Cincinnati Bell 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

director. These restricted shares will not vest until the third anniversary of the grant date and payment of such

grants will be deferred until such non-employee director ceases to be a director of the Company.

The Board will exercise its discretion in granting such options and/or time-based restricted shares with the

intent that such grants, together with other Company equity-based compensation, provide Company equity-based

compensation that is competitive with the value of equity-based compensation provided by comparable

companies to their non-employee directors.

Each stock option granted to a non-employee director under the 2007 Directors Stock Option Plan, or a

predecessor plan, requires that, upon the exercise of the option, the price to be paid for the common shares that

are being purchased under the option will be equal to 100% of the fair market value of such shares as determined

at the time the option is granted. With certain exceptions provided in the 2007 Directors Stock Option Plan, a

non-employee director of the Company who is granted an option under the plan generally will have ten years

from the date of the grant to exercise the option.

In general, each restricted share award will require that the restrictions not lapse in full unless the

non-employee director continues to serve as a director of the Company for at least three years after the award

grant date or ends service as a Company director under special circumstances (e.g., death, disability, or attaining

retirement age). In addition, payment for these awards will be deferred until the non-employee director no longer

serves as a director of the Company.

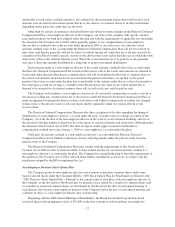

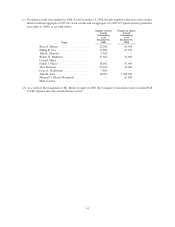

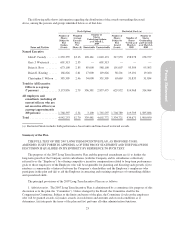

Actual Director Compensation in 2008 Fiscal Year

The following table shows the compensation paid to our non-employee directors for the 2008 fiscal year.

Director Compensation for Fiscal 2008

Name

Fees Earned or

Paid in Cash ($)

(a)

Stock

Awards ($)

(b)(c)

Option

Awards ($)

(c)

Total

($)

Bruce L. Byrnes ......................... 98,000 (13,151) — 84,849

Phillip R. Cox ........................... 296,000 (58,794) — 237,206

Jakki L. Haussler ........................ 61,375 7,777 — 69,152

Robert W. Mahoney ...................... 96,625 2,157 — 98,782

Craig F. Maier .......................... 33,989 — — 33,989

Daniel J. Meyer ......................... 116,000 (48,664) — 67,336

Alex Shumate ........................... 80,500 3,973 — 84,473

Lynn A. Wentworth ...................... 70,250 7,777 — 78,027

John M. Zrno ........................... 113,125 (52,553) — 60,572

Michael G. Morris (Resigned) .............. 26,250 (62,039)(d) — (35,789)

Mark Lazarus .......................... — — — —

(a) Board fees included deferred compensation during 2008 for those directors who deferred some or all of their

cash retainer/fees.

(b) The values reflect the FAS 123(R) expense or (income) the Company recorded in 2008. Each non-employee

director had his account under the Directors Deferred Compensation Plan credited with an amount equal to

the value of 6,000 common shares of the Company on January 2, 2008. The values reflect a decrease in the

value of the 2008 award resulting from the change in the Company’s closing stock price on January 2, 2008

of $4.52 to $1.93 at December 31, 2008. The values also reflect a decrease in the value of awards granted in

prior years resulting from the change in the Company’s closing stock price of $4.75 at December 31, 2007 to

$1.93 at December 31, 2008. The values also include the FAS 123(R) expense related to the grant of time-

based restricted shares at the 2008 Annual Meeting of Shareholders. For a discussion of the valuation

assumptions and methodology, see Note 13 to the Company’s Consolidated Financial Statements included in

the Annual Report on Form 10-K for the year ended December 31, 2008.

13

Proxy Statement