Cincinnati Bell 2008 Annual Report Download - page 162

Download and view the complete annual report

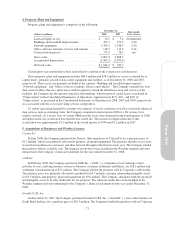

Please find page 162 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additions and improvements, including interest and certain labor costs incurred during the construction

period, are capitalized, while expenditures that do not enhance the asset or extend its useful life are charged to

operating expenses as incurred. Capitalized interest for 2008, 2007, and 2006 was $3.1 million, $3.6 million, and

$1.0 million, respectively.

The Company records the fair value of a legal liability for an asset retirement obligation in the period it is

incurred. The removal cost is initially capitalized and depreciated over the remaining life of the underlying asset.

The associated liability is accreted to its present value each period. Once the obligation is ultimately settled, any

difference between the final cost and the recorded liability is recognized as income or loss on disposition.

Goodwill and Indefinite-Lived Intangible Assets — Goodwill represents the excess of the purchase price

consideration over the fair value of assets acquired and recorded in connection with business acquisitions.

Indefinite-lived intangible assets consist of Federal Communications Commission (“FCC”) licenses for wireless

spectrum and trademarks of the Wireless segment. The Company may renew the wireless licenses in a routine

manner every ten years for a nominal fee, provided the Company continues to meet the service and geographic

coverage provisions required by the FCC.

Goodwill and intangible assets not subject to amortization are tested for impairment annually, or when

events or changes in circumstances indicate that the asset might be impaired. The impairment test for goodwill

involves comparing the estimated fair value of the reporting unit based on discounted future cash flows to the

unit’s carrying value. The impairment test for indefinite-lived intangibles consists of comparing the estimated

fair value of the intangible asset, aggregated by geographical area in the case of the FCC licenses, to its carrying

value. For each intangible tested, the carrying values were lower than the estimated fair values, and no

impairment charges were recorded in 2008, 2007, and 2006.

Long-Lived Assets, Other than Goodwill and Indefinite-Lived Intangibles — The Company reviews the

carrying value of long-lived assets, other than goodwill and indefinite-lived intangible assets discussed above,

when events or changes in circumstances indicate that the carrying amount of the assets may not be recoverable.

An impairment loss is recognized when the estimated future undiscounted cash flows expected to result from the

use of an asset (or group of assets) and its eventual disposition are less than the carrying amount. An impairment

loss is measured as the amount by which the asset’s carrying value exceeds its fair value.

In 2008, the Wireline segment recorded an asset impairment charge of $1.2 million related to software that

is no longer being used.

Investments — The Company has certain investments that do not have readily determinable fair market

values. Investments over which the Company exercises significant influence are recorded under the equity

method. At December 31, 2008 and 2007, the Company had no equity method investments. Investments in which

the Company owns less than 20% and cannot exercise significant influence over the investee operations are

recorded at cost. The carrying value of these investments was approximately $2.2 million and $2.3 million as of

December 31, 2008 and 2007, respectively, and was included in “Other noncurrent assets” in the Consolidated

Balance Sheets. Investments are reviewed annually for impairment. If the carrying value of the investment

exceeds its estimated fair value and the decline in value is determined to be other-than-temporary, an impairment

loss is recognized for the difference. The Company estimates fair value using external information and

discounted cash flow analyses. In 2007, the Company received a one-time dividend of $1.9 million from a cost

investment. During 2006, the Company sold a cost investment and recorded a gain of $3.2 million. These gains

are included in “Other expense (income), net” in the Consolidated Statements of Operations.

Revenue Recognition — The Company adheres to sales recognition principles described in Staff

Accounting Bulletin (“SAB”) No. 104, “Revenue Recognition,” issued by the SEC. Under SAB No. 104, sales

are recognized when there is persuasive evidence of a sale arrangement, delivery has occurred or services have

been rendered, the sales price is fixed or determinable, and collectibility is reasonably assured.

Service revenue — The Company recognizes service revenue as services are provided. Revenue from local

telephone, special access and data and internet product services, which are billed monthly prior to performance of

service, and from prepaid wireless service, which is collected in advance, is not recognized upon billing or cash

receipt but rather is deferred until the service is provided. Postpaid wireless, long distance, switched access and

reciprocal compensation are billed monthly in arrears. The Company bills service revenue in regular monthly

62