Cincinnati Bell 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Treasury Shares — The repurchase of common shares is recorded at purchase cost as treasury shares. The

Company’s policy is to retire, either formally or constructively, treasury shares that the Company anticipates will

not be reissued. Upon retirement, the purchase cost of the treasury shares that exceeds par value is recorded as a

reduction to “Additional paid-in capital” in the Consolidated Balance Sheets.

Recently Issued Accounting Standards

In June 2009, new accounting guidance under ASC 860, “Transfers and Servicing,” was issued. The

guidance eliminates the concept of a qualifying special-purpose entity, changes the requirements for

derecognizing financial assets, and requires additional disclosures that will provide greater transparency about

transfers of financial assets, including securitization transactions, and an entity’s continuing involvement in and

exposure to the risks related to transferred financial assets. Such guidance is effective for fiscal years beginning

after November 15, 2009. The Company does not expect the impact of this guidance to be material to the

Company’s financial statements.

In September 2009, new accounting guidance under ASC 605 related to revenue arrangements with multiple

deliverables was issued. The guidance addresses the unit of accounting for arrangements involving multiple

deliverables, how arrangement consideration should be allocated to the separate units of accounting and

eliminates the criterion that objective and reliable evidence of fair value of any undelivered items must exist for

the delivered item to be considered a separate unit of accounting. Such guidance is effective for fiscal years

beginning on or after June 15, 2010. Early adoption is permitted. The Company has not yet assessed the impact

of this guidance on the Company’s financial statements.

In September 2009, new accounting guidance under ASC 605, was issued regarding tangible products

containing both software and non-software components that function together to deliver the product’s essential

functionality. Such guidance is effective for fiscal years beginning on or after June 15, 2010. Early adoption is

permitted. The Company has not yet assessed the impact of this guidance on the Company’s financial statements.

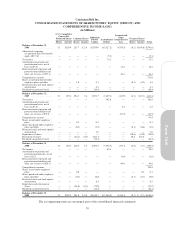

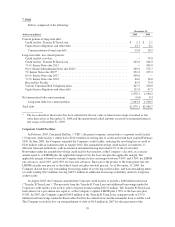

2. Earnings Per Common Share

Basic earnings per common share (“EPS”) is based upon the weighted average number of common shares

outstanding during the period. Diluted EPS reflects the potential dilution that would occur if common stock

equivalents were exercised, but only to the extent that they are considered dilutive to the Company’s diluted EPS.

The impact of participating securities on the calculations of basic and diluted EPS was immaterial. The following

table is a reconciliation of the numerators and denominators of the basic and diluted EPS computations:

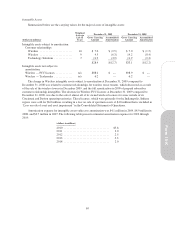

Year Ended December 31,

(in millions, except per share amounts) 2009 2008 2007

Numerator:

Net income ......................................................... $ 89.6 $102.6 $ 73.2

Preferred stock dividends .............................................. 10.4 10.4 10.4

Numerator for basic and diluted EPS ..................................... $ 79.2 $ 92.2 $ 62.8

Denominator:

Denominator for basic EPS — weighted average common shares outstanding .... 212.2 237.5 247.4

Warrants ........................................................... 0.6 3.4 7.1

Stock-based compensation arrangements ................................. 2.4 1.8 2.3

Denominator for diluted EPS ........................................... 215.2 242.7 256.8

Basic earnings per common share ......................................... $ 0.37 $ 0.39 $ 0.25

Diluted earnings per common share ........................................ $ 0.37 $ 0.38 $ 0.24

Potentially issuable common shares excluded from denominator for diluted EPS due

to anti-dilutive effect ................................................. 42.4 42.0 36.5

65

Form 10-K