Cincinnati Bell 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

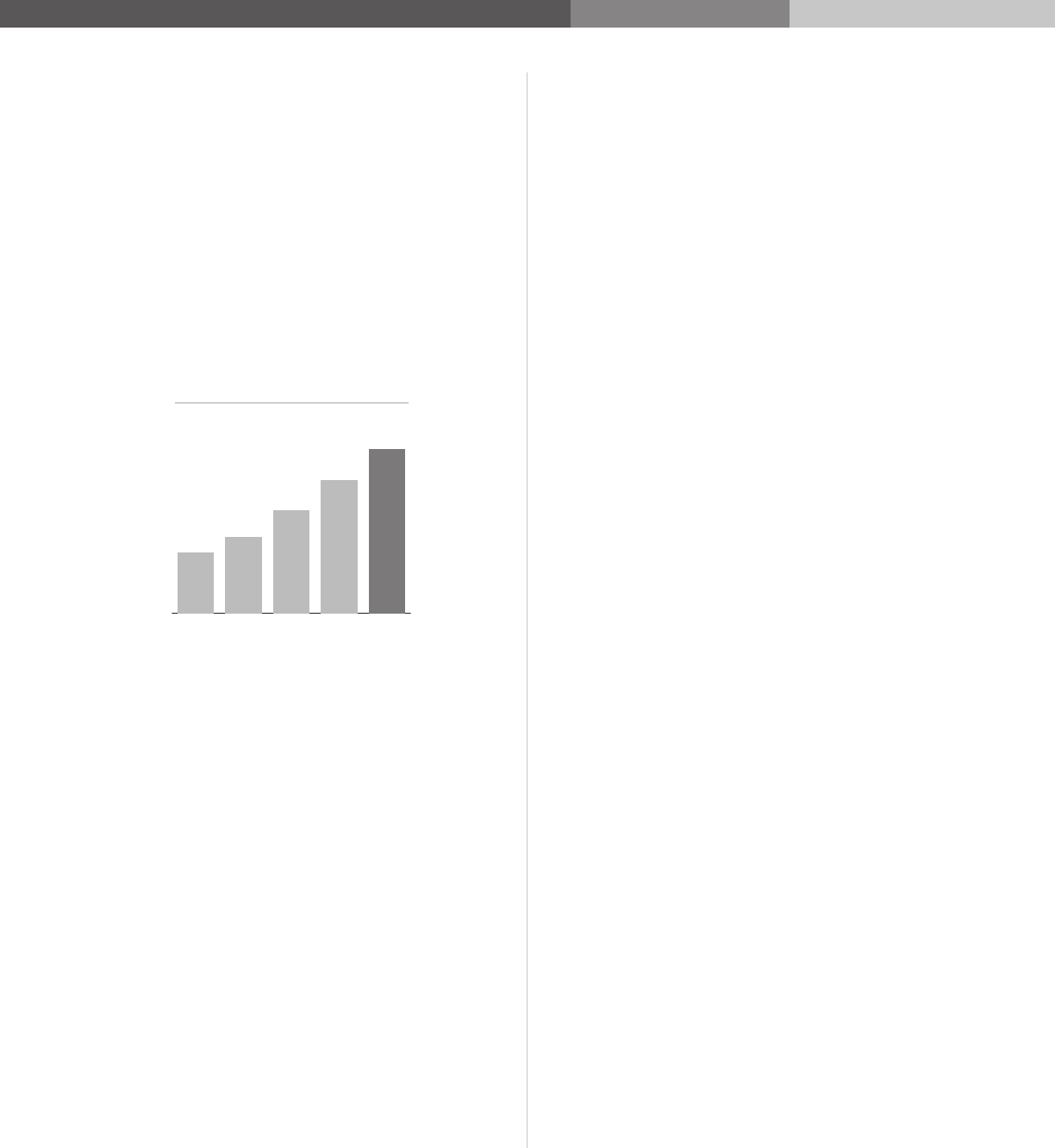

economy, which drove a 7% decline to the Technology

Solutions total revenue compared to 2008, but we

believe this revenue will return as the economy

improves over the next several years. Adjusted EBITDA3

of $43 million and operating income of $22 million

both increased over 20% from a year ago as a result of

the revenue growth in the high-margin data center

operations.

200720062005 2008 2009

Technology Solutions

Adjusted EBITDA

(in millions)

$43

$35

$27

$20

$16

In addition to keeping pace with demand for data

center space, we took important steps in the area of data

center virtualization during 2009. We qualified to

participate as a service provider and reseller of the

Vblock™ ecosystem, which is a virtual data center

offering that combines the best-of-breed virtualization

software from VMware, unified networking, security,

and computing from Cisco, and storage, security and

management technologies from EMC. This package is

an element of the recently announced Virtual

Computing Environment coalition formed by Cisco

and EMC, together with VMware. Now we can help

customers accelerate their plans to implement a private

cloud infrastructure based on industry-leading

technology and take advantage of the critical IT

efficiencies this provides. This is an important step for

the industry and for us, and we believe virtual data

centers, which provide a more efficient and cost-

effective means of computing for customers, will be one

of the next evolutionary steps for the data center

operations industry.

The outsourced data center operations industry is in its

nascency, as only 10% of companies have outsourced

their data center operations. We believe that this

percentage will increase significantly over time given the

cost and capital savings that can be obtained by

companies from outsourcing their data center

operations to an industry expert such as Cincinnati Bell.

We believe our right to win in this space comes from

our history of reliably delivering diverse carrier-grade

network solutions for businesses of all sizes, and the

success and expertise displayed with our organically

grown 271,000 square feet of data center space. We

intend to commit significant resources to expand our

data center operations, including growth of our existing

operations, greenfield construction of new data center

sites in geographic areas outside our current footprint

including international sites, and acquisitions.

Wireless

Focus on Smartphones Sustains High Data Revenues

Particularly in these difficult economic times, we

understand that it is critical to provide the best value for

the customer. To that end, in 2009 we introduced the

Why-Pay-For-Two campaign, which provides a free

smartphone data plan for a customer that uses our DSL

high-speed internet service. We saw strong interest in

this new bundle and other smartphone-oriented

promotions, which almost doubled our smartphone

activations in 2009 and resulted in 83,000 smartphone

subscribers at the end of 2009. These smartphone

subscribers drove a 25% increase in our average revenue

per user (ARPU) for data plans to $10.00 per month for

2009, and allowed our total monthly ARPU to remain

steady compared to 2008 despite a decline in voice

minutes of use. Although we believe these devices have

2