Cincinnati Bell 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

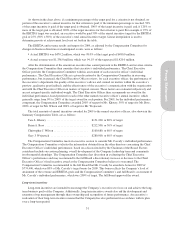

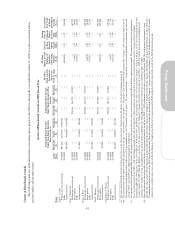

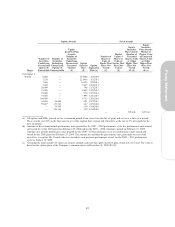

Grants of Plan-Based Awards

The following table sets forth information concerning option grants to the Officers during the year ended December 31, 2009 as well as estimated future

payouts under cash incentive plans:

Grants of Plan-Based Awards in 2009 Fiscal Year

Name

Grant

Date

Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards (a)

Estimated Future Payouts

Under Equity Incentive Plan

Awards

All Other

Stock Awards:

Number of

Shares of

Stock or Units

(#)

All Other

Option Awards:

Number of

Securities

Underlying

Options

(#) (b)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Closing

Price of

Company

Shares

on Grant

Date

($/Sh)

Grant Date

Fair Value

of Stock

and Option

Awards

($) (c)

Threshold

($)

Target

($)

Maximum

($)

Threshold

(#)

Target

(#)

Maximum

(#)

John F. Cassidy

Performance-based award (d) 01/30/09 997,428 1,329,904 5,000,000 — — — — — — — —

SARs 01/30/09 — — — — — — — 1,000,000 1.39 1.39 510,000

Annual incentive 484,000 968,000 1,936,000 — — — — — — — —

Gary J. Wojtaszek

Performance-based award 01/30/09 — — — 198,546 264,728 397,092 — — — — 367,972

Stock option 01/30/09 — — — — — — — 76,989 1.39 1.39 39,041

SARs 01/30/09 — — — — — — — 130,363 1.39 1.39 66,485

Annual incentive 175,000 350,000 700,000 — — — — — — — —

Brian A. Ross

Performance-based award 01/30/09 — — — 199,289 265,719 398,579 — — — — 369,349

Stock option 01/30/09 — — — — — — — 60,938 1.39 1.39 30,902

SARs 01/30/09 — — — — — — — 103,185 1.39 1.39 52,624

Annual incentive 212,500 425,000 850,000 — — — — — — — —

Tara L. Khoury

Performance-based award 05/01/09 — — — 187,500 250,000 375,000 — — — — 692,500

Stock option 03/23/09 — — — — — — — 200,000 2.21 2.21 169,400

Annual incentive 94,500 189,000 378,000 — — — — — — — —

Christopher J. Wilson

Performance-based award 01/30/09 — — — 150,954 201,272 301,908 — — — — 279,768

Stock option 01/30/09 — — — — — — — 74,495 1.39 1.39 37,776

SARs 01/30/09 — — — — — — — 126,140 1.39 1.39 64,331

Annual incentive 100,425 200,850 401,700 — — — — — — — —

(a) For more detail about the annual incentive program, see the discussion in the Compensation Disclosure and Analysis beginning on page 26.

(b) The material terms of the options and SARs granted are: grant type — non-incentive; exercise price — fair market value of common stock on grant date; vesting — 28% on the first anniversary of

the original grant date and thereafter at the rate of 3% per month for the next 24 months; term of grant — 10 years; termination — except in the case of death, disability or retirement, any unvested

awards will be cancelled 90 days following termination of employment.

(c) For amounts related to option and SAR awards, the amounts reflect the grant-date fair values as determined using the Black-Scholes option-pricing model. The amounts related to the performance-

based awards granted for the 2009 — 2011 performance period reflect the grant-date fair value assuming the target number of shares are earned and the executive remains with the Company

through the applicable vesting dates. In the case of Messrs. Wojtaszek, Ross and Wilson, the grant date fair value was based on the Company’s closing stock price of $1.39 as determined on the date

of grant, January 30, 2009, while Ms. Khoury’s grant date fair value was $2.77, the Company’s closing stock price on the date of grant, May 1, 2009. For further discussion of assumptions and

valuation, refer to Note 13 to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2009.

(d) Represents potential amounts payable related to the cash-payment performance award for the 2009 — 2011 performance cycle that was granted in January 2009. The cash-payment performance award

provides for a target award, with the final award payment indexed to the percentage change in the Company’s stock price from the date of grant. Although the cash-payment performance award is subject to a

$5 million limit under the terms of the 2007 Long Term Incentive Plan, the maximum would only be obtained if the Company’s closing stock price on January 30, 2012 would equal or exceed $5.22 and the

adjusted free cash flow targets were achieved. See the Summary Compensation Table for the amount earned in 2009 and paid in 2010 related to this award for the 2009 performance period.

41

Proxy Statement