Cincinnati Bell 2008 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

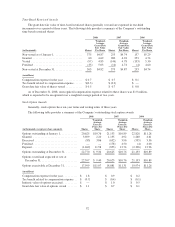

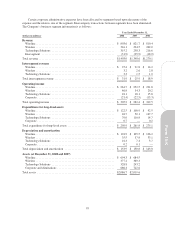

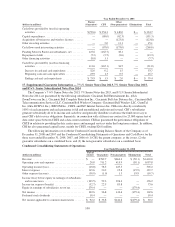

Time-Based Restricted Awards

The grant date fair value of time-based restricted shares generally vest and are expensed in one-third

increments over a period of three years. The following table provides a summary of the Company’s outstanding

time-based restricted shares:

2008 2007 2006

(in thousands) Shares

Weighted-

Average

Grant Date

Fair Value

Per Share Shares

Weighted-

Average

Grant Date

Fair Value

Per Share Shares

Weighted-

Average

Grant Date

Fair Value

Per Share

Non-vested as of January 1, ................... 375 $4.87 253 $4.74 157 $5.29

Granted ................................... 60 4.69 280 4.94 253 4.74

Vested .................................... (97) 4.85 (144) 4.78 (153) 5.30

Forfeited .................................. (35) 5.03 (14) 4.74 (4) 4.60

Non-vested at December 31, ................... 303 $4.82 375 $4.87 253 $4.74

(in millions)

Compensation expense for the year ............. $0.7 $ 0.7 $ 0.1

Tax benefit related to compensation expense ...... $(0.3) $ (0.3) $ —

Grant date fair value of shares vested ............ $0.5 $ 0.7 $ 0.8

As of December 31, 2008, unrecognized compensation expense related to these shares was $1.0 million,

which is expected to be recognized over a weighted average period of two years.

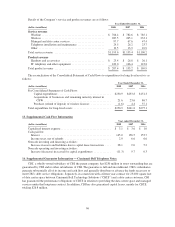

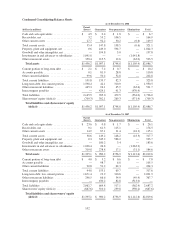

Stock Option Awards

Generally, stock options have ten-year terms and vesting terms of three years.

The following table provides a summary of the Company’s outstanding stock option awards:

2008 2007 2006

(in thousands, except per share amounts) Shares

Weighted-

Average

Exercise

Prices Per

Share Shares

Weighted-

Average

Exercise

Prices Per

Share Shares

Weighted-

Average

Exercise

Prices Per

Share

Options outstanding at January 1, ........... 20,625 $10.76 21,153 $10.89 22,828 $11.28

Granted ............................... 3,699 2.20 1,135 4.92 1,260 4.61

Exercised .............................. (85) 3.86 (632) 3.96 (535) 3.56

Forfeited ............................... — — (178) 4.50 (4) 4.00

Expired ................................ (1,469) 11.58 (853) 12.74 (2,396) 12.96

Options outstanding at December 31, ........ 22,770 $ 9.34 20,625 $10.76 21,153 $10.89

Options vested and expected to vest at

December 31, ......................... 22,597 $ 9.40 20,625 $10.76 21,153 $10.89

Options exercisable at December 31, ........ 17,999 $11.07 18,881 $11.31 19,974 $11.26

(in millions)

Compensation expense for the year .......... $ 1.8 $ 0.9 $ 0.2

Tax benefit related to compensation expense . . $ (0.7) $ (0.4) $ (0.1)

Intrinsic value of options exercised .......... $ — $ 1.0 $ 0.5

Grant date fair value of options vested ....... $ 1.1 $ 0.7 $ 0.1

92