Cincinnati Bell 2008 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

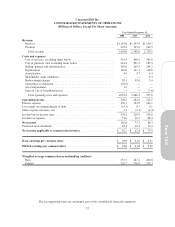

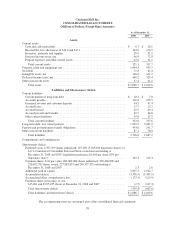

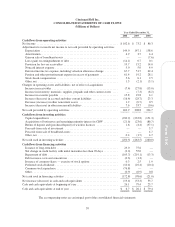

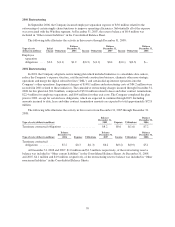

Notes to Consolidated Financial Statements

1. Description of Business and Significant Accounting Policies

Description of Business — Cincinnati Bell Inc. and its consolidated subsidiaries (the “Company”) provides

diversified telecommunications services through businesses in three segments: Wireline, Wireless, and

Technology Solutions. See Note 14 for information on the Company’s reportable segments.

The Company generates a large portion of its revenue by serving customers in the Greater Cincinnati and

Dayton, Ohio areas. An economic downturn or natural disaster occurring in this limited operating territory could

have a disproportionate effect on the Company’s business, financial condition, results of operations and cash

flows compared to similar companies of a national scope and similar companies operating in different geographic

areas.

Additionally, since approximately 35% of the Company’s workforce is party to collective bargaining

agreements, which expire in 2011, a dispute or failed renegotiation of the collective bargaining agreements could

have a material adverse effect on the business.

Basis of Presentation — The consolidated financial statements of the Company have been prepared

pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) in accordance with

accounting principles generally accepted in the United States of America.

Basis of Consolidation — The consolidated financial statements include the consolidated accounts of

Cincinnati Bell Inc. and its majority-owned subsidiaries over which it exercises control. Intercompany accounts

and transactions have been eliminated in the consolidated financial statements.

Use of Estimates — Preparation of financial statements in conformity with accounting principles generally

accepted in the United States of America requires management to make estimates and assumptions that affect the

amounts reported. Actual results could differ from those estimates.

Cash Equivalents — Cash equivalents consist of short-term, highly liquid investments with original

maturities of three months or less.

Accounts Receivables — Accounts receivables consist principally of trade receivables from customers and

are generally unsecured and due within 30 days. The Company has one large customer with receivables that

represent 10% of the Company’s outstanding accounts receivable balances. Unbilled receivables arise from

services rendered but not yet billed. As of December 31, 2008 and 2007, unbilled receivables totaled $27.7

million and $28.9 million, respectively. Expected credit losses related to trade receivables are recorded as an

allowance for uncollectible accounts in the Consolidated Balance Sheets. The Company establishes the

allowances for uncollectible accounts using percentages of aged accounts receivable balances to reflect the

historical average of credit losses as well as specific provisions for certain identifiable, potentially uncollectible

balances. When internal collection efforts on accounts have been exhausted, the accounts are written off by

reducing the allowance for uncollectible accounts.

Inventory, Materials and Supplies — Inventory, materials and supplies consists of wireless handsets,

wireline network components, various telephony and IT equipment to be sold to customers, maintenance

inventories, and other materials and supplies, which are carried at the lower of average cost or market.

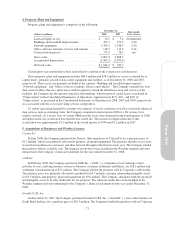

Property, Plant and Equipment — Property, plant and equipment is stated at original cost and presented

net of accumulated depreciation and impairment charges. Most of the Wireline network property, plant and

equipment used to generate its voice and data revenue is depreciated using the group method, which develops a

depreciation rate annually based on the average useful life of a specific group of assets rather than for each

individual asset as would be utilized under the unit method. The estimated life of the group changes as the

composition of the group of assets and their related lives change. Provision for depreciation of other property,

plant and equipment, other than leasehold improvements, is based on the straight-line method over the estimated

economic useful life. Depreciation of leasehold improvements is based on a straight-line method over the lesser

of the economic useful life or the term of the lease, including option renewal periods if renewal of the lease is

reasonably assured.

61

Form 10-K