Cincinnati Bell 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

credit-related disconnections that the Company has experienced in the past. Credit-related disconnections

represented 32% of total ILEC consumer access line losses in 2009, which is approximately 3 percentage points

higher than in the past. The Company believes this level of credit-related disconnections will continue in 2010.

The Company has been successful at partially offsetting revenue reductions from access line losses with

additional data revenue. DSL subscribers have increased by 600 in 2009, 11,700 in 2008, and 23,200 in 2007.

The rate of the DSL subscribers increase is declining because the Company’s operating territory is saturated with

customers that already have high-speed internet service.

Offsetting this trend, in 2009 the Company launched its Fioptics fiber-to-the-home product suite, which

provides entertainment, high-speed internet and voice services. At year-end 2009, the Company passed and can

provide service to 41,000 homes, and had 11,100 entertainment, 10,200 high-speed internet, and 7,500 voice

Fioptics customers. The penetration rate of this product is almost 30% after only a six-month period. The

Company expects the number of Fioptics customers to increase in 2010 and plans to construct additional fiber

network in 2010, subject to capital availability.

Long distance and VoIP revenues will be impacted by several factors. As noted above, customers may

disconnect local voice service for various reasons. In doing so, customers that have both the Company’s local

voice and long distance service are likely to disconnect long distance service as well. Also, as noted above, some

customers have disconnected wireline service in order to use service from other providers. These other providers

are normally providing VoIP service, which the Company offers to business customers. The Company believes

its VoIP operations will expand as business customers continue to look for alternatives to traditional ILEC-based

operations and the VoIP technology continues to improve. The Company is planning to expand its VoIP offering

and CLEC operations to two additional cities in 2010. This expansion effort has considerably lower capital

investment than many of the Company’s other plans and will further leverage the Cincinnati Bell brand outside

of the current operating footprint. The Company had 14,600 VoIP access line equivalents at December 31, 2009

versus 7,600 VoIP access line equivalents at December 31, 2008.

Wireless

Wireless postpaid revenue in the future is likely to be affected by data ARPU increases, as more customers

begin using data services and smartphones. The Company’s data ARPU has increased from $6.21 in 2007 to

$8.02 in 2008 to $10.00 in 2009. Given the Company’s focus on increasing smartphone subscribers, the

Company expects data ARPU to increase in 2010. However, the Company believes postpaid ARPU will remain

flat to 2009 as any data ARPU increase may be offset by lower voice revenue, consistent with the lower voice

minutes of use per subscriber experienced in 2009.

Wireless postpaid subscribers decreased by 24,600 in 2009. The Company believes it lost subscribers in

2009 due to the Company’s tightening of credit standards and increased competition, in part driven by handset

exclusivity contracts, such as for the iPhoneTM, which keeps the Company from being able to sell these popular

handsets to its customers. Similar to DSL service, the Company’s operating territory is well-saturated with

existing wireless cell phone users. Future subscriber increases are more likely to come from increasing market

share, as opposed to acquiring a customer who has never had a cell phone. The Company’s competitors are well-

funded, and increases in market share are difficult to attain. The Company believes it is likely in 2010 that

competition will be fierce and its competitors will continue to have exclusivity contracts on the most popular

handsets, which could result in further postpaid subscriber decreases in 2010. Improvements in CBW net

subscriber losses would need to come from a higher level of gross activations resulting from enhanced

communication regarding CBW’s strong network, the value proposition of its wireless voice and data plans, and

outstanding customer service. The Company believes average postpaid churn will remain at the same levels as

experienced in 2009.

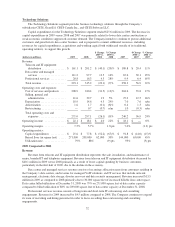

Technology Solutions

Revenue from data center and managed services increased by 14% in 2009, 45% in 2008, and 43% in 2007.

Although the Company plans to add new data center capacity in 2010 and believes data center operations is a key

growth area for the Company, the poor economic environment in 2009 caused a decrease in the demand for new

data center space. The Company expects that a recovering economy could help to increase demand for data

center space and managed services in 2010.

37

Form 10-K