Cincinnati Bell 2008 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

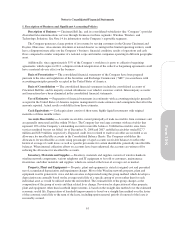

agreement with its union workforce on a new three-year labor agreement. As part of this agreement, the

Company offered and, by March 31, 2008, 284 union employees accepted special termination benefits

totaling $25 million. The Company determined that $22.1 million of these benefits had been earned

through March 31, 2008, and this amount was therefore accrued as of March 31, 2008. Remaining special

termination benefits for both union and management employees are subject to future service requirements

as determined by the Company and will be amortized to expense over the future service period. The

Company amortized $4.9 million of these remaining special termination benefit amounts in 2008 with the

remaining $2 million to be amortized in 2009.

•Pension and postretirement curtailment charges — Management terminations contemplated above

represented 10% of plan service years for the management pension plan and 15% of plan service years for

the management postretirement plan, resulting in a pension and postretirement plan curtailment charge of

$6.4 million in the fourth quarter of 2007. Union terminations contemplated above represented

approximately 11% of the plan service years for both the pension and postretirement plans, resulting in a

curtailment charge of $15.5 million for the pension and postretirement plans in 2008.

For further discussion related to the special termination benefits and curtailment charges discussed above,

see Note 9 to the Consolidated Financial Statements.

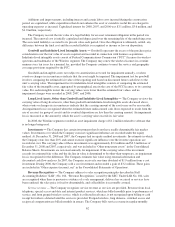

The restructuring expense in 2008 was associated with the Wireline segment for $27.1 million, Wireless for

$0.5 million, and Technology Solutions for $0.7 million. The restructuring expense in 2007 was associated with

the Wireline segment for $34.0 million, Wireless for $2.1 million, Technology Solutions for $1.0 million, and

Corporate for $0.4 million. At December 31, 2008, $1.5 million of the reserve related to employee separation

was included in “Other current liabilities,” and $6.5 million was included in “Other noncurrent liabilities” in the

Consolidated Balance Sheet. At December 31, 2007, $4.5 million of the reserve related to employee separation

was included in “Other current liabilities,” and $18.4 million was included in “Other noncurrent liabilities” in the

Consolidated Balance Sheet. The special termination benefits and curtailment charges are included in “Pension

and postretirement benefit obligations” in the Consolidated Balance Sheets at December 31, 2008 and 2007.

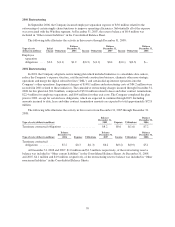

In the first quarter of 2007, the Company incurred employee separation expense of $2.4 million related to

the outsourcing of certain accounting functions and the reduction in workforce of various other administrative

functions. All of the expense was associated with the Wireline segment. At December 31, 2007, $0.4 million of

the reserve was included in “Other current liabilities,” and $0.1 million was included in “Other noncurrent

liabilities” in the Consolidated Balance Sheet. The following table illustrates the activity in this reserve through

December 31, 2008:

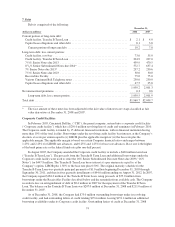

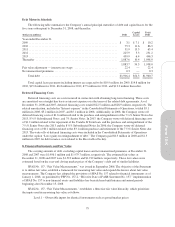

Type of costs (dollars in millions)

Initial

Charge Utilizations

Balance

December 31,

2007 Expense Utilizations

Balance

December 31,

2008

Employee separation obligations ....... $2.4 $(1.9) $0.5 $0.1 $(0.6) $—

69

Form 10-K