Cincinnati Bell 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

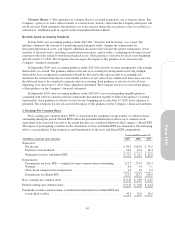

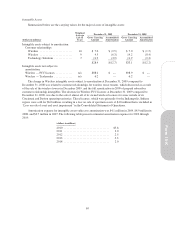

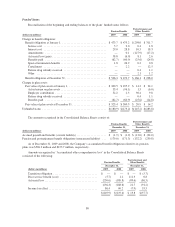

7. Debt

Debt is comprised of the following:

December 31,

(dollars in millions) 2009 2008

Current portion of long-term debt:

Credit facility, Tranche B Term Loan ......................................... $ 2.1 $ 2.1

Capital lease obligations and other debt ....................................... 13.7 8.1

Current portion of long-term debt .......................................... 15.8 10.2

Long-term debt, less current portion:

Credit facility, revolver .................................................... — 73.0

Credit facility, Tranche B Term Loan ......................................... 202.8 204.9

7

1

⁄

4

% Senior Notes due 2013 ............................................... — 439.9

83/8% Senior Subordinated Notes due 2014* ................................... 569.8 572.7

7% Senior Notes due 2015* ................................................ 252.3 257.2

8

1

⁄

4

% Senior Notes due 2017 ............................................... 500.0 —

7

1

⁄

4

% Senior Notes due 2023 ............................................... 40.0 50.0

Receivables Facility ...................................................... 85.9 75.0

Various Cincinnati Bell Telephone notes ...................................... 207.5 230.0

Capital lease obligations and other debt ....................................... 111.8 47.5

1,970.1 1,950.2

Net unamortized (discount) premium ........................................... (6.8) 0.3

Long-term debt, less current portion ........................................ 1,963.3 1,950.5

Total debt ................................................................. $1,979.1 $1,960.7

* The face amount of these notes has been adjusted for the fair value of interest rate swaps classified as fair

value derivatives at December 31, 2008 and the unamortized called amounts received on terminated interest

rate swaps at December 31, 2009.

Corporate Credit Facilities

In February 2005, Cincinnati Bell Inc. (“CBI”), the parent company, entered into a corporate credit facility

(“Corporate credit facility”) which had a $250.0 million revolving line of credit and would have expired February

2010. In June 2009, the Company amended the Corporate credit facility, reducing the revolving line of credit to

$210 million with an expiration date in August 2012. The amended revolving credit facility is funded by 11

different financial institutions, with no financial institution having more than 12% of the total facility.

Borrowings under the amended revolving credit facility bear interest, at the Company’s election, at a rate per

annum equal to (i) LIBOR plus the applicable margin or (ii) the base rate plus the applicable margin. The

applicable margin is based on certain Company financial ratios and ranges between 3.00% and 3.50% for LIBOR

rate advances, and 2.00% and 2.50% for base rate advances. Base rate is the greater of the bank prime rate, the

LIBOR rate plus one percent or the federal funds rate plus one-half percent. As of December 31, 2009, the

Company did not have any outstanding borrowings under its revolving credit facility, and had outstanding letters

of credit totaling $24.5 million, leaving $185.5 million in additional borrowing availability under its Corporate

credit facility.

In August 2005, the Company amended the Corporate credit facility to include a $400 million term loan

(“Tranche B Term Loan”). The proceeds from the Tranche B Term Loan and additional borrowings under the

Corporate credit facility were used to retire corporate bonds totaling $447.8 million. The Tranche B Term Loan

bears interest at a per annum rate equal to, at the Company’s option, LIBOR plus 1.50% or the base rate plus

0.50%. In 2007, the Company repaid $184.0 million of the Tranche B Term Loan, using proceeds of $75.0

million from borrowings under the Receivables Facility described below and the remainder from available cash.

The Company recorded a loss on extinguishment of debt of $0.4 million in 2007 for the repayment of the

70