Cincinnati Bell 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

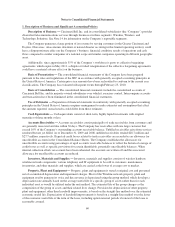

separation obligation was included in “Other current liabilities,” and $6.5 million was included in “Other

noncurrent liabilities” in the Consolidated Balance Sheet. The special termination benefits and curtailment

charges are included in “Pension and postretirement benefit obligations” in the Consolidated Balance Sheets at

December 31, 2009 and 2008.

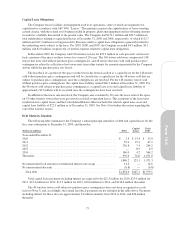

In 2001, the Company adopted a restructuring plan which included initiatives to eliminate non-strategic

operations and merge internet operations into the Company’s other operations. The Company completed the plan

prior to 2003, except for certain lease obligations, which are expected to continue through 2015 and for which a

liability remains at December 31, 2009 totaling $4.4 million. Cash payments against this lease termination

liability have approximated $1 million per year in 2009, 2008, and 2007.

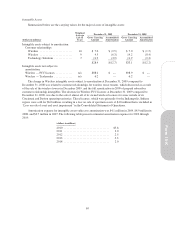

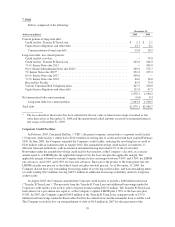

4. Property, Plant and Equipment

Property, plant and equipment is comprised of the following:

December 31, Depreciable

Lives (Years)(dollars in millions) 2009 2008

Land and rights-of-way ........................ $ 9.8 $ 10.1 20-Indefinite

Buildings and leasehold improvements ............ 466.8 391.9 2-40

Network equipment ........................... 2,519.2 2,399.2 2-50

Office software, furniture, fixtures and vehicles ..... 122.5 118.3 3-14

Construction in process ........................ 26.8 87.9 n/a

Gross value ................................. 3,145.1 3,007.4

Accumulated depreciation ...................... (2,021.8) (1,963.1)

Net book value ............................... $1,123.3 $ 1,044.3

Gross property, plant and equipment includes $139.9 million and $66.4 million of assets accounted for as

capital leases as of December 31, 2009 and 2008, respectively, primarily related to wireless towers, and data

center equipment and facilities. These assets are primarily included in the captions “Building and leasehold

improvements,” “Network equipment,” and “Office software, furniture, fixtures and vehicles.” See Notes 5 and 7

for further discussion regarding capital leases related to wireless towers. The Company currently has capital

leases for four data center facilities with an option to extend the initial lease term and, for two of the facilities, the

Company has the option to purchase the buildings. Amortization of capital leases is included in “Depreciation” in

the Consolidated Statements of Operations. Approximately 82%, 81%, and 82% of “Depreciation,” as presented

in the Consolidated Statements of Operations in 2009, 2008, and 2007, respectively, was associated with the cost

of providing services and products.

5. Sale of Wireless Towers and Acquisitions of Businesses

Sale of Wireless Towers

In December 2009, the Company sold 196 wireless towers for $99.9 million in cash proceeds, and leased

back a portion of the space on these towers for a term of 20 years. The 196 towers sold were composed of 148

towers that were sold without purchase price contingencies, and 48 towers that were sold with purchase price

contingencies related to collection of net tower rents from other tenants for amounts represented by the Company

and on which the purchase price was based.

Proceeds of $75.4 million for the 148 wireless towers sold without purchase price contingencies resulted in

a deferred gain of $35.1 million. This deferred gain is included in “Other noncurrent liabilities” on the

Consolidated Balance Sheet and will be amortized to income on a straight-line basis over the 20-year term of the

leaseback of the space on the towers.

The 48 towers sold subject to purchase price contingencies have not been recognized as a sale, since the

ultimate purchase price is not yet determined. The net book value for these 48 towers remains in “Property, plant

and equipment, net,” and amounts received in December 2009 for these towers totaling $24.5 million have been

included as a current liability in “Deposit received for sale of wireless towers” in the Consolidated Balance Sheet

in accordance with the deposit method. Most of the contingencies are expected to be resolved by the end of 2010,

67

Form 10-K