Cincinnati Bell 2008 Annual Report Download - page 58

Download and view the complete annual report

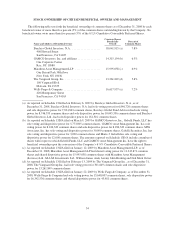

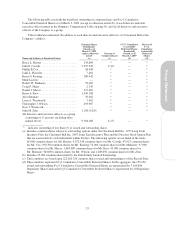

Please find page 58 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Options

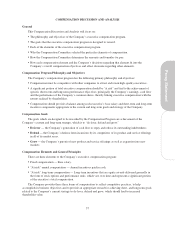

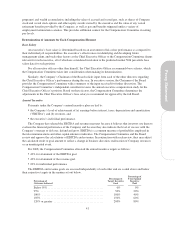

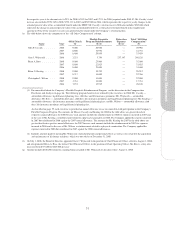

The Company grants stock options with an exercise price equal to the fair market value of the Company’s

common shares on the date of grant. The “fair market value” of the Company’s common shares on the date of

grant is generally defined in the 2007 Long Term Incentive Plan as the closing price of the stock on the NYSE on

the date of grant. To encourage executives to achieve the Company’s long-term goals, stock options generally

vest over a three-year period with a percentage of the award vesting each year. Stock options cannot remain

outstanding beyond a ten-year period. The Compensation Committee has a long-standing practice of making its

annual grants of stock options at its December meeting.

The Compensation Committee (and in the case of the Chief Executive Officer, the full Board) grants stock

option awards based upon a review of peer company practices and each executive’s performance (as well as the

Chief Executive Officer’s recommendations concerning the other executives). Because of the small in-the-money

value of prior years’ stock option grants, the Compensation Committee has not considered prior years’ grants in

determining amounts of stock options granted. Thus, the actual option award to a named executive officer is a

function of market data from the peer groups, the dollar value in long-term incentive approved by the

Compensation Committee, the binomial value of one stock option on the actual date of grant, and the executive’s

individual performance.

As noted in the preceding section, for this half of the executive officers’ 2009 long-term equity grants, a

combination of stock options and SARs were used.

Performance Plan

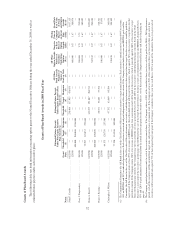

Performance-based awards, which are paid in common shares, are based on the achievement of specific

Company quantitative goals over a three-year performance period. Such awards are granted during the first

quarter of each calendar year following finalization and approval by the full Board of the one-year, two-year

cumulative and three-year cumulative financial goal(s) for the next three-year period. For the 2006 – 2008

performance period and subsequent three-year performance periods (for which the performance-based awards

have consisted of and will consist of performance units), the Compensation Committee (and the full Board in the

case of the Chief Executive Officer) established a criterion of adjusted free cash flow. To compute each

executive’s performance plan attainment, the Company adds to or subtracts from reported free cash flow certain

pre-established and non-recurring investment and financing cash flows. Additionally, the Compensation

Committee or the Board may also adjust reported free cash flow for unanticipated items, reallocation of

Company resources or changes in certain business objectives. The Compensation Committee and the full Board

have selected adjusted free cash flow as the performance measure for performance-based awards because both

believe that the Company’s ability to generate strong cash flow over a sustained period is the key to continuing

its de-lever, defend and grow strategy over the next several years.

Using peer group data (along with the Chief Executive Officer’s recommendations for the other executives),

the Compensation Committee makes performance unit grants to each executive other than the Chief Executive

Officer and makes a recommendation to the full Board for performance unit grants for the Chief Executive

Officer. The actual number of performance units granted is based on the long-term incentive dollar value

approved by the Compensation Committee and the value of one share of stock on the date of grant. The threshold

and target performance levels are the same for each of the named executive officers. For each performance cycle,

actual adjusted free cash flow achieved must be at least 90% of the target goal in order to generate a threshold

level payout equal to 75% of the target award for each executive.

As previously discussed, due to the depletion of available shares and the 1,000,000 share annual individual

limit, it was determined to make the Chief Executive Officer’s target award, if achieved, payable in cash under

the 2009 – 2011 performance plan cycle.

For the 2006 – 2008 cumulative period under the 2006 – 2008 performance cycle, the adjusted free cash

flow target goal and result were, respectively, $499.0 million and $577.7 million, or 115.8% of the target goal.

For the 2007 – 2008 cumulative period under the 2007 – 2009 performance cycle, the adjusted free cash flow

target goal and result were, respectively, $256.0 million and $337.1 million, or 131.7% of the target goal. For the

44