Cincinnati Bell 2008 Annual Report Download - page 122

Download and view the complete annual report

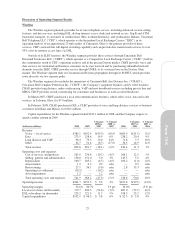

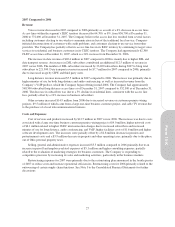

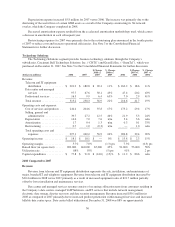

Please find page 122 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” should be read

in conjunction with the “Private Securities Litigation Reform Act of 1995 Safe Harbor Cautionary Statement,”

“Risk Factors,” and the Consolidated Financial Statements and accompanying Notes to Consolidated Financial

Statements.

Executive Summary

In 2008, in the face of extremely difficult economic conditions, the Company grew revenue by 4%,

operating income by 8%, and operating cash flow by 31%. This growth was generated in the following product

areas:

Technology Solutions

The Company increased its data center and managed services revenue by 45% to $97.7 million in 2008

compared to 2007, which was primarily generated through utilization and billing of 50,000 square feet of new

data center capacity by the end of 2008. The Company has total data center capacity of 209,000 square feet, 88%

utilized by customers, at December 31, 2008 compared to 144,000 square feet, 93% utilized, at December 31,

2007. Technology Solutions spent $77.8 million of capital expenditures in 2008, primarily to construct new data

center space in the Greater Cincinnati area. Sales of telecom and IT equipment, a large portion of which are

generated from data center customers, totaled $201.2 million during 2008, an 11% increase over 2007. The

Company intends to continue to pursue additional customers and growth specific to its data center business and is

prepared to commit additional resources, including capital expenditures and working capital, to support this

growth.

Technology Solutions operating income totaled $18.1 million in 2008, equal to 2007. The income generated

from the increased revenue noted above was offset by increased depreciation on more data center assets,

increased incentive compensation to stimulate future growth, and additional headcount to support the growing

operations.

Wireless

The Company increased wireless service revenue by 9% to $290.5 million in 2008 compared to 2007,

primarily generated from an average of 11,000 more postpaid subscribers and a 5% increase in average monthly

revenue per postpaid subscriber. A portion of the increase in revenue per postpaid subscriber is derived from

increased data usage (e.g., text messaging, emails, and internet service). The Company earned $8.02 per month

on average from postpaid subscribers for data service in 2008, compared to $6.21 in 2007. Contributing to the

data revenue increase, the Company’s subscribers using “smart phones” (i.e., phones that provide robust

keyboards and a rich internet experience for messaging and web browsing) increased by 59% at December 31,

2008 compared to December 31, 2007.

Primarily as a result of the wireless service revenue increases, Wireless segment operating income increased

by $12.5 million to $46.8 million in 2008.

To satisfy increasing demand for voice minutes of use by customers as well as to provide enhanced data

services, the Company completed the construction of a 3G network overlay. The Company spent approximately

$16 million in 2008 and $11 million in 2007 to construct the 3G network overlay. In the fourth quarter of 2008,

the Company launched 3G for commercial service.

Wireline

Wireline revenue decreased 2% to $803.6 million, as reductions in voice revenue due to ILEC access line

loss more than offset growth in revenue from additional CLEC customers, data services, long distance and VoIP.

The Company ended the year with 779,700 total access lines, a loss of 7% compared to 834,300 access lines at

December 31, 2007. Access lines decreased by 8% in 2008 in its ILEC territory but was partially offset by an

8,900 increase in access lines in areas outside of the ILEC territory (i.e., suburbs north of Cincinnati and Dayton).

Data revenue growth of 6% to $273.5 million was generated from additional DSL subscribers, which increased

by 5% to 233,200 at December 31, 2008, and additional data transport revenue, primarily from business

22