Cincinnati Bell 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

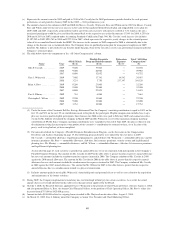

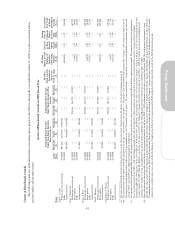

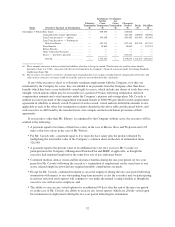

Option Awards Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Option (#)

Exercisable

Number of

Securities

Underlying

Unexercised

Option (#)

Unexercisable

Equity

Incentive Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)

Option

Exercise

Price

($)

Option

Expiration

Date (a)

Number of

Shares or

Units of

Stocks That

Have Not

Vested

(#)

Market

Value of

Shares or

Units of

Stocks That

Have Not

Vested

($)

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares, Units

or Other

Rights That

Have Not

Vested

(#) (b)

Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units

or Other

Rights That

Have Not

Vested

($) (c)

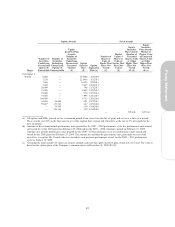

Christopher J.

Wilson ..... 8,000 — 35.9688 1/3/2010

7,250 — 22.8438 1/2/2011

1,000 — 16.425 9/5/2011

7,400 — 9.645 12/4/2011

20,000 — 3.48 12/5/2012

51,000 — 5.655 12/4/2013

75,000 — 3.70 12/3/2014

77,400 — 3.995 12/1/2015

100,000 — 4.735 12/8/2016

64,000 36,000 4.91 12/7/2017

59,027 151,783 1.67 12/5/2018

— 74,495 1.39 1/30/2019

— 126,140 1.39 1/30/2019

— — 245,606 847,341

(a) All options and SARs granted are for a maximum period of ten years from the date of grant and vest over a three year period.

These awards vest 28% on the first anniversary of the original date of grant and, thereafter, at the rate of 3% per month for the

next 24 months.

(b) Amounts in the column include performance units granted for the 2007 – 2009 performance cycle less performance units earned

and vested for (i) the 2007 period on February 29, 2008 and (ii) the 2007 – 2008 cumulative period on February 27, 2009.

Amounts also include performance units granted for the 2008 – 2010 performance cycle less performance units earned and

vested for the 2008 period on February 27, 2009. The amount also includes the performance unit grant made to each of the

executives, except for Mr. Cassidy who was awarded a cash-payment performance award, for the 2009 – 2011 performance

cycle on January 30, 2009.

(c) Assuming the target number of shares are earned, amounts represent the equity incentive plan awards not yet vested. The value is

based on the closing price of the Company’s common shares on December 31, 2009 ($3.45).

45

Proxy Statement