Cincinnati Bell 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

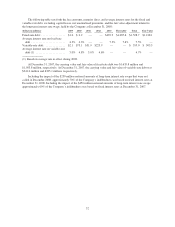

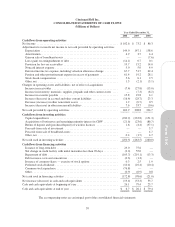

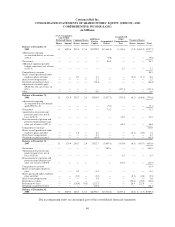

Cincinnati Bell Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Millions of Dollars)

Year Ended December 31,

2008 2007 2006

Cash flows from operating activities

Net income ......................................................... $102.6 $ 73.2 $ 86.3

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation ...................................................... 149.0 147.1 138.6

Amortization ...................................................... 4.9 3.7 4.4

Gain on sale of broadband assets ...................................... — — (7.6)

Loss (gain) on extinguishment of debt .................................. (14.1) 0.7 0.1

Provision for loss on receivables ...................................... 19.7 15.2 14.0

Noncash interest expense ............................................ 5.0 5.0 4.9

Deferred income tax expense, including valuation allowance change ......... 67.7 51.7 62.4

Pension and other postretirement expense in excess of payments ............. 61.4 19.2 28.1

Stock-based compensation ........................................... 5.6 6.1 2.5

Other, net ........................................................ 1.3 (2.1) (5.1)

Changes in operating assets and liabilities, net of effect of acquisitions

Increase in receivables .............................................. (7.4) (27.8) (15.0)

Increase in inventory, materials, supplies, prepaids and other current assets .... — (7.3) (6.2)

Increase in accounts payable ......................................... 15.8 19.8 4.1

Increase (decrease) in accrued and other current liabilities .................. (16.4) (28.7) 23.3

Decrease (increase) in other noncurrent assets ........................... 1.2 (0.7) 0.5

Increase (decrease) in other noncurrent liabilities ......................... 7.6 33.7 (0.6)

Net cash provided by operating activities ................................. 403.9 308.8 334.7

Cash flows from investing activities

Capital expenditures ................................................ (230.9) (233.8) (151.3)

Acquisitions of businesses and remaining minority interest in CBW .......... (21.6) (23.6) (86.7)

Return of deposit and (purchase/deposit) of wireless licenses ............... 1.6 (4.4) (37.1)

Proceeds from sale of investment ..................................... — — 5.7

Proceeds from sale of broadband assets ................................. — — 4.7

Other, net ........................................................ 0.4 (1.7) 4.7

Net cash used in investing activities ..................................... (250.5) (263.5) (260.0)

Cash flows from financing activities

Issuance of long-term debt ........................................... 23.0 75.6 —

Net change in credit facility with initial maturities less than 90 days .......... (2.0) 55.0 —

Repayment of debt ................................................. (105.7) (219.1) (13.3)

Debt issuance costs and consent fees ................................... (0.3) (1.3) —

Issuance of common shares — exercise of stock options ................... 0.3 2.5 1.9

Preferred stock dividends ............................................ (10.4) (10.4) (10.4)

Common stock repurchase ........................................... (76.8) — —

Other ............................................................ (0.9) (0.9) 0.8

Net cash used in financing activities ..................................... (172.8) (98.6) (21.0)

Net increase (decrease) in cash and cash equivalents ........................ (19.4) (53.3) 53.7

Cash and cash equivalents at beginning of year ............................. 26.1 79.4 25.7

Cash and cash equivalents at end of year .................................. $ 6.7 $ 26.1 $ 79.4

The accompanying notes are an integral part of the consolidated financial statements.

59

Form 10-K