Cincinnati Bell 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

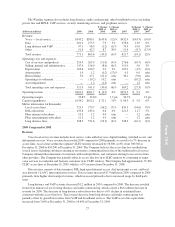

Wireless

The Wireless segment provides advanced digital voice and data communications services through the

operation of a regional wireless network in the Company’s licensed service territory, which surrounds Cincinnati

and Dayton, Ohio and includes areas of northern Kentucky and southeastern Indiana. Although Wireless does not

market to customers outside of its licensed service territory, it is able to provide service outside of this territory

through roaming agreements with other wireless operators. The segment also sells wireless handset devices and

related accessories to support its service business.

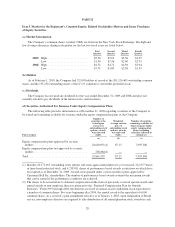

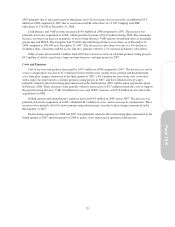

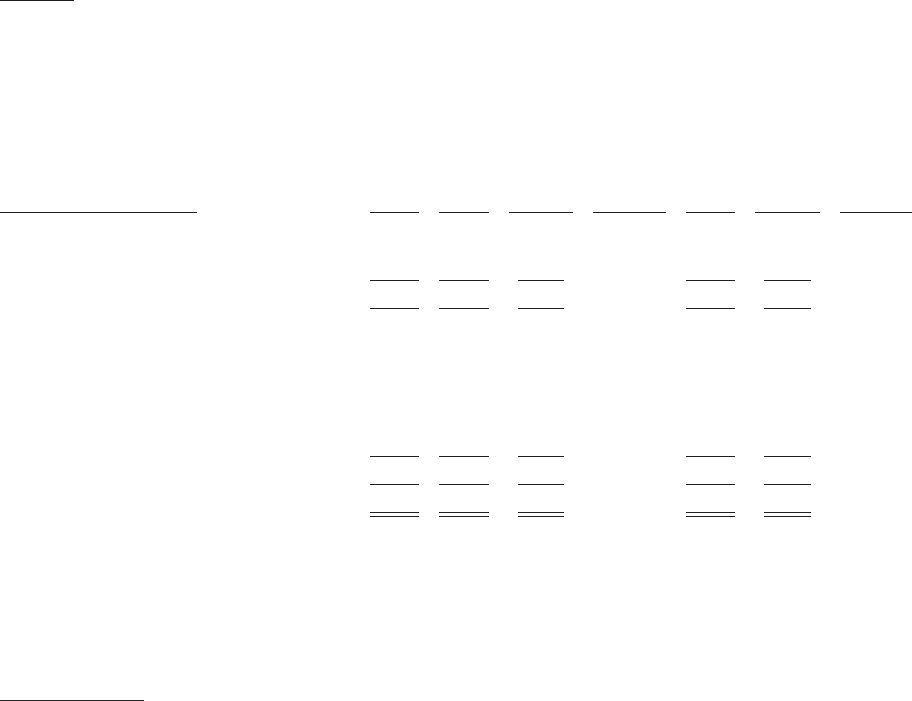

(dollars in millions,

except for operating metrics) 2009 2008

$ Change

2009 vs.

2008

% Change

2009 vs.

2008 2007

$ Change

2008 vs.

2007

% Change

2008 vs.

2007

Revenue:

Service .............................. $284.3 $290.5 $ (6.2) (2)% $267.5 $ 23.0 9%

Equipment ............................ 22.7 25.6 (2.9) (11)% 27.0 (1.4) (5)%

Total revenue ......................... 307.0 316.1 (9.1) (3)% 294.5 21.6 7%

Operating costs and expenses:

Cost of services and products ............. 161.6 162.6 (1.0) (1)% 152.1 10.5 7%

Selling, general and administrative ........ 68.2 70.7 (2.5) (4)% 68.2 2.5 4%

Depreciation .......................... 37.9 33.4 4.5 13% 34.8 (1.4) (4)%

Amortization .......................... 1.5 2.1 (0.6) (29)% 3.0 (0.9) (30)%

Restructuring ......................... — 0.5 (0.5) n/m 2.1 (1.6) n/m

Loss on sale of asset .................... 4.8 — 4.8 n/m — — n/m

Total operating costs and expenses ........ 274.0 269.3 4.7 2% 260.2 9.1 3%

Operating income ........................ $ 33.0 $ 46.8 $(13.8) (29)% $ 34.3 $ 12.5 36%

Operating margin ........................ 10.7% 14.8% (4.1) pts 11.6% 3.2 pts

Capital expenditures ...................... $ 34.9 $ 50.3 $(15.4) (31)% $ 45.7 $ 4.6 10%

Operating metrics

Postpaid ARPU* ....................... $48.56 $48.69 $(0.13) 0% $46.55 $ 2.14 5%

Prepaid ARPU* ....................... $28.64 $26.56 $ 2.08 8% $23.97 $ 2.59 11%

Postpaid subscribers (in thousands) .......... 379.1 403.7 (24.6) (6)% 400.4 3.3 1%

Prepaid subscribers (in thousands) ........... 154.0 146.9 7.1 5% 170.6 (23.7) (14)%

Average postpaid churn ................... 2.2% 2.1% 0.1 pts 1.6% 0.5 pts

* The Company has presented certain information regarding monthly average revenue per user (“ARPU”)

because the Company believes ARPU provides a useful measure of the operational performance of the

wireless business. ARPU is calculated by dividing service revenue by the average subscriber base for the

period.

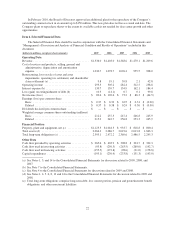

2009 Compared to 2008

Revenue

Service revenue decreased by $6.2 million during 2009 as compared to last year primarily due to the

following:

•Postpaid service revenue decreased $7.3 million primarily due to a decrease in subscribers. The

Company’s monthly subscriber churn increased from 2.1% in 2008 to 2.2% in 2009. The Company

believes it lost subscribers in 2009 due to the Company’s tightening of credit standards and increased

competition in part driven by handset exclusivity contracts, such as for the iPhoneTM, which keeps the

Company from being able to sell these popular handsets to its customers. ARPU remained steady as a

decline in voice revenue offset a 25% increase in data ARPU, as more customers are using smartphones,

which promotes increased data usage. At December 31, 2009, the Company had 83,000 smartphone

subscribers which represents 22% of its postpaid subscribers, compared to 11% at December 31, 2008;

and

•Prepaid service revenue increased $1.1 million compared to 2008 primarily due to an increase in ARPU of

$2.08, which resulted from the focus on marketing higher value rate plans.

Equipment revenue for 2009 decreased $2.9 million from $25.6 million in 2008 to $22.7 million in 2009

primarily due to lower postpaid subscriber activations partially offset by higher handset revenue per unit.

30