Cincinnati Bell 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.effective January 1, 2004 to its present level and has remained unchanged. Mr. Cassidy’s total cash

compensation, which is the sum of his base salary plus annual target bonus, is 104% of the peer group

benchmark.

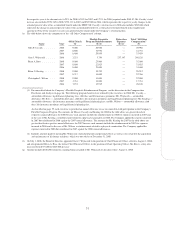

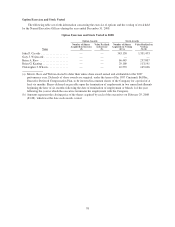

•Long-Term Incentives — For the 2008 fiscal year, Mr. Cassidy was granted 317,955 performance units (at

target) with respect to the 2008-2010 performance period in January 2008 and a nonqualified stock option

for 559,355 common shares in December 2007. For the 2009 fiscal year, Mr. Cassidy’s nonqualifed stock

option grant in December 2008 was limited to 680,000 shares due to the 1,000,000 annual individual share

limit. In January 2009, Mr. Cassidy was granted a $1,329,904 target award with respect to the 2009-2011

performance period and 1,000,000 SARs with the same terms and conditions as regular nonqualified stock

option grants. Mr. Cassidy’s total 2008 opportunity was equal to 105% of the peer group benchmark and

his total 2009 opportunity is equal to 112% of the peer group benchmark.

The Company is requesting shareholder approval for additional shares of stock to be made available for

issuance under the 2007 Long Term Incentive Plan. If such approval is given, any SARs exercised and any

performance units earned under the 2009 – 2011 performance plan will be required to be settled in shares. If

shareholders do not approve the additional share request, the SARs and performance units will be required to be

settled in cash.

Miscellaneous Items

Stock Ownership Guidelines

The Compensation Committee recognizes that executive stock ownership is an important means of aligning

the interests of the Company’s executives with those of its shareholders. To that end, the Compensation

Committee has established the following stock ownership guidelines:

•Chief Executive Officer — 3 times base salary (as adjusted each year)

•Other named executive officers — 1.5 times base salary (as adjusted each year)

Since the personal situation of each executive may vary, the Compensation Committee has not set a specific

period of time in which the ownership level must be achieved, but does expect each executive to make

measurable progress on a year-over-year basis as evidenced by the number of shares owned multiplied by the fair

market value of the Company’s stock. Aside from the Company’s actual performance from one year to the next,

the price of the Company’s stock may vary due to the general condition of the economy and the stock market.

Therefore, the Compensation Committee may measure an executive’s progress more on the basis of the year-

over-year increase in the number of shares owned than the overall market value of the shares owned in relation to

the executive’s ownership goal. For purposes of measuring ownership, only shares owned outright by the

executive (including shares owned by the executive’s spouse or dependent children and shares owned through the

Company’s savings plan or deferred compensation plan) are included. Shares represented by unvested stock

options or any other form of equity for which some condition remains to be completed before the executive earns

a right to and receives the shares (except for shares that have been electively deferred to a future date) are not

counted in determining the executive’s level of ownership.

As of March 2, 2009, Mr. Cassidy owned shares valued at approximately 86% of his ownership target;

Mr. Ross achieved approximately 74% of his ownership goal; Mr. Wojtaszek, who joined the Company on

August 1, 2008, has not achieved any of his ownership goal; Mr. Keating achieved approximately 38% of his

ownership goal; and Mr. Wilson achieved approximately 47% of his ownership goal. The major decline in the

stock market, including the price of Cincinnati Bell’s stock, significantly affected the percentage of share

ownership achieved for each of the executive officers of the Company. Excluding Mr. Wojtaszek, the actual

number of shares owned by each executive officer increased during 2008.

48