Cincinnati Bell 2008 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

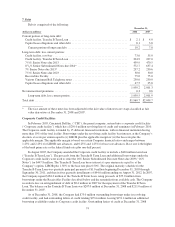

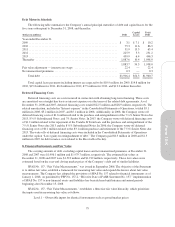

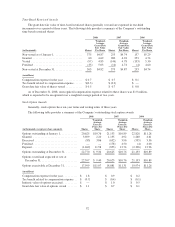

Amounts recognized in “Accumulated other comprehensive loss” on the Consolidated Statements of

Shareowners’ Equity (Deficit) and Comprehensive Income (Loss) for the year ended December 31, 2008, are

shown below:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Transition obligation:

Reclassification adjustments ..................................... $ — $ 2.0

Actuarial gain arising during the period ............................. — 10.4

Prior service cost recognized:

Reclassification adjustments ..................................... 1.3 0.3

Actuarial gain (loss) arising during the period ........................ (0.1) 16.7

Actuarial loss recognized:

Reclassification adjustments ..................................... 2.8 3.5

Actuarial loss arising during the period ............................. (124.0) (10.3)

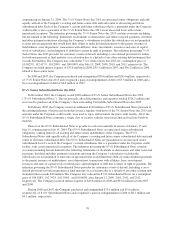

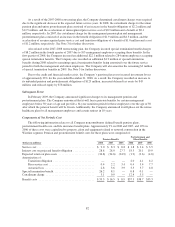

The following amounts currently included in “Accumulated other comprehensive loss” are expected to be

recognized in 2009 as a component of net periodic pension and postretirement cost:

(dollars in millions)

Pension

Benefits

Postretirement

and Other

Benefits

Transition obligation ........................................... $— $1.4

Prior service cost (benefit) ....................................... 1.7 (0.2)

Actuarial loss ................................................. 5.3 3.8

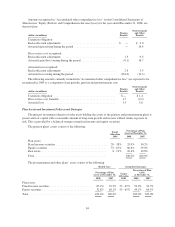

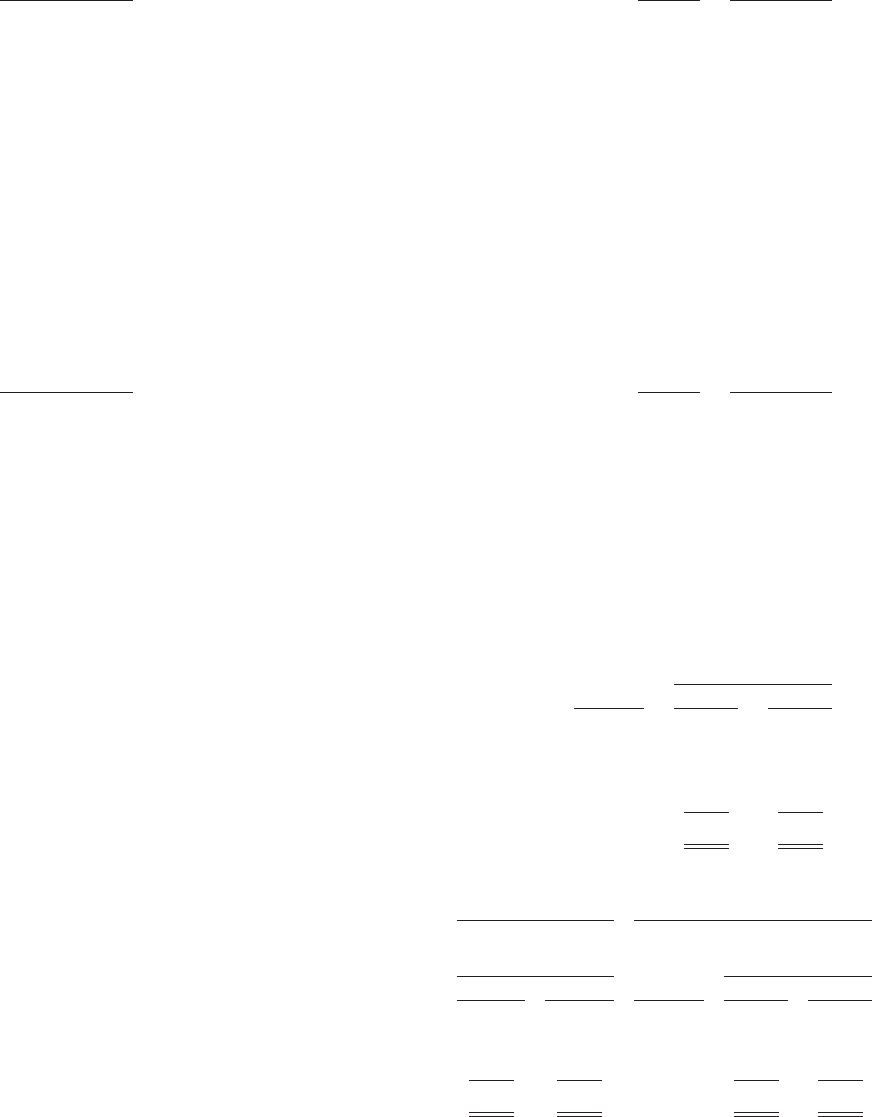

Plan Assets and Investment Policies and Strategies

The primary investment objective for the trusts holding the assets of the pension and postretirement plans is

preservation of capital with a reasonable amount of long-term growth and income without undue exposure to

risk. This is provided by a balanced strategy using fixed income and equity securities.

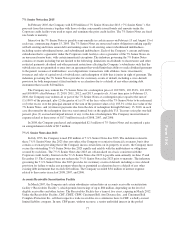

The pension plans’ assets consist of the following:

Target

Allocation

2009

Percentage of Plan

Assets at December 31,

2008 2007

Plan assets:

Fixed income securities ................................... 20-38% 29.0% 30.2%

Equity securities ........................................ 55-65% 60.6% 59.0%

Real estate ............................................. 8-12% 10.4% 10.8%

Total .................................................. 100.0% 100.0%

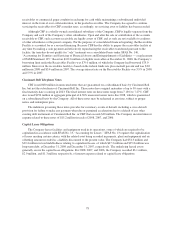

The postretirement and other plans’ assets consist of the following:

Health Care Group Life Insurance

Percentage of Plan

Assets at December 31, Target

Allocation

2009

Percentage of Plan

Assets

at December 31,

2008 2007 2008 2007

Plan assets:

Fixed income securities ............................ 67.2% 39.9% 35 - 45% 50.9% 39.5%

Equity securities .................................. 32.8% 60.1% 55 - 65% 49.1% 60.5%

Total ........................................... 100.0% 100.0% 100.0% 100.0%

84