Cincinnati Bell 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

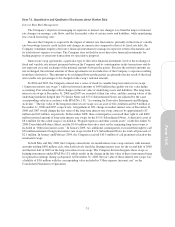

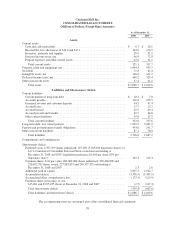

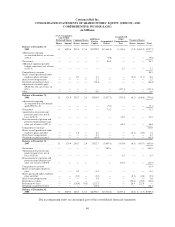

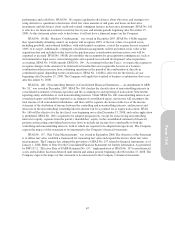

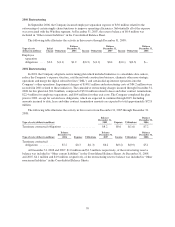

Cincinnati Bell Inc.

CONSOLIDATED STATEMENTS OF SHAREOWNERS’ EQUITY (DEFICIT) AND

COMPREHENSIVE INCOME (LOSS)

(in Millions)

6

3

⁄

4

% Cumulative

Convertible

Preferred Shares Common Shares Additional

Paid-in

Capital

Accumulated

Deficit

Accumulated

Other

Comprehensive

Loss

Treasury Shares

TotalShares Amount Shares Amount Shares Amount

Balance at December 31,

2005 ..................... 3.1 $129.4 255.0 $ 2.6 $2,929.9 $(3,604.5) $ (49.6) (7.9) $(145.5) $(737.7)

Adjustment to opening

accumulated deficit, net of taxes

of $5.2 .................... — — — — — (9.0) — — — (9.0)

Net income .................. — — — — — 86.3 — — — 86.3

Additional minimum pension

liability adjustment, net of taxes

of ($1.4) .................. — — — — — — 2.2 — — 2.2

Comprehensive income ......... 88.5

Shares issued (purchased) under

employee plans and other ..... — — 0.7 — 2.1 — — (0.3) (1.3) 0.8

Stock-based compensation ...... — — — — 2.5 — — — — 2.5

Dividends on preferred stock .... — — — — (10.4) — — — — (10.4)

Adjustment to initially apply

SFAS No. 158, net of taxes of

$73.3 ..................... — — — — — — (127.1) — — (127.1)

Other ....................... — — — — 0.8 — — — — 0.8

Balance at December 31,

2006 ..................... 3.1 129.4 255.7 2.6 2,924.9 (3,527.2) (174.5) (8.2) (146.8) (791.6)

Adjustment to opening

accumulated deficit to initially

apply FIN No. 48 ........... — — — — — (5.1) — — — (5.1)

Net income .................. — — — — — 73.2 — — — 73.2

Amortization of pension and

postretirement costs, net of

taxes of ($7.0) .............. — — — — — — 12.2 — — 12.2

Remeasurement of pension and

postretirement liabilities and

other, net of taxes of ($27.1) . . . — — — — — — 46.4 — — 46.4

Comprehensive income ......... 131.8

Shares issued (purchased) under

employee plans and other ..... — — 1.0 — 2.1 — — (0.1) (0.5) 1.6

Stock-based compensation ...... — — — — 6.1 — — — — 6.1

Dividends on preferred stock .... — — — — (10.4) — — — — (10.4)

Balance at December 31,

2007 ..................... 3.1 129.4 256.7 2.6 2,922.7 (3,459.1) (115.9) (8.3) (147.3) (667.6)

Net income .................. — — — — — 102.6 — — — 102.6

Amortization of pension and

postretirement costs, net of

taxes of ($3.6) .............. — — — — — — 6.3 — — 6.3

Remeasurement of pension and

postretirement liabilities and

other, net of taxes of $39.8 .... — — — — — — (67.5) — — (67.5)

Comprehensive income ......... 41.4

Shares issued under employee

plans ..................... — — 0.5 — 0.3 — — — — 0.3

Shares purchased under employee

plans and other ............. — — (0.3) — (1.2) — — (0.1) (0.6) (1.8)

Stock-based compensation ...... — — — — 5.6 — — — — 5.6

Repurchase of shares .......... — — — — — — — (20.6) (76.8) (76.8)

Retirement of shares ........... — — (28.4) (0.3) (221.7) — — 28.4 222.0 —

Dividends on preferred stock .... — — — — (10.4) — — — — (10.4)

Balance at December 31,

2008 ..................... 3.1 $129.4 228.5 $ 2.3 $2,695.3 $(3,356.5) $(177.1) (0.6) $ (2.7) $(709.3)

The accompanying notes are an integral part of the consolidated financial statements.

60