Cincinnati Bell 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

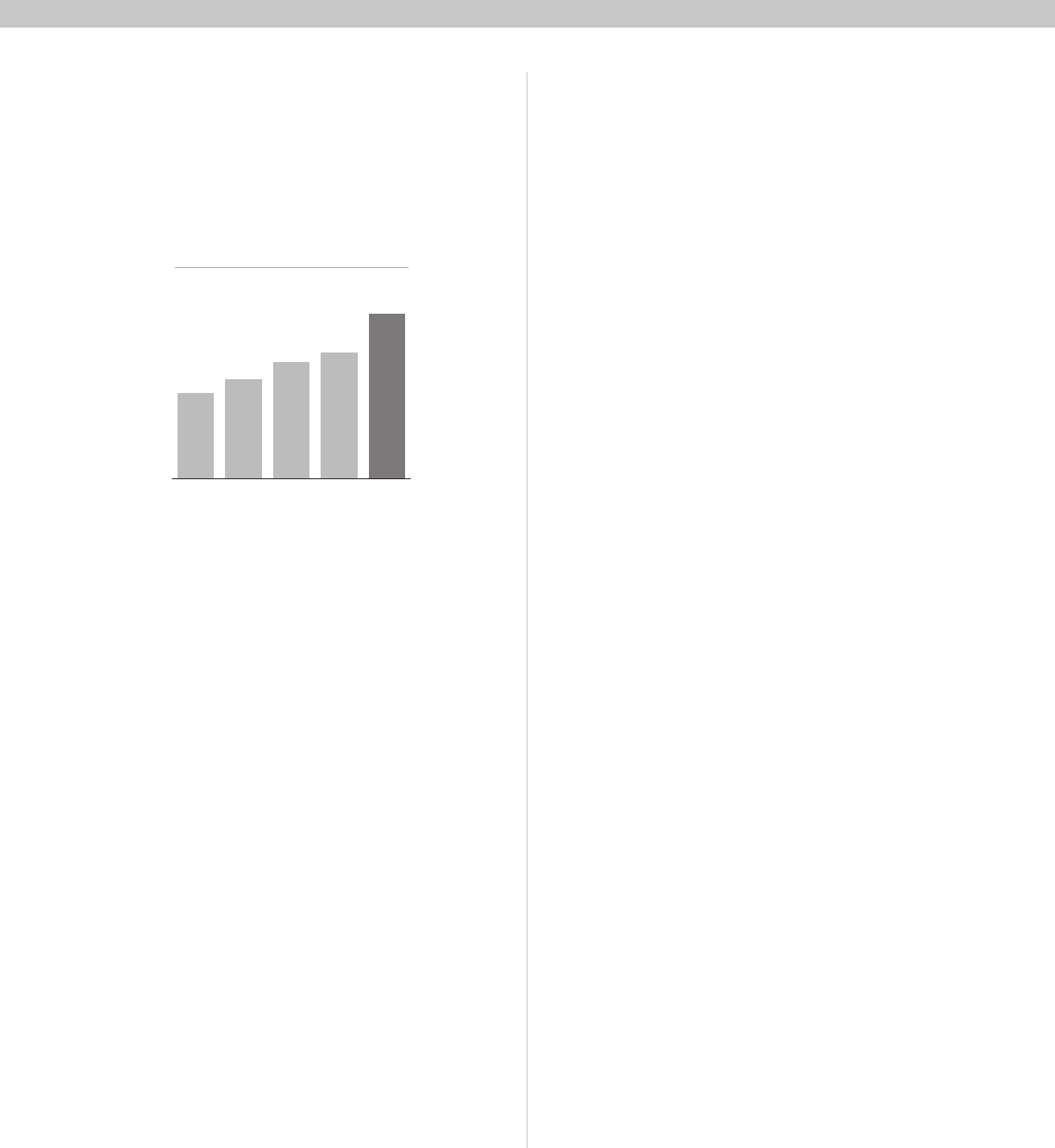

widespread appeal, smartphone subscribers account for

only 22% of our postpaid subscribers at the end of

2009. As a result, we will continue to emphasize sales of

these devices and the sales of the high-value data plans.

2Q091Q094Q08 3Q09 4Q09

Wireless Postpaid

Smartphone Customers

(in thousands)

83

64

59

50

43

Wireless service revenue of $284 million in 2009

decreased 2% compared to 2008 primarily due to fewer

subscribers. Lack of handset availability continues to be

an issue for us when competing against the national

carriers, but we have some exciting phones coming in

the first half of 2010 that we believe will help level the

playing field. We began selling Third Generation

Network (3G) smartphones in our stores at the end of

January 2010, and expect to have a full line up of 3G

Blackberry, Android and other devices in the first half of

this year. Wireless operating income decreased by $14

million to $33 million in 2009, primarily as a result of

the revenue decline, higher subsidies to support the

smartphone growth, and a loss on sale of spectrum for

non-operating areas.

Wireline

Cost Reductions Maintain Wireline Profitability

New Product Introduction Revitalizes the Segment

Like all wireline providers, Cincinnati Bell continues to

experience access line loss due primarily to wireless

substitution. Total access lines including VoIP (voice

over internet protocol) equivalents declined by 6%,

reflecting an in-territory access line decline of 8% offset

by VoIP access line equivalents and net access line

additions in out-of-territory markets. Business access

lines, when including the access line equivalents of new

and existing customers migrating to VoIP services,

remained essentially flat. We believe this is an

outstanding result in the midst of an economic

downturn that has produced an increased rate of small

business failures and job losses.

Despite the $46 million reduction in Wireline revenue

from access line losses, we were able to generate

Wireline operating income of $261 million in 2009, a

flat result to the prior year. This is an incredible

achievement. The significant benefits from the cost

reduction initiatives previously mentioned and the

decrease to restructuring charges effectively offset the

revenue declines in 2009.

We invested in the long-term viability of the Wireline

segment in 2009 by introducing our new Fioptics suite

of services. Fioptics is a fiber-to-the-home suite of

services that provides entertainment, high-speed

internet, and traditional voice services. We sell our

Fioptics internet product at speeds up to 30 megabits

per second, which is the fastest internet service in our

region, and offer 300 basic and premium video

entertainment channels, including 50 channels in high

definition. At the end of 2009, our Fioptics services

were available to 41,000 homes in Greater Cincinnati,

and we had 11,100 customers for our Fioptics

entertainment services, 10,200 high-speed internet

customers, and 7,500 voice customers. We are very

pleased with the initial results of these services,

particularly with the almost 30% customer penetration

rate of homes passed that we are achieving after six

months. We are equally pleased with the bundling

results within the Fioptics product suite. Over 80% of

our Fioptics customers take two or more of our

3