Cincinnati Bell 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

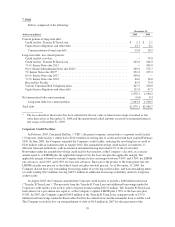

obligations, ranking junior to all existing and future senior indebtedness of the Company. The 8

3

⁄

8

%

Subordinated Notes rank equally with all of the Company’s existing and future senior subordinated debt and rank

senior to all existing and future subordinated debt. The 8

3

⁄

8

% Subordinated Notes are guaranteed on an

unsecured senior subordinated basis by each of the Company’s current subsidiaries that is a guarantor under the

Corporate credit facility, with certain immaterial exceptions. The indenture governing the 8

3

⁄

8

% Subordinated

Notes contains covenants including but not limited to the following: limitations on dividends to shareowners and

other restricted payments; dividend and other payment restrictions affecting the Company’s subsidiaries such that

the subsidiaries are not permitted to enter into an agreement that would limit their ability to make dividend

payments to the parent; issuance of indebtedness; asset dispositions; transactions with affiliates; liens;

investments; issuances and sales of capital stock of subsidiaries; and redemption of debt that is junior in right of

payment. The indenture governing the 8

3

⁄

8

% Subordinated Notes provides for customary events of default,

including a cross-default provision for both nonpayment at final maturity or acceleration due to a default of any

other existing debt instrument that exceeds $20 million. The Company may redeem the 8

3

⁄

8

% Subordinated

Notes for a redemption price of 102.792%, 101.396%, and 100.000% after January 15, 2010, 2011, and 2012,

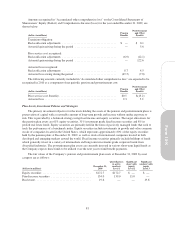

respectively. The Company incurred interest expense of $46.9 million in 2009, $49.6 million in 2008 and $53.6

million in 2007 related to these notes.

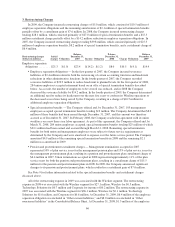

During 2008 and 2007, the Company purchased and extinguished $75.0 million and $5.0 million,

respectively, of 8

3

⁄

8

% Subordinated Notes and recognized a gain on extinguishment of debt of $8.1 million and

$0.1 million, respectively.

7% Senior Notes due 2015

In February 2005, the Company sold $250 million of 7% Senior Notes due 2015 (“7% Senior Notes”). Net

proceeds from this issuance together with those of other concurrently issued bonds and amounts under the

Corporate credit facility were used to repay and terminate the prior credit facility. The 7% Senior Notes are fixed

rate bonds to maturity.

Interest on the 7% Senior Notes is payable semi-annually in cash in arrears on February 15 and August 15 of

each year, commencing August 15, 2005. The 7% Senior Notes are unsecured senior obligations ranking equally

with all existing and future senior debt and ranking senior to all existing and future senior subordinated

indebtedness and subordinated indebtedness. Each of the Company’s current and future subsidiaries that is a

guarantor under the Corporate credit facility is also a guarantor of the 7% Senior Notes on an unsecured senior

basis, with certain immaterial exceptions. The indenture governing the 7% Senior Notes contains covenants

including but not limited to the following: limitations on dividends to shareowners and other restricted payments;

dividend and other payment restrictions affecting the Company’s subsidiaries such that the subsidiaries are not

permitted to enter into an agreement that would limit their ability to make dividend payments to the parent;

issuance of indebtedness; asset dispositions; transactions with affiliates; liens; investments; issuances and sales of

capital stock of subsidiaries; and redemption of debt that is junior in right of payment. The indenture governing

the 7% Senior Notes provides for customary events of default, including a cross-default provision for both

nonpayment at final maturity or acceleration due to a default of any other existing debt instrument that exceeds

$20 million.

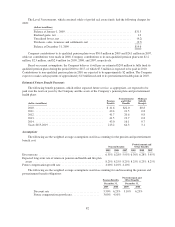

The Company may redeem the 7% Senior Notes for a redemption price of 103.500%, 102.333%, 101.167%,

and 100.000% after February 15, 2010, 2011, 2012, and 2013, respectively. The Company incurred interest

expense related to these notes of $17.3 million in 2009 and $17.5 million in both 2008 and 2007.

In 2008, the Company purchased and extinguished $2.5 million of 7% Senior Notes and recognized a gain

on extinguishment of debt of $0.7 million.

7

1

⁄

4

% Senior Notes due 2023

In July 1993, the Company issued $50 million of 7

1

⁄

4

% Senior Notes due 2023. The indenture related to

these 7

1

⁄

4

% Senior Notes due 2023 does not subject the Company to restrictive financial covenants, but it does

contain a covenant providing that if the Company incurs certain liens on its property or assets, the Company must

secure the outstanding 7

1

⁄

4

% Senior Notes due 2023 equally and ratably with the indebtedness or obligations

secured by such liens. The 7

1

⁄

4

% Senior Notes due 2023 are collateralized on a basis consistent with the

73

Form 10-K