Cincinnati Bell 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

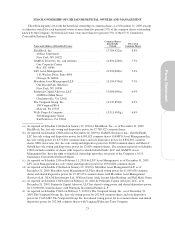

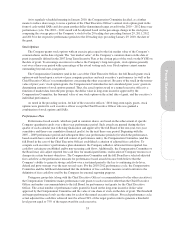

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of common shares as of December 31, 2009 (except

as otherwise noted) by each beneficial owner of more than five percent (5%) of the common shares outstanding

known by the Company. No beneficial owner owns more than five percent (5%) of the 6

3

⁄

4

% Cumulative

Convertible Preferred Shares.

Name and Address of Beneficial Owner

Common Shares

Beneficially

Owned

Percent of

Common Shares

BlackRock, Inc. ................................. 17,789,422(a) 8.8%

40 East 52nd Street

New York, NY 10022

GAMCO Investors, Inc. and affiliates ................ 14,850,226(b) 7.3%

One Corporate Center

Rye, NY 10580

LSV Asset Management .......................... 10,920,684(c) 5.4%

1 N. Wacker Drive, Suite 4000

Chicago, IL 60606

Marathon Asset Management LLP .................. 15,195,474(d) 7.5%

One Bryant Park 38th floor

New York, NY 10036

Peninsula Capital Advisors, LLC ................... 13,000,000(e) 6.4%

404B East Main Street

Charlottesville, VA 22902

The Vanguard Group, Inc. ......................... 13,947,850(f) 6.9%

100 Vanguard Blvd.

Malvern, PA 19355

Wells Fargo & Company .......................... 13,311,405(g) 6.6%

420 Montgomery Street

San Francisco, CA 94104

(a) As reported on Schedule 13G filed on January 29, 2010 by BlackRock, Inc., as of December 31, 2009,

BlackRock, Inc. has sole voting and dispositive power for 17,789,422 common shares.

(b) As reported on Schedule 13D/A filed on November 16, 2009 by GAMCO Investors, Inc., Gabelli Funds,

LLC has sole voting and dispositive power for 6,005,625 common shares, GAMCO Asset Management Inc.

has sole voting power for 8,372,601 common shares and sole dispositive power for 8,802,601 common

shares, MJG Associates, Inc. has sole voting and dispositive power for 30,000 common shares and Mario J.

Gabelli has sole voting and dispositive power for 12,000 common shares. The amounts reported on Schedule

13D/A include a number of shares with respect to which Gabelli Funds, LLC and GAMCO Asset

Management Inc. have the right to beneficial ownership upon the conversion of the Company’s 6

3

⁄

4

%

Cumulative Convertible Preferred Shares.

(c) As reported on Schedule 13G on February 11, 2010 by LSV Asset Management, as of December 31, 2009,

LSV Asset Management has sole voting and dispositive power for 10,920,684 common shares.

(d) As reported on Schedule 13G filed on January 29, 2010 by Marathon Asset Management LLP, as of

December 31, 2009, Marathon Asset Management LLP has shared voting power for 11,085,636 common

shares and shared dispositive power for 15,195,474 common shares with Marathon Asset Management

(Services) Ltd., M.A.M. Investments Ltd., William James Arah, Jeremy John Hosking, and Neil Mark Ostrer.

(e) As reported on Schedule 13G/A filed on February 10, 2010 by Peninsula Capital Advisors, LLC, as of

December 31, 2009, Peninsula Capital Advisors, LLC has shared voting power and shared dispositive power

for 13,000,000 common shares with Peninsula Investment Partners L.P.

(f) As reported on Schedule 13G/A on February 5, 2010 by The Vanguard Group, Inc., as of December 31,

2009, The Vanguard Group, Inc. has sole voting power for 292,968 common shares and sole dispositive

power for 13,654,882. The Vanguard Group, Inc. has shared voting power for no common shares and shared

dispositive power for 292,968 common shares with Vanguard Fiduciary Trust Company.

23

Proxy Statement