Cincinnati Bell 2008 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

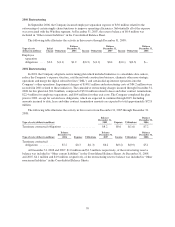

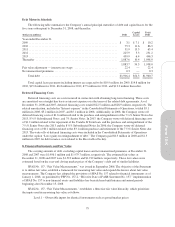

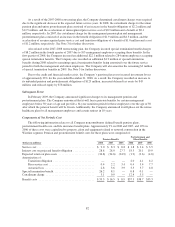

Debt Maturity Schedule

The following table summarizes the Company’s annual principal maturities of debt and capital leases for the

five years subsequent to December 31, 2008, and thereafter:

(dollars in millions) Debt

Capital

Leases

Total

Debt

Year ended December 31,

2009 .............................................................. $ 3.1 $ 7.1 $ 10.2

2010 .............................................................. 75.3 11.6 86.9

2011 .............................................................. 51.9 13.5 65.4

2012 .............................................................. 225.9 5.3 231.2

2013 .............................................................. 439.9 6.4 446.3

Thereafter ......................................................... 1,087.6 10.4 1,098.0

1,883.7 54.3 1,938.0

Fair value adjustment — interest rate swaps .............................. 22.4 — 22.4

Net unamortized premiums ............................................ 0.3 — 0.3

Total debt ..................................................... $1,906.4 $54.3 $1,960.7

Total capital lease payments including interest are expected to be $10.9 million for 2009, $14.8 million for

2010, $15.8 million for 2011, $6.8 million for 2012, $7.5 million for 2013, and $13.3 million thereafter.

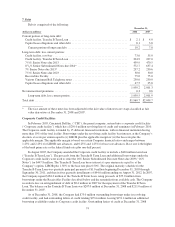

Deferred Financing Costs

Deferred financing costs are costs incurred in connection with obtaining long-term financing. These costs

are amortized on a straight-line basis as interest expense over the terms of the related debt agreements. As of

December 31, 2008 and 2007, deferred financing costs totaled $22.5 million and $28.9 million, respectively. The

related amortization, included in “Interest expense” in the Consolidated Statements of Operations, totaled $5.1

million in 2008, $5.2 million in 2007, and $5.1 million in 2006. Additionally, in 2008, the Company wrote-off

deferred financing costs of $1.6 million related to the purchase and extinguishment of the 7

1

⁄

4

% Senior Notes due

2013, 8

3

⁄

8

% Subordinated Notes, and 7% Senior Notes. In 2007, the Company wrote-off deferred financing costs

of $1.2 million related to the repayment of the Tranche B Term loan, and the purchase and extinguishment of the

7

1

⁄

4

% Senior Notes due 2013 and the 8

3

⁄

8

% Subordinated Notes. In 2006, the Company wrote-off deferred

financing costs of $0.1 million related to the $3.1 million purchase and retirement of the 7

1

⁄

4

% Senior Notes due

2013. The write-offs of deferred financing costs were included in the Consolidated Statements of Operations

under the caption “Loss (gain) on extinguishment of debt.” The Company paid $0.3 million in 2008 and $1.3

million in 2007 for debt issuance costs related to the Receivables Facility.

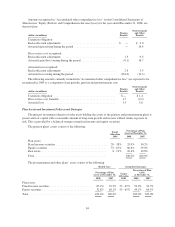

8. Financial Instruments and Fair Value

The carrying amounts of debt, excluding capital leases and net unamortized premiums, at December 31,

2008 and 2007 were $1,906.1 million and $1,979.7 million, respectively. The estimated fair values at

December 31, 2008 and 2007 were $1,523 million and $1,919 million, respectively. These fair values were

estimated based on the year-end closing market prices of the Company’s debt and of similar liabilities.

SFAS No. 157, “Fair Value Measurements,” was issued in September 2006. The objective of the Statement

is to define fair value, establish a framework for measuring fair value and expand disclosures about fair value

measurements. The Company has adopted the provisions of SFAS No. 157 related to financial instruments as of

January 1, 2008. As permitted by FSP No. 157-2, “Effective Date of FASB Statement No. 157,” implementation

of SFAS No. 157 to non-financial assets and liabilities has been deferred until interim and annual periods

beginning after November 15, 2008.

SFAS No. 157, “Fair Value Measurements,” establishes a three-tier fair value hierarchy, which prioritizes

the inputs used in measuring fair value as follows:

Level 1 – Observable inputs for identical instruments such as quoted market prices;

79

Form 10-K