Cincinnati Bell 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

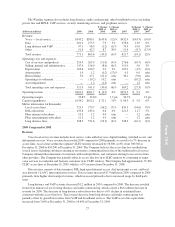

(a) Market Information

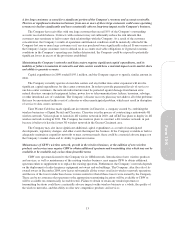

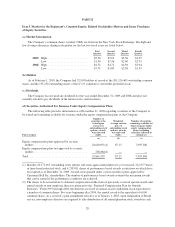

The Company’s common shares (symbol: CBB) are listed on the New York Stock Exchange. The high and

low closing sales prices during each quarter for the last two fiscal years are listed below:

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

2009 High ............................ $2.30 $3.03 $3.56 $3.59

Low ............................ $1.30 $2.46 $2.60 $2.93

2008 High ............................ $4.52 $4.71 $4.38 $3.04

Low ............................ $3.75 $3.89 $2.98 $1.39

(b) Holders

As of February 1, 2010, the Company had 32,903 holders of record of the 201,126,463 outstanding common

shares and the 155,250 outstanding shares of the 6

3

⁄

4

% cumulative convertible preferred stock.

(c) Dividends

The Company has not paid any dividends for the year ended December 31, 2009 and 2008 and does not

currently intend to pay dividends in the future on its common shares.

(d) Securities Authorized For Issuance Under Equity Compensation Plans

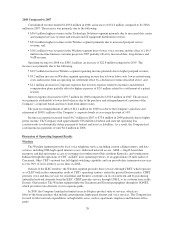

The following table provides information as of December 31, 2009 regarding securities of the Company to

be issued and remaining available for issuance under the equity compensation plans of the Company:

Plan Category

Number of

securities to be

issued upon

exercise of

outstanding stock

options, awards,

warrants and

rights

Weighted-

average exercise

price of

outstanding stock

options, awards,

warrants and

rights

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))

(a) (b) (c)

Equity compensation plans approved by security

holders ..................................... 24,603,051(1) $7.15 7,995,386

Equity compensation plans not approved by security

holders ..................................... 238,884(2) — —

Total ........................................ 24,841,935 $7.15 7,995,386

(1) Includes 20,172,163 outstanding stock options and stock appreciation rights not yet exercised, 212,877 shares

of time-based restricted stock, and 4,218,011 shares of performance-based awards, restrictions on which have

not expired as of December 31, 2009. Awards were granted under various incentive plans approved by

Cincinnati Bell Inc. shareholders. The number of performance-based awards assumes the maximum awards

that can be earned if the performance conditions are achieved.

(2) The shares to be issued relate to deferred compensation in the form of previously received special awards and

annual awards to non-employee directors pursuant to the “Deferred Compensation Plan for Outside

Directors.” From 1997 through 2004, the directors received an annual award of phantom stock equivalent to

a number of common shares. For years beginning after 2004, the annual award is the equivalent of 6,000

common shares. As a result of a plan amendment effective as of January 1, 2005, upon termination of Board

service, non-employee directors are required to take distribution of all annual phantom stock awards in cash.

20