Dish Network 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

68

68

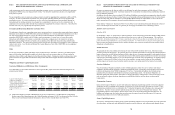

Subscriber acquisition costs. “Subscriber acquisition costs” totaled $1.687 billion for the year ended December 31,

2012, an increase of $182 million or 12.1% compared to the same period in 2011. This increase was primarily

attributable to the increase in gross new subscriber activations and SAC described below. The $1.687 billion of

subscriber acquisition costs includes $6 million of expenses related to our broadband services for the period beginning

January 1, 2012 through September 30, 2012 that were previously included in “Subscriber-related expenses” and

were reclassified to “Subscriber acquisition costs.” These amounts associated with our broadband services for 2011

were immaterial.

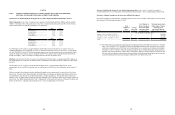

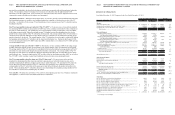

Pay-TV SAC. Pay-TV SAC was $784 during the year ended December 31, 2012 compared to $770 during the same

period in 2011, an increase of $14 or 1.8%. This increase was primarily attributable to increased advertising associated

with our Hopper set-top box. The following table details Pay-TV SAC by quarter for the year ended December 31,

2012.

Pay-TV SAC

Pay-TV

SAC

First Quarter, 2012......................... 747$

Second Quarter, 2012..................... 800

Third Quarter, 2012........................ 797

Fourth Quarter, 2012...................... 791

Year-to-date, 2012.......................... 784

During the years ended December 31, 2012 and 2011, the amount of equipment capitalized under our lease program

for new Pay-TV subscribers totaled $506 million and $480 million, respectively. This increase in capital expenditures

under our lease program for new Pay-TV subscribers resulted primarily from an increase in gross new Pay-TV

subscribers. Capital expenditures resulting from our equipment lease program for new Pay-TV subscribers were

partially mitigated by the redeployment of equipment returned by disconnecting lease program Pay-TV subscribers.

To remain competitive we upgrade or replace subscriber equipment periodically as technology changes, and the

costs associated with these upgrades may be substantial. To the extent technological changes render a portion of our

existing equipment obsolete, we would be unable to redeploy all returned equipment and consequently would realize

less benefit from the Pay-TV SAC reduction associated with redeployment of that returned lease equipment.

Our Pay-TV SAC calculation does not reflect any benefit from payments we received in connection with equipment

not returned to us from disconnecting lease subscribers and returned equipment that is made available for sale or

used in our existing customer lease program rather than being redeployed through our new customer lease program.

During the years ended December 31, 2012 and 2011, these amounts totaled $140 million and $96 million,

respectively.

We have been deploying receivers that utilize 8PSK modulation technology and receivers that utilize MPEG-4

compression technology for several years. These technologies, when fully deployed, will allow more programming

channels to be carried over our existing satellites. Many of our customers today, however, do not have receivers that

use MPEG-4 compression and a smaller but still significant number do not have receivers that use 8PSK

modulation. We may choose to invest significant capital to accelerate the conversion of customers to MPEG-4

and/or 8PSK to realize the bandwidth benefits sooner. In addition, given that all of our HD content is broadcast in

MPEG-4, any growth in HD penetration will naturally accelerate our transition to these newer technologies and may

increase our subscriber acquisition and retention costs. All new receivers that we purchase from EchoStar have

MPEG-4 technology. Although we continue to refurbish and redeploy MPEG-2 receivers, as a result of our HD

initiatives and current promotions, we currently activate most new customers with higher priced MPEG-4

technology. This limits our ability to redeploy MPEG-2 receivers and, to the extent that our promotions are

successful, will accelerate the transition to MPEG-4 technology, resulting in an adverse effect on our SAC.

Our “Subscriber acquisition costs” and “Pay-TV SAC” may materially increase in the future to the extent that we

transition to newer technologies, introduce more aggressive promotions, or provide greater equipment subsidies. See

further discussion under “Other Liquidity Items – Subscriber Acquisition and Retention Costs.”

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

69

69

General and administrative expenses. “General and administrative expenses” totaled $1.354 billion during the year

ended December 31, 2012, a $119 million or 9.6% increase compared to the same period in 2011. This increase was

primarily due to increased personnel and infrastructure expenses for DISH Network and the inclusion of twelve months

of costs in 2012 for personnel, building and maintenance and other administrative costs associated with our

Blockbuster operations compared to eight months during the previous year. Blockbuster operations are included in our

financial results beginning April 26, 2011.

Litigation expense. “Litigation expense” related to legal settlements, judgments or accruals associated with certain

significant litigation totaled $730 million during the year ended December 31, 2012 related to the Voom Settlement

Agreement. During the year ended December 31, 2011, “Litigation expense” totaled a negative $317 million.

During the year ended December 31, 2011, we reversed $341 million related to the April 29, 2011 settlement

agreement with TiVo, which was previously recorded as an expense. See Note 16 and Note 20 in the Notes to our

Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for further discussion.

Depreciation and amortization. “Depreciation and amortization” expense totaled $983 million during the year ended

December 31, 2012, a $61 million or 6.6% increase compared to the same period in 2011. This change in

“Depreciation and amortization” expense was primarily due to $68 million of depreciation expense related to the 148

degree orbital location in 2012 and an increase in depreciation expense associated with additional assets which were

placed in service to support DISH Network, partially offset by a decrease in depreciation expense on equipment

leased to subscribers. See Note 8 in the Notes to the Consolidated Financial Statements in Item 15 of this Annual

Report on Form 10-K for further discussion.

Interest income. “Interest income” totaled $100 million during the year ended December 31, 2012, an increase of $65

million compared to the same period in 2011. This increase principally resulted from higher percentage returns earned

on our cash and marketable investment securities and higher average cash and marketable investment securities

balances during the year ended December 31, 2012.

Interest expense, net of amounts capitalized. “Interest expense, net of amounts capitalized” totaled $537 million

during the year ended December 31, 2012, a decrease of $21 million or 3.8% compared to the same period in 2011.

This change primarily resulted from capitalized interest of $106 million related to our wireless spectrum, partially

offset by the net interest expense associated with the issuances and redemption of our senior notes during 2012 and

2011.

Other, net. “Other, net” income totaled $148 million during the year ended December 31, 2012, an increase of $142

million compared to the same period in 2011. This change primarily resulted from a $99 million non-cash gain related

to the conversion of our DBSD North America 7.5% Convertible Senior Secured Notes due 2009 in connection with

the completion of the DBSD Transaction during the first quarter 2012 and an increase in net gains on the sale of

marketable investment securities of $96 million, partially offset by an increase in impairment charges of $32 million

during 2012. In addition, this change was impacted by a $25 million impairment charge related to the Blockbuster

UK Administration. See Note 6 and Note 10 in the Notes to the Consolidated Financial Statements in Item 15 of

this Annual Report on Form 10-K for further discussion.