by our existing stock incentive plans and consistent with the Spin-off

exchange ratio, each DISH Network stock option was converted into two stock options as follows:

x an adjusted DISH Network stock option for the same number of shares that were exercisable under the original

DISH Network stock option, with an exercise price equal to the exercise price of the original DISH Network

stock option multiplied by 0.831219.

x a new EchoStar stock option for one-fifth of the number of shares that were exercisable under the original DISH

Network stock option, with an exercise price equal to the exercise price of the original DISH Network stock

option multiplied by 0.843907.

Similarly, each holder of DISH Network restricted stock units retained his or her DISH Network restricted stock

units and received one EchoStar restricted stock unit for every five DISH Network restricted stock units that they

held.

Consequently, the fair value of the DISH Network stock award and the new EchoStar stock award immediately

following the Spin-off was equivalent to the fair value of such stock award immediately prior to the Spin-off.

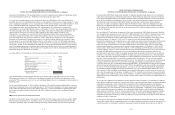

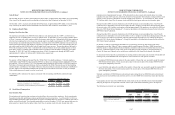

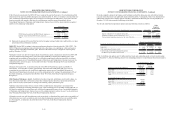

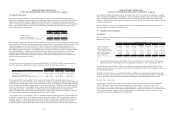

The following stock awards were outstanding:

Stock Aw ard s Outstan ding

Stock

Options

Restricted

Stock

Units

Stock

Options

Restricted

Stock

Units

Held by DISH Network employees.......... 14,209,557 1,090,081 1,109,868 45,620

Held by EchoStar employees................... 2,190,313 94,999 N/A N/A

Total......................................................... 16,399,870 1,185,080 1,109,868 45,620

As of December 31, 2012

EchoStar Aw ardsDISH N etwork Awards

F-47