Cincinnati Bell 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

data centers, the Company purchased a data center business in South Bend, Indiana in December 2007 for a

purchase price of $20.3 million, of which $19.0 million was paid in cash in 2007. In the first quarter of 2007, the

Company purchased a local telecommunications business and paid $4.6 million. Also, in late 2007 the Company

deposited $4.4 million with the FCC for the opportunity to participate in the auction for the purchase of

additional wireless spectrum. Cash flows from investing activities for 2006 include payments of $86.7 million for

the acquisitions of ATI and the 19.9% minority interest in CBW, as well as $37.1 million for the purchase of

wireless licenses in an FCC auction. Proceeds were received in 2006 for $4.7 million on the sale of broadband

fiber assets and for $5.7 million on the sale of an investment.

Cash flow used in financing activities was $98.6 million in 2007 compared to $21.0 million during 2006.

The increased use of cash flow for financing activities primarily relates to increased repayments of debt, net of

debt issuances, in 2007. In 2006, the Company used a greater portion of its cash flows generated by operating

activities to make the acquisitions discussed above and to increase its ending cash balance, which left decreased

cash amounts available for 2006 debt payments.

Future Operating Trends

Wireline

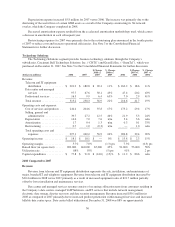

The Company suffered an 8% loss of ILEC access lines in 2008 as some customers elected to use wireless

communication in lieu of the traditional local service, elected to use service from other providers, or can no

longer pay for phone service. The Company believes these same factors will continue to affect its operations in

future years. Further, the economic issues facing consumers and businesses could further exacerbate credit-

related disconnections that the Company has faced in the past. Credit-related disconnections represented 29% of

total ILEC access line losses in 2008. The Company believes this percentage could increase in 2009.

In the past several years, the Company has partially offset the access line loss in its ILEC territory by

continuing to target voice services to residential and business customers in its CLEC territory. The Company

added 8,900 CLEC territory access lines in 2008 and 12,000 such lines in 2007. The Company believes these

trends will continue into 2009.

The Company has also been successful at offsetting access line losses with additional data revenue. DSL

subscribers have increased by 11,700 in 2008, 23,200 in 2007, and 35,800 in 2006. Although the Company is

maintaining its market share, the rate of its DSL subscribers increase is declining as the Company’s operating

territory is becoming saturated with customers that already have high-speed internet service. The Company

believes its ability to affect this trend depends on its ability to increase market share.

Long distance and VoIP revenues will be impacted by several factors. As noted above, customers may

disconnect local voice service for various reasons. In doing so, customers that have both the Company’s local

voice and long distance service are likely to disconnect long distance service as well. Also, as noted above, some

customers have disconnected wireline service in order to use service from other providers. These other providers

are normally providing VoIP service, which the Company offers to business customers. The Company believes

an increasing number of business customers that disconnect from local wireline voice service will become

Company VoIP customers in the future.

Wireless

Wireless revenue increases in the future are likely to come from ARPU increases, as more customers begin

using data services and smart phones. The Company’s data ARPU has increased from $5.10 in 2006 to $6.21 in

2007 to $8.02 in 2008. Particularly given the Company’s investment in its 3G network overlay, which provides a

better, faster experience for data users, the Company expects data ARPU to increase in 2009.

Similar to DSL service, the Company’s operating territory is well-saturated with existing wireless cell

phone users. Future subscriber increases are more likely to come from increasing market share, as opposed to

acquiring a customer who has never had a cell phone. The Company’s competitors are well-funded, and increases

in market share are difficult to attain. New products are not always available to the Company, as other

competitors may have exclusive agreements for those new products.

34