Cincinnati Bell 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

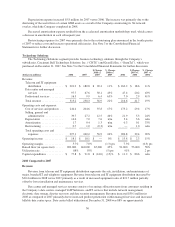

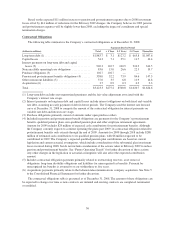

The increase in selling, general and administrative expenses for 2007 was primarily due to an increase in

labor and employee related costs associated with increased headcount to support the growing operations.

The increase in depreciation expense for 2007 compared to 2006 was primarily due to capital expenditures

associated with expanding data center capacity.

Restructuring expenses for 2007 were primarily due to the restructuring plan announced in the fourth quarter

of 2007 to reduce costs and increase operational efficiencies. See Note 3 to the Consolidated Financial

Statements for further discussion.

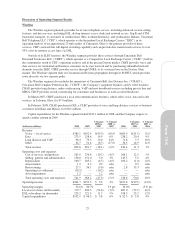

The Company’s Financial Condition, Liquidity, and Capital Resources

Capital Investment, Resources and Liquidity

The Company’s primary sources of cash in 2009 will be cash generated by operations and borrowings from

the revolving credit facility under which the Company had $151.4 million of availability at December 31, 2008.

Cash flows from operations totaled $403.9 million in 2008. These 2008 cash flows from operations included

payments totaling $21.5 million related to a prepayment from a customer for data center services and a $10.0

million refund for operating taxes that the Company does not expect to recur in 2009. Additionally, the Company

expects interest payments will be reduced by approximately $14 million as compared to 2008 due to lower debt

balances and interest rates, and has received $10.5 million in early 2009 related to the termination of certain

interest rate swaps by the counterparty.

Uses of cash will include repayments and repurchases of debt and related interest, repurchases of common

shares, dividends on preferred stock, and working capital. In February 2008, the Company’s Board of Directors

authorized the repurchase of the Company’s outstanding common stock in an amount up to $150 million during

the next two years. The Company repurchased $76.8 million of common stock in 2008, which leaves $73.2

million of common stock that can be repurchased under the stock buyback program. The Company believes the

cash generated by operations and borrowings on its Corporate credit facility are sufficient to fund its primary

uses of cash.

The Company also expects to make $288 million of estimated cash contributions to its qualified pension

plans for the years 2009 to 2018, with approximately $6 million expected to be contributed in 2009. The

Company’s estimated cash contributions are based on current legislation and current actuarial assumptions,

which include consideration of the substantial plan investment losses incurred during 2008, but do not include

consideration of the actions taken in February 2009 to reduce pension and postretirement benefits. See “Future

Operating Trends” for further discussion of these actions. Any other changes in legislation or actuarial

assumptions will also affect the estimated cash contribution required.

The Corporate credit facility financial covenants require that the Company maintain certain leverage,

interest coverage, and fixed charge ratios. The facility also contains certain covenants which, among other things,

limit the Company’s ability to incur additional debt or liens, pay dividends, repurchase Company common stock,

sell, transfer, lease, or dispose of assets, and make investments or merge with another company. If the Company

were to violate any of its covenants and were unable to obtain a waiver, it would be considered a default. If the

Company were in default under its credit facility, no additional borrowings under the credit facility would be

available until the default was waived or cured. The Company believes it is in compliance and expects to remain

in compliance with its Corporate credit facility covenants, and plans to refinance the revolving credit facility

before it expires in February 2010.

Various issuances of the Company’s public debt, which include the 7

1

⁄

4

% Senior Notes due 2013, 8

3

⁄

8

%

Senior Subordinated Notes due 2014 (“8

3

⁄

8

% Subordinated Notes”), and the 7% Senior Notes due 2015 (“7%

Senior Notes”), contain covenants that, among other things, limit the Company’s ability to incur additional debt

or liens, pay dividends or make other restricted payments, sell, transfer, lease, or dispose of assets and make

investments or merge with another company. Restricted payments include common stock dividends, repurchase

of common stock, and certain other public debt repayments. The Company believes it has sufficient ability under

its public debt indentures to make its intended restricted payments in 2009. The Company believes it is in

compliance and expects to remain in compliance with its public debt indentures.

32