Cincinnati Bell 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Except for indemnification amounts recorded in relation to the sale of its national broadband business in 2003,

the Company has not recorded a liability for these indemnities, commitments, and other guarantees in the

Consolidated Balance Sheets.

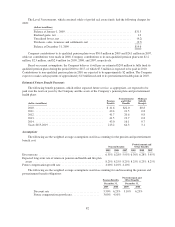

12. Income Taxes

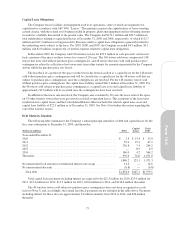

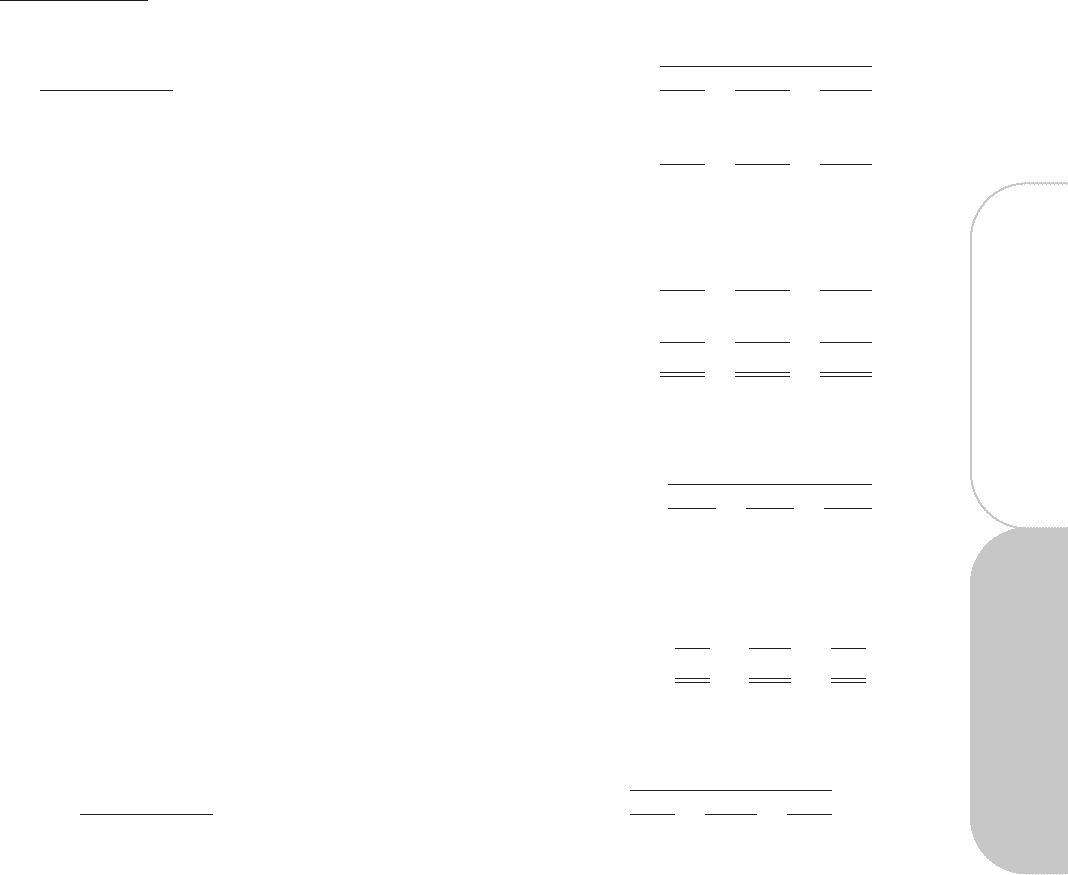

Income tax expense consists of the following:

Year Ended December 31,

(dollars in millions) 2009 2008 2007

Current:

Federal ................................................... $ 2.5 $ 3.5 $ 3.0

State and local ............................................. 1.5 2.8 2.4

Total current .............................................. 4.0 6.3 5.4

Investment tax credits ......................................... (0.3) (0.4) (0.4)

Deferred:

Federal ................................................... 59.8 64.7 48.7

State and local ............................................. 6.9 70.1 13.7

Total deferred ............................................. 66.7 134.8 62.4

Valuation allowance .......................................... (5.7) (67.1) (10.7)

Total ...................................................... $64.7 $ 73.6 $ 56.7

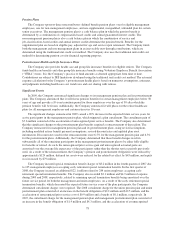

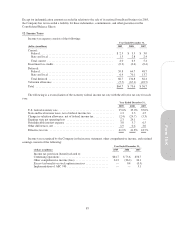

The following is a reconciliation of the statutory federal income tax rate with the effective tax rate for each

year:

Year Ended December 31,

2009 2008 2007

U.S. federal statutory rate ....................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal income tax ............... 1.3 3.3 4.5

Change in valuation allowance, net of federal income tax .............. (2.4) (24.7) (5.3)

Expiring state net operating loss ................................. 2.3 24.1 —

Nondeductible interest expense .................................. 3.8 3.7 6.5

Other differences, net .......................................... 1.9 0.4 3.0

Effective tax rate ............................................. 41.9% 41.8% 43.7%

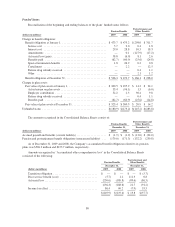

Income tax recognized by the Company in the income statement, other comprehensive income, and retained

earnings consists of the following:

Year Ended December 31,

(dollars in millions) 2009 2008 2007

Income tax provision (benefit) related to:

Continuing operations .................................. $64.7 $ 73.6 $56.7

Other comprehensive income (loss) ....................... 24.2 (36.2) 34.1

Excess tax benefits or stock option exercises ................ — 0.4 (0.5)

Implementation of ASC 740 ............................. — — 5.1

85

Form 10-K