Cincinnati Bell 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company often is contracted to install the IT equipment that it sells. The revenue recognition guidance

in ASC 985, “Software,” is applied, which requires vendor specific objective evidence (“VSOE”) in order to

recognize the IT equipment separate from the installation. The Company has customers to which it sells IT

equipment without the installation service, customers to which it provides installation services without the IT

equipment, and also customers to which it provides both the IT equipment and the installation services. As such,

the Company has VSOE that permits the separation of the IT equipment from the installation services. The

Company recognizes revenue from the sale of the IT equipment upon completion of its contractual obligations,

generally upon delivery of the IT equipment to the customer, and recognizes installation service revenue upon

completion of the installation.

Pricing of local voice services is generally subject to oversight by both state and federal regulatory

commissions. Such regulation also covers services, competition, and other public policy issues. Various

regulatory rulings and interpretations could result in increases or decreases to revenue in future periods.

Advertising Expenses — Costs related to advertising are expensed as incurred and amounted to $22.8

million, $25.1 million, and $26.4 million in 2009, 2008, and 2007, respectively.

Legal Expenses — Legal costs incurred in connection with loss contingencies are expensed as incurred.

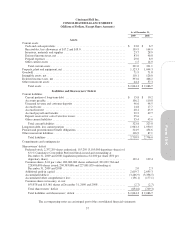

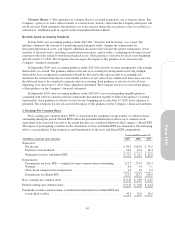

Income and Operating Taxes — The income tax provision consists of an amount for taxes currently

payable and an amount for tax consequences deferred to future periods. Deferred investment tax credits are being

amortized as a reduction of the provision for income taxes over the estimated useful lives of the related property,

plant and equipment. At December 31, 2009, the Company has $477.5 million of deferred income taxes, net in

the Consolidated Balance Sheet. The ultimate realization of the deferred income tax assets depends upon the

Company’s ability to generate future taxable income during the periods in which basis differences and other

deductions become deductible and prior to the expiration of the net operating loss carryforwards with the

majority of them expiring between 2021 and 2023. The Company’s previous tax filings are subject to normal

reviews by regulatory agencies until the related statute of limitations expires.

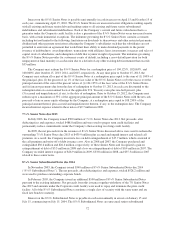

The Company adopted the provisions of ASC 740 on January 1, 2007. As a result of the implementation of

ASC 740, the Company recognized a $5.1 million increase in the liability for unrecognized tax benefits, which

was accounted for as an increase to the January 1, 2007 accumulated deficit balance. At December 31, 2009 and

2008, the Company had a $16.7 million and $15.6 million liability recorded for unrecognized tax benefits,

respectively. The total amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate

is $16.4 million at December 31, 2009. The Company does not currently anticipate that the amount of

unrecognized tax benefits will change significantly over the next year. Refer to Note 12 for further discussion

related to income taxes.

The Company incurs certain operating taxes that are reported as expenses in operating income, such as

property, sales, use, and gross receipts taxes. These taxes are not included in income tax expense because the

amounts to be paid are not dependent on the level of income generated by the Company. The Company also

records expense against operating income for the establishment of liabilities related to certain operating tax audit

exposures. These liabilities are established based on the Company’s assessment of the probability of payment.

Upon resolution of an audit, any remaining liability not paid is released and increases operating income.

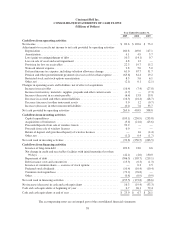

The Company incurs federal regulatory taxes on certain revenue producing transactions. The Company is

permitted to recover certain of these taxes by billing the customer; however, collections cannot exceed the

amount due to the federal regulatory agency. These federal regulatory taxes are presented in sales and cost of

services on a gross basis because, while the Company is required to pay the tax, it is not required to collect the

tax from customers and, in fact, does not collect the tax from customers in certain instances. The amount

recorded as revenue for 2009, 2008, and 2007 was $16.7 million, $16.6 million, and $17.3 million, respectively.

Excluding an operating tax settlement gain of $10.2 million in 2008, the amount expensed for 2009, 2008, and

2007 was $17.2 million, $17.0 million, and $18.2 million, respectively. The Company records all other taxes

collected from customers on a net basis. In the fourth quarter of 2008, the Company settled certain operating tax

issues and as a result recorded $10.2 million of income, which is presented as an “Operating tax settlement” in

the Consolidated Statements of Operations.

63

Form 10-K