Cincinnati Bell 2008 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

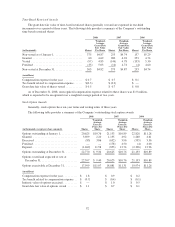

As a result of the 2007-2008 restructuring plan, the Company determined curtailment charges were required

due to the significant decrease in the expected future service years. In 2008, the curtailment charge for the union

pension plan and union postretirement plan consisted of an increase in the benefit obligation of $2.2 million and

$12.5 million, and the acceleration of unrecognized prior service cost of $0.9 million and a benefit of $0.1

million, respectively. In 2007, the curtailment charge for the management pension plan and management

postretirement plan consisted of an increase in the benefit obligation of $1.9 million and $4.3 million, and the

acceleration of an unrecognized prior service cost and transition obligation of a benefit of $1.0 million and a cost

of $1.2 million, respectively. See Note 3 for further discussion.

Also related to the 2007-2008 restructuring plan, the Company incurred special termination benefit charges

of $8.2 million in the fourth quarter of 2007 due to 105 management employees accepting these benefits. In the

first quarter of 2008, the Company incurred an additional $22.1 million related to 284 union employees accepting

special termination benefits. The Company also recorded an additional $4.9 million of special termination

benefits during 2008 related to remaining special termination benefits being amortized over the future service

period for both the management and union employees. The Company will also amortize the remaining $2 million

of special termination benefits in 2009. See Note 3 for further discussion.

Due to the credit and financial market crisis, the Company’s pension plan assets incurred investment losses

of approximately 23% for the year ended December 31, 2008. As a result, the Company recorded an increase to

its unfunded pension and postretirement obligations of $123 million, increased deferred tax assets by $45

million, and reduced equity by $78 million.

Subsequent Event

In February 2009, the Company announced significant changes to its management pension and

postretirement plans. The Company announced that it will freeze pension benefits for certain management

employees below 50 years of age and provide a 10-year transition period for those employees over the age of 50

after which the pension benefit will be frozen. Additionally, the Company announced it will phase out the retiree

healthcare plan for all management employees and certain retirees in 10 years.

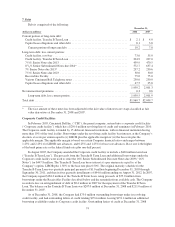

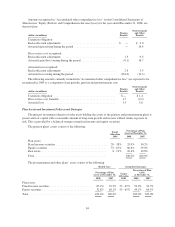

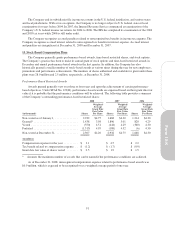

Components of Net Periodic Cost

The following information relates to all Company noncontributory defined benefit pension plans,

postretirement health care, and life insurance benefit plans. Approximately 9% in 2008 and 2007, and 10% in

2006 of these costs were capitalized to property, plant and equipment related to network construction in the

Wireline segment. Pension and postretirement benefit costs for these plans were comprised of:

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) 2008 2007 2006 2008 2007 2006

Service cost ........................................ $ 9.0 $ 8.3 $ 8.8 $ 1.8 $ 3.4 $ 3.5

Interest cost on projected benefit obligation ............... 28.8 28.0 27.7 18.3 20.1 19.9

Expected return on plan assets ......................... (34.8) (34.6) (34.9) (1.9) (3.6) (4.8)

Amortization of:

Transition obligation .............................———2.04.14.2

Prior service cost ................................ 0.4 2.2 3.4 0.4 5.4 7.7

Actuarial loss ................................... 2.8 3.6 3.9 3.5 3.7 4.8

Special termination benefit ............................ 26.2 8.1 — 0.8 0.1 —

Curtailment charge .................................. 3.1 0.9 — 12.4 5.5 —

Benefit costs ....................................... $35.5 $ 16.5 $ 8.9 $37.3 $38.7 $35.3

82