Cincinnati Bell 2008 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

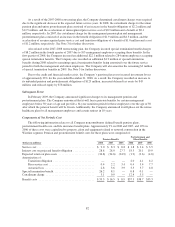

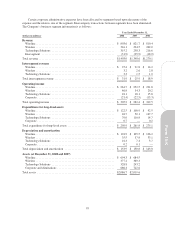

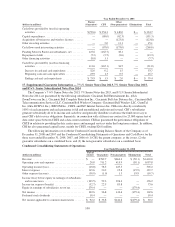

The components of the Company’s deferred tax assets and liabilities are as follows:

December 31,

(dollars in millions) 2008 2007

Deferred tax assets:

Net operating loss carryforwards ............................. $505.1 $ 626.9

Pension and postretirement benefits .......................... 178.9 119.7

Other .................................................. 67.7 63.3

Total deferred tax assets ................................... 751.7 809.9

Valuation allowance ....................................... (72.9) (140.0)

Total deferred income tax assets, net of valuation allowance ....... 678.8 669.9

Deferred tax liabilities:

Property, plant and equipment ............................... 108.8 65.9

Federal deferred liability on state deferred tax assets ............. 6.6 7.0

Other .................................................. 0.4 0.8

Total deferred tax liabilities ................................. 115.8 73.7

Net deferred tax assets ................................... $563.0 $ 596.2

As of December 31, 2008, the Company had approximately $1.3 billion of federal operating loss tax

carryforwards, with a deferred tax asset value of approximately $439.1 million, and approximately $66.0 million

in deferred tax assets related to state and local operating loss tax carryforwards. The majority of the remaining

tax loss carryforwards will generally expire between 2017 and 2023. U.S. tax laws limit the annual utilization of

tax loss carryforwards of acquired entities. These limitations should not materially impact the utilization of the

tax carryforwards.

The ultimate realization of the deferred income tax assets depends upon the Company’s ability to generate

future taxable income during the periods in which basis differences and other deductions become deductible, and

prior to the expiration of the net operating loss carryforwards. Due to its historical and future projected earnings,

the Company believes it will utilize future federal deductions and available net operating loss carryforwards prior

to their expiration. The Company also concluded that it was more likely than not that certain state tax loss

carryforwards would not be realized based upon the analysis described above and therefore provided a valuation

allowance. The reduction in valuation allowance in 2008 relates primarily to the write off of Ohio net operating

loss carryforwards, which were fully reserved, pursuant to the elimination of the Ohio corporate income tax

during 2008.

The Company adopted the provisions of FASB Interpretation No. 48, “Accounting for Uncertainty in

Income Taxes,” (“FIN 48”) on January 1, 2007. As a result of the implementation of FIN 48, the Company

recognized a $5.1 million increase in the liability for unrecognized tax benefits, which was accounted for as an

increase to the January 1, 2007 accumulated deficit balance. The total amount of unrecognized tax benefits that,

if recognized, would affect the effective tax rate is $14.5 million at December 31, 2007 and $15.3 million at

December 31, 2008. The Company does not currently anticipate that the amount of unrecognized tax benefits

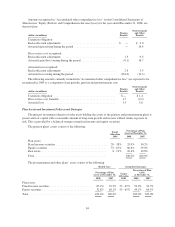

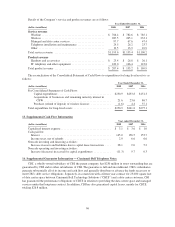

will change significantly over the next year. A reconciliation of the beginning and ending amount of

unrecognized tax benefits is as follows:

(dollars in millions)

Unrecognized tax benefits balance at January 1, 2007 ........................ $14.7

Changes for tax positions for prior years ................................... 0.1

Unrecognized tax benefits balance at December 31, 2007 ..................... $14.8

Changes for tax positions for the current year ............................... 0.8

Unrecognized tax benefits balance at December 31, 2008 ..................... $15.6

90