Cincinnati Bell 2008 Annual Report Download - page 178

Download and view the complete annual report

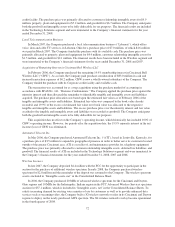

Please find page 178 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.receivables to commercial paper conduits in exchange for cash while maintaining a subordinated undivided

interest, in the form of over-collateralization, in the pooled receivables. The Company has agreed to continue

servicing the receivables for CBF at market rates; accordingly, no servicing asset or liability has been recorded.

Although CBF is a wholly-owned consolidated subsidiary of the Company, CBF is legally separate from the

Company and each of the Company’s other subsidiaries. Upon and after the sale or contribution of the accounts

receivable to CBF, such accounts receivable are legally assets of CBF, and as such are not available to creditors

of other subsidiaries or the parent company. For the purposes of consolidated financial reporting, the Receivables

Facility is accounted for as a secured financing. Because CBF has the ability to prepay the receivables facility at

any time by making a cash payment and effectively repurchasing the receivables transferred pursuant to the

facility, the transfers do not qualify for “sale” treatment on a consolidated basis under SFAS No. 140,

“Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities — a replacement

of FASB Statement 125.” Based on $122.6 million of eligible receivables at December 31, 2008, the Company’s

borrowing limit under the Receivables Facility was $79.0 million, of which the Company had borrowed $75.0

million. Interest on the receivables facility is based on the federal funds rate plus one-half percent and was $3.0

million in 2008 and $3.4 million in 2007. The average interest rate on the Receivables Facility was 3.9% in 2008

and 5.9% in 2007.

Cincinnati Bell Telephone Notes

CBT issued $80 million in unsecured notes that are guaranteed on a subordinated basis by Cincinnati Bell

Inc. but not the subsidiaries of Cincinnati Bell Inc. These notes have original maturities of up to 30 years with a

final maturity date occurring in 2023. The fixed interest rates on these notes range from 7.18% to 7.27%. CBT

also issued $150 million in aggregate principal of 6.30% unsecured senior notes due 2028, which is guaranteed

on a subordinated basis by the Company. All of these notes may be redeemed at any time, subject to proper

notice and redemption price.

The indenture governing these notes provides for customary events of default, including a cross-default

provision for failure to make any payment when due or permitted acceleration due to a default of any other

existing debt instrument of Cincinnati Bell Inc. or CBT that exceeds $20 million. The Company incurred interest

expense related to these notes of $15.2 million in each of 2008, 2007, and 2006.

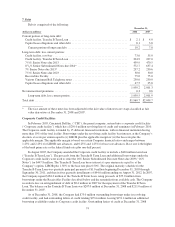

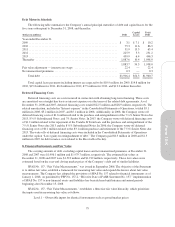

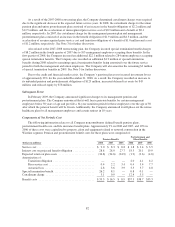

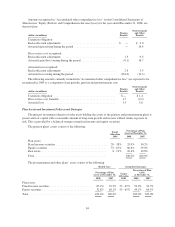

Capital Lease Obligations

The Company leases facilities and equipment used in its operations, some of which are required to be

capitalized in accordance with SFAS No. 13, “Accounting for Leases.” SFAS No. 13 requires the capitalization

of leases meeting certain criteria, with the related asset being recorded in property, plant and equipment and an

offsetting amount recorded as a liability discounted to the present value. The Company had $54.3 million and

$29.4 million in total indebtedness relating to capitalized leases, of which $47.2 million and $25.8 million was

long-term debt, at December 31, 2008 and December 31, 2007, respectively. The underlying leased assets

generally secure the capital lease obligations. For 2008, 2007, and 2006, the Company recorded $3.1 million,

$2.0 million, and $1.3 million, respectively, of interest expense related to capital lease obligations.

78