Cincinnati Bell 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2008 Annual Report

Letter to

Shareholders

Notice of

2009 Annual Meeting

and Proxy Statement

Report on

Form 10-K

Table of contents

-

Page 1

2008 Annual Report Letter to Shareholders Notice of 2009 Annual Meeting Report on and Proxy Statement Form 10-K -

Page 2

Contents Letter to Shareholders from the Chairman, the President & Chief Executive Officer and the Chief Financial Officer Financial Highlights Board of Directors and Company Officers Notice of Annual Meeting of Shareholders Proxy Statement Report on Form 10-K -

Page 3

..., the President & Chief Executive Officer and the Chief Financial Officer or 135 years, Cincinnati Bell has combined innovative market approaches with superior network quality and customer service in order to provide communications solutions for consumers and businesses in Ohio, Kentucky, and... -

Page 4

... Technology Solutions business, which includes our data center and managed services operations. Cincinnati Bell has a solid history of delivering diverse carrier-grade network solutions for businesses of all sizes. Through the Technology Solutions business, we provide business customers with access... -

Page 5

...developed the Web interface used by Virtual Data Center customers. Maintaining our edge in Wireless customers with exceptional mobile coverage and download speeds unparalleled by other wireless carriers in the Cincinnati and Dayton areas. We offer Fusion WiFi as a bolt-on to monthly rate plans, and... -

Page 6

... of the Smart Home Phone. With this handset, customers can send and receive SMS text messages, review a list of their voicemail entries, play or delete them in any order, and even read them as text messages via the SpinVox 4 In closing, Cincinnati Bell experienced an exciting and eventful 2008. We... -

Page 7

...result is that over time, as we maintain our enterprise value while retiring debt and repurchasing shares, shareholders will see the value of their ownership increase. We remain committed to serving customers, employees, and shareholders in the next year and years to come. Use of Non-GAAP Financial... -

Page 8

...suggested by any such forward-looking statement for a variety of reasons, including but not limited to Cincinnati Bell's ability to maintain its market position in communications services, including wireless, wireline and internet services; general economic trends affecting the purchase or supply of... -

Page 9

... Chief Executive Officer Cox Financial Corporation Bruce L. Byrnes (2, 3, 4*) Retired Vice Chairman of the Board The Procter & Gamble Company John F. Cassidy (3) President and Chief Executive Officer Cincinnati Bell Inc. Jakki L. Haussler (4) Chairman and Chief Executive Officer Opus Capital Group... -

Page 10

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 11

... Savings Time, at the Queen City Club, 331 East Fourth Street, Cincinnati, Ohio, for the following purposes: 1. 2. To elect five directors to serve a one-year term ending in 2010; To approve a proposal to amend the Cincinnati Bell Inc. 2007 Long Term Incentive Plan to increase the number of shares... -

Page 12

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 13

INFORMATION FOR SHAREHOLDERS THAT PLAN TO ATTEND THE 2009 ANNUAL MEETING OF SHAREHOLDERS The Queen City Club is located on the corner of Fourth Street and Broadway Street at 331 East Fourth Street, Cincinnati, Ohio. Below are directions to the Queen City Club located in downtown Cincinnati. From I-... -

Page 14

... OF CONTENTS Page Proxy Statement ...Questions and Answers about the Proxy Materials and the Annual Meeting ...Board Structure and Corporate Governance ...Director Compensation ...Compensation Committee Interlocks and Insider Participation ...Code of Business Conduct and Codes of Ethics ...Certain... -

Page 15

...shareholders of Cincinnati Bell Inc., an Ohio corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors for use at the 2009 Annual Meeting of Shareholders. The Annual Meeting will be held on Friday, May 1, 2009, at 11:00 a.m., Eastern Daylight Savings Time... -

Page 16

... on its owned local and wireless networks with a well-regarded brand name and reputation for service. In addition, the Company provides business customers with efficient, scalable office communications systems and complex information technology solutions, including data center and managed services... -

Page 17

... the close of business on the Record Date. This includes: (i) shares held directly in your name as the shareholder of record, including common shares purchased through the Cincinnati Bell Employee Stock Purchase Plan; (ii) shares that are held by a trust used in connection with a Company employee or... -

Page 18

... and then you will be presented a proxy card. Beneficial shares, held either in street name or credited to your account under a Company employee or director plan, cannot be voted at the Annual Meeting unless you obtain a signed proxy from the shareholder of record authorizing you to vote these... -

Page 19

... instructions at any time prior to the vote at the Annual Meeting. You may change your vote by either: (i) granting a new proxy or voting instructions bearing a later date (which automatically revokes the earlier proxy or voting instructions) whether made on the internet, by telephone or by mail... -

Page 20

... any internet access charges you may incur. In addition to the costs of mailing the proxy materials, the Company may also incur costs to provide additional copies of these proxy materials (if requested) and for its directors, officers and employees to solicit proxies or votes in person, by telephone... -

Page 21

... STRUCTURE AND CORPORATE GOVERNANCE Our business, property and affairs are managed under the direction of our Board. Members of our Board are kept informed of our business through discussions with our President and Chief Executive Officer and other officers, by reviewing materials provided to them... -

Page 22

... of the Company meet in executive session without management present at each regularly scheduled meeting of the Board. Mr. Cox presides at the meetings of the non-management directors. Committees of the Board The following table sets forth the membership of the committees of the Board for 2008: Name... -

Page 23

... see page 67. In performing its duties, the Compensation Committee meets at least three times each calendar year. The Compensation Committee also meets separately with the Company's Chief Executive Officer and other corporate officers, as it deems appropriate, to establish and review the performance... -

Page 24

... 2009 Annual Meeting by any shareholder. The Governance and Nominating Committee uses the following process to identify and evaluate director nominee candidates. Any qualified individual or group, including shareholders, incumbent directors and members of senior management, may at any time propose... -

Page 25

...options that he or she chooses. In addition, each non-employee director of the Company on the first business day of the year, in each of 2008 and 2009, had his or her account under the Directors Deferred Compensation Plan credited on such date with an amount equal to the value of 6,000 common shares... -

Page 26

... make further amendments as necessary to comply with the regulations adopted by the IRS to implement the Act. Non-Employee Directors Stock Option Plan The Company grants its non-employee directors stock options to purchase common shares and/or timebased restricted shares under the Cincinnati Bell... -

Page 27

...to 100% of the fair market value of such shares as determined at the time the option is granted. With certain exceptions provided in the 2007 Directors Stock Option Plan, a non-employee director of the Company who is granted an option under the plan generally will have ten years from the date of the... -

Page 28

...in 2008. As of December 31, 2008, the non-employee directors (and a former director) held an aggregate of 235,417 stock awards and an aggregate of 1,609,975 option awards (granted in years prior to 2008), as set forth below: Number of Stock Awards Outstanding as of December 31, 2008 Number of Option... -

Page 29

... fiscal year served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Company's Board or Compensation Committee. CODE OF BUSINESS CONDUCT AND CODES OF ETHICS The Company has a Code of Business Conduct applicable to... -

Page 30

... and on terms that were reasonable and in the best interest of the Company. The aggregate amount paid by P&G for the Company's services in 2008 was approximately $7 million. The Company believes that Mr. Byrnes received no personal benefit in connection with the Company providing these services and... -

Page 31

Proxy Statement [THIS PAGE INTENTIONALLY LEFT BLANK] 17 -

Page 32

..., one of whom is an officer of the Company. As previously disclosed, Messrs. Mahoney and Meyer will serve only until the 2009 Annual Meeting of Shareholders, and then they will retire as required by the Company's retirement policy applicable to Board members that provides that directors cannot... -

Page 33

... Chairman and Chief Executive Officer of Opus Capital Group (a registered investment advisory firm) since 1996. She is a director of The Victory Funds, the University of Cincinnati Foundation and the Northern Kentucky University Foundation, and is on the Richard T. Farmer School of Business Board of... -

Page 34

... Accountants. She is on the Board of the Community Foundation of Greater Atlanta and the Board of Visitors at Emory University. Director since 2008. Age 50. Lynn A. Wentworth Mr. Zrno is retired. He was President and Chief Executive Officer of IXC Communications, Inc. (a telecommunications company... -

Page 35

... has been the President and Chief Executive Officer of Cincinnati Bell Inc. since July 2003 and a director of Cincinnati Bell Inc. since September 2002. Among other positions held with the Company, he has been President and Chief Operating Officer of Cincinnati Bell Telephone Company since May 2001... -

Page 36

... Company's stock price with the stock market's dramatic decline, made it apparent to the Board that there would be insufficient shares remaining under the 2007 Long Term Incentive Plan to make timely equity grants and to best align executive compensation with the interests of shareholders. The Board... -

Page 37

... TEXT. The purposes of the 2007 Long Term Incentive Plan and the proposed amendment are (i) to further the long-term growth of the Company and its subsidiaries (with the Company and its subsidiaries collectively referred to as the "Employer") by offering competitive incentive compensation related... -

Page 38

... 162(m) of the Internal Revenue Code. Thus, the Chief Executive Officer generally can grant awards under the 2007 Long Term Incentive Plan to employees of the Employer who are not officers of the Company if delegated this right by the Board. If the Chief Executive Officer is delegated such right... -

Page 39

... that either the employee remains employed by the Employer for at least one year after the award's grant or the employee's employment with the Employer ends in special circumstances (such as his or her death, disability, or retirement). A portion of the maximum number of common shares subject to the... -

Page 40

...) granted under the plan to any employee during each and any calendar year may be based (that is, the maximum number of common shares that can be issued or paid under such awards or have their fair market value or increase in fair market value over a period used to determine the amount of payments... -

Page 41

... the event a change in control of the Company (as is defined in the terms of the 2007 Long Term Incentive Plan) occurs, then, in general terms and among other things (unless otherwise prescribed by the terms of the applicable award): (i) all then outstanding stock options and SARs that were granted... -

Page 42

... would make any other change in the plan that is required by applicable law to be approved by the Company's shareholders in order to be effective. Further, the purchase, grant, or other similar price applicable to any award granted under the 2007 Long Term Incentive Plan, including a stock option or... -

Page 43

... a non-restricted stock award granted under the 2007 Long Term Incentive Plan to an employee, the employee generally must recognize ordinary compensation income equal to the fair market value of the common shares received under the award at the time it is received; and the Employer will be entitled... -

Page 44

... December 31, 2008 regarding securities of the Company to be issued and remaining available for issuance under the equity compensation plans of the Company. Number of securities to be issued upon exercise of outstanding stock options, awards, warrants and rights (a) Weightedaverage exercise price of... -

Page 45

...LLP as the Independent Registered Public Accounting Firm of the Company requires the affirmative vote of the holders of a majority of the common shares and 6 3â„ 4% Cumulative Convertible Preferred Shares, voting as one class, present or represented at the annual meeting, in person or by proxy, and... -

Page 46

... Committee recommended to the Board that the audited financial statements for the Company's fiscal year ended December 31, 2008 be included in the Company's Annual Report on Form 10-K for the Company's fiscal year ended December 31, 2008. The Board has determined that each member of the Audit and... -

Page 47

... The audit fees for the years ended December 31, 2008 and 2007 were for services rendered in connection with the audit of the Company's annual consolidated financial statements, review of consolidated financial statements included in the Company's reports filed with the SEC and services related to... -

Page 48

... power for 12,000 common shares. The amounts reported on Schedule 13D/A include a number of shares with respect to which Gabelli Funds, LLC and GAMCO Asset Management Inc. have the right to beneficial ownership upon the conversion of the Company's 6 3â„ 4% Cumulative Convertible Preferred Shares... -

Page 49

... named in the Summary Compensation Table on page 50, and (ii) all directors and executive officers of the Company as a group. Unless otherwise indicated, the address of each director and executive officer is c/o Cincinnati Bell at the Company's address. Common Shares Beneficially Owned as of March... -

Page 50

... our review and discussions with management, we have recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference in Cincinnati Bell Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2008... -

Page 51

...elements to the Company's executive compensation program: • Fixed compensation - Base salary. • "At-risk" annual compensation - Annual incentives paid in cash. • "At-risk" long-term compensation - Long-term incentives that are equity awards delivered generally in the form of stock options and... -

Page 52

... contact each member of the Compensation Committee annually as part of the Compensation Committee's self-evaluation and report his conclusions to the Compensation Committee. In addition, the Company retains Towers Perrin, a compensation consulting firm, to assist it with various compensation-related... -

Page 53

...annual revenues that are closely aligned with the Company's revenues, and they provide the Company and the Compensation Committee with insight with respect to executive compensation practices across a wide cross-section of industries. These companies include: • Advanced Medical • • • Optics... -

Page 54

...company's annual revenue, the Company, in consultation with Towers Perrin, adjusts the compensation pay data of the two peer groups to take into account differences in revenue among companies using a statistical technique called "regression analysis." Using this technique, for each executive officer... -

Page 55

... stock options and other equity awards owned by the executive and the value of any vested retirement benefits provided by the Company, as well as pay and benefits triggered under a variety of employment termination scenarios. This provides additional context for the Compensation Committee in setting... -

Page 56

... planning, overall development of the Company leadership team and community involvement/relationships. The Compensation Committee has discretion in evaluating the Chief Executive Officer's performance and may recommend to the full Board a discretionary increase or decrease to the Chief Executive... -

Page 57

...of significant grants of shares to operational management under a special five year incentive plan approved by the Compensation Committee to drive growth in a key area of the business. That, combined with the large decline in the Company's stock price as the general stock market dropped dramatically... -

Page 58

... a ten-year period. The Compensation Committee has a long-standing practice of making its annual grants of stock options at its December meeting. The Compensation Committee (and in the case of the Chief Executive Officer, the full Board) grants stock option awards based upon a review of peer company... -

Page 59

... applicable Internal Revenue Code limits for qualified plans. The Company funds all contributions to this plan. In addition, the Chief Executive Officer is also covered under a nonqualified supplemental retirement plan, the Cincinnati Bell Pension Program ("SERP"), the benefits of which are payable... -

Page 60

... salary, annual bonus and long-term incentive compensation - with the Compensation Committee. In addition, the Compensation Committee reviewed a tally sheet showing the value or cost of participation in the Company's various benefits, retirement and perquisite plans for each named executive officer... -

Page 61

... programs; The compensation of other chief executive officers in the two study company peer groups; The overall results achieved by the Company in a highly competitive market environment; and Mr. Cassidy's personal performance, including succession planning and his personal involvement in community... -

Page 62

..., the Compensation Committee has not set a specific period of time in which the ownership level must be achieved, but does expect each executive to make measurable progress on a year-over-year basis as evidenced by the number of shares owned multiplied by the fair market value of the Company's stock... -

Page 63

...the 12-month period following the date the applicable financial statements were issued and any profits from any sale of securities of the Company during that 12-month period. Compensation Limitation Section 162(m) of the Internal Revenue Code generally limits to $1,000,000 the available deduction to... -

Page 64

... compensated persons who served as executive officers (Brian A. Ross, Brian G. Keating, Christopher J. Wilson) during the year ended December 31, 2008 (collectively, the "Named Executive Officers"): Summary Compensation Table Change in Pension Value and Non-Qualified Deferred Option Compensation... -

Page 65

..., club dues, life insurance premiums and legal/financial planning fees. As described on page 55, each executive is provided an annual allowance to use in connection with participation in the Company's Flexible Perquisite Program. The amounts for Messrs. Cassidy and Keating for 2008 in the table... -

Page 66

... Stock Number of Securities Plan Awards (a) Awards (b) Shares of Underlying Threshold Target Maximum Threshold Target Maximum Stock or Units Options c) - 680,000 - 200,000 324,324 - - 362,162 - - 100,000 - - 210,810 - Closing Exercise Price of Grant Date or Base Company Fair Value Price of Shares... -

Page 67

.... The grant date fair value was determined using the Black-Scholes option-pricing model. For amounts related to stock awards, the amounts set forth in this column represent the expense the Company may record over the next three years assuming the maximum number of shares are earned and the executive... -

Page 68

...extensions. Mr. Wilson's employment agreement provides for a minimum base salary of $309,000 per year and a minimum bonus target of $200,850 per year. Each of the Named Executive Officers participates in the Cincinnati Bell Management Pension Plan (the "Management Pension Plan"), which contains both... -

Page 69

...-term business strategy. The long-term incentives granted to the Named Executive Officers are discussed in the Compensation Discussion and Analysis on page 43. Other Benefits Each Named Executive Officer is eligible to participate in the Cincinnati Bell Inc. Flexible Perquisite Reimbursement Program... -

Page 70

... Executive Officers at December 31, 2008: Outstanding Equity Awards at 2008 Fiscal Year-End Option Awards Stock Awards Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (b) Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares... -

Page 71

... Number of Shares or Units of Stock That Have Not Vested (#) Market Value of Shares or Units of Stock That Have Not Vested ($) Proxy Statement - - 178,129 343,788 (a) All options granted are for a maximum period of 10 years from the date of grant and vest over a three year period. Options... -

Page 72

... are required, under the terms of the 1997 Cincinnati Bell Inc. Executive Deferred Compensation Plan, to be invested in common shares of the Company for a period of at least six months. Shares deferred are payable upon the termination of employment in two annual installments beginning the later of... -

Page 73

...(e) Management Pension Plan. Nonqualified ERISA Excess Provisions of the Cincinnati Bell Management Pension Plan. See page 54 for further details on the SERP. Employment agreement between the Company and Mr. Cassidy. None of the executive officers have been granted additional years of service under... -

Page 74

...of a plan participant's total plan compensation for 2008 that exceeds the Social Security old-age retirement taxable wage base for 2008. A participant's account under the Management Pension Plan is also generally credited with assumed interest for each calendar year at a certain interest rate. Such... -

Page 75

... closing price of the Company's stock ($1.93) on December 31, 2008 with respect to deferrals made prior to 2008. The 1997 Cincinnati Bell Inc. Executive Deferred Compensation Plan (the "Executive Deferred Compensation Plan") generally permits under its current policies, for any calendar year, each... -

Page 76

... under the Executive Deferred Compensation Plan are generally distributed, as so elected by the participant, in a lump sum or in two to ten annual installments (in cash and/or common shares), that begin at some date after his or her termination of employment with the Company and its subsidiaries... -

Page 77

... contracts, agreements, plans or arrangements, whether written or unwritten, as of January 1, 2009, for various scenarios involving a change-in-control or termination of employment, assuming a January 2, 2009 termination date and, where applicable, using the closing price of our common shares... -

Page 78

... date of termination times 526,549; • A payment equal to the present value of an additional one year (two years for Mr. Cassidy) of participation in the Company's Management Pension Plan and SERP, if applicable, as though the executive had remained employed at the same base rate of pay and target... -

Page 79

... A payment equal to the present value of an additional one year (two years for Mr. Cassidy) of participation in the Company's Management Pension Plan as though the executive had remained employed at the same base rate of pay and target bonus; • Continued medical, dental, vision and life insurance... -

Page 80

..., 2008, all such persons complied on a timely basis with the filing requirements of Section 16(a). Shareholder Proposals for Next Year's Annual Meeting Shareholder proposals intended for inclusion in next year's Proxy Statement should be sent to Christopher J. Wilson, Vice President, General Counsel... -

Page 81

...Vice President, General Counsel and Secretary, Cincinnati Bell Inc., 221 East Fourth Street, Cincinnati, Ohio 45202, for a free copy: Corporate Governance Document Website Audit and Finance Committee Charter Compensation Committee Charter Governance and Nominating Committee Charter Code of Business... -

Page 82

..., Vice President, General Counsel and Secretary, Cincinnati Bell Inc., 221 East Fourth Street, Cincinnati, Ohio 45202, and identify the intended recipient or recipients. All communications addressed to the Board or any identified director or directors will be forwarded to the identified person or... -

Page 83

Appendix A CINCINNATI BELL INC. 2007 LONG TERM INCENTIVE PLAN (As adopted and originally effective as of May 3, 2007) (As amended and effective upon shareholder approval on May 1, 2009) Proxy Statement -

Page 84

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 85

... of Plan. The name of this Plan is the Cincinnati Bell Inc. 2007 Long Term Incentive Plan, and its sponsor is CBI. 1.2 Purposes of Plan. The purposes of this Plan are (i) to further the long term growth of the Company by offering competitive incentive compensation related to long term performance... -

Page 86

...granted under the Plan that by its terms provides for issuance or payments (upon, if applicable, its exercise or the meeting of certain performance goals or other criteria or conditions) of fixed numbers of Common Shares or of amounts determined with reference to the fair market value (or the change... -

Page 87

... of the Plan that concern the making of awards to such Employees, the terms of such awards, and the verification that all conditions applicable to the payment under or the exercise of such awards have been met shall be read to refer to CBI's Chief Executive Officer as if such person was the... -

Page 88

... of this subsection 6.2 (which generally involve the maximum number of Common Shares and other compensation on which awards granted to any Participant during a calendar year may be based) shall apply to the grant of awards under the Plan. No award may be granted under the Plan to the extent it would... -

Page 89

... to be higher, the Exercise Price with respect to any number of Common Shares that are subject to a stock option granted under the Plan shall be 100% (and may not in any event be less than 100%) of the fair market value of such number of Common Shares (disregarding lapse restrictions as defined... -

Page 90

.... 7.6 Special Limit on Value of ISOs. If the aggregate fair market value of all Common Shares with respect to which stock options that are intended to be ISOs and that are exercisable for the first time by any Participant during any calendar year (under the Plan and all other plans of the Company... -

Page 91

... employee of the Company for a specified continuous period of time of at least three years (or of at least one year if the restricted stock is subject to the meeting of certain performance goals) or terminate employment with the Company in special circumstances (such as the Participant's retirement... -

Page 92

... must either be an employee of the Company for a specified continuous period of time of at least one year or terminate employment with the Company in special circumstances (such as the Participant's retirement, disability, or death); and (ii) conditions related to the meeting of certain performance... -

Page 93

... share is involved, in Common Shares. To the extent that payment is made in Common Shares or other property, the Common Shares or other property shall be valued at its fair market value on the date as of which the payment is made. 11. Non-Restricted Stock Awards. Any awards granted under the Plan... -

Page 94

..., dividend payments and proceeds from the issuance of equity securities, and proceeds from the sale of assets); (b) earnings before interest, taxes, depreciation, and amortization; (c) earnings per share; (d) operating income; (e) total shareholder returns; (f) profit targets; (g) revenue targets... -

Page 95

...Control on Awards. In the event a Change in Control occurs on or after the Effective Date, then, unless otherwise prescribed by the Committee in the terms of an applicable award, (i) all outstanding stock options and stock appreciation rights granted under the Plan to a Participant shall immediately... -

Page 96

... the aggregate fair market value (on the date of the Change in Control) of the Common Shares that are subject to such stock option or stock appreciation right exceeds the aggregate exercise price of such Common Shares under such stock option or stock appreciation right. In the event the Committee... -

Page 97

...Voting Securities among the holders thereof immediately prior to the Reorganization or Sale; (2) no person (other than any employee benefit plan sponsored or maintained by the Surviving Entity or the Parent Entity or the related trust of any such plan) is or becomes the beneficial owner, directly or... -

Page 98

..., cashier's check, or money order) equal to the amount of such payment/withholding requirements; (b) by making a payment to the Company in Common Shares which are previously owned by the Participant (or such other person) and have a fair market value on the date of payment equal to the amount of... -

Page 99

... event shall the exercise or other similar price applicable to an award granted under the Plan, including a stock option or a stock appreciation right granted under the Plan, be reduced, directly or indirectly, by an amendment to the award, by the cancellation of the award and the granting of a new... -

Page 100

... CBI Affiliate May Be Made In Shares of Subsidiary. Notwithstanding any other provision of the Plan, any award granted under the Plan to an Employee who is, at the time of the grant of the award, an employee of a corporation (other than CBI) that is part of a controlled group of corporations (within... -

Page 101

... FILE NUMBER: 1-8519 CINCINNATI BELL INC. Ohio (State of Incorporation) 31-1056105 (I.R.S. Employer Identification No.) 221 East Fourth Street, Cincinnati, Ohio 45202 Telephone 513-397-9900 Securities registered pursuant to Section 12(b) of the Act: Title of each class Common Shares (par value... -

Page 102

..., Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services ...106... -

Page 103

... cable and fiber optical cable in limited areas, DirecTV commissioning over its entire operating area, inside wire installation for business enterprises, billing, clearinghouse and other ancillary services primarily for inter-exchange (long distance) carriers. Cincinnati Bell Telephone Company LLC... -

Page 104

... Bell Any Distance Inc. Cincinnati Bell Any Distance Inc. ("CBAD") provides long distance, audio conferencing and VoIP services to businesses and residential customers in the Greater Cincinnati and Dayton, Ohio areas. In 2007, CBAD began to provide new broadband services, including private line... -

Page 105

... Cincinnati Bell Wireless LLC ("CBW"), the Wireless segment provides advanced digital wireless voice and data communications services through the operation of a Global System for Mobile Communications/ General Packet Radio Service ("GSM") network with a 3G Universal Mobile Telecommunications System... -

Page 106

...wireline services, and extensive and conveniently located retail outlets. The segment offers unique rate plans and products, such as the "Unlimited Everyday Calling Plan" to any Cincinnati Bell local voice, wireless or business customers and Fusion WiFi, which utilizes Unlicensed Mobile Access ("UMA... -

Page 107

... equipment and operating systems to meet the needs of small to large businesses. This unit also manages the implementation and maintenance of traditional voice systems as well as converged VoIP systems. The data center and managed services product line includes the operations of ten data centers... -

Page 108

..., the Company's mix of business and consumer customers is changing, as many of the Company's growth products, such as data center services and data transport services, are geared primarily toward business customers. In 2008, the Company's revenues were comprised of 59% to business customers and 41... -

Page 109

... could cause the Company's pension and postretirement costs to increase. Investment returns of the Company's pension funds depend largely on trends in the U.S. and world securities markets and the U.S. and world economies in general. As noted above, pension investment losses in 2008 equaled 23%. The... -

Page 110

... to Cincinnati Bell Inc. ("CBI"), the parent company, CBI may not be able to make the scheduled interest and principal repayments on its $1.6 billion of debt. This would have a material adverse effect on the Company's liquidity and the trading price of Cincinnati Bell's common stock, preferred stock... -

Page 111

... retired $76.8 million of its common stock and $108.1 million face amount of its corporate bonds at an average discount of 14%. Payments to repurchase common stock under the Company's repurchase program and prepay debt are considered restricted payments under certain of the Company's debt agreements... -

Page 112

... and long distance services in 2007. Time Warner Cable, AT&T, Verizon, and others offer VoIP and long distance services in Cincinnati and Dayton. Wireless providers offer plans with no additional fees for long distance. Partially as a result of this increased competition, the Company's access lines... -

Page 113

..., companies that offer unlimited wireless service plans for a flat monthly fee, are a cause of CBT's access line loss. The Technology Solutions segment competes against numerous other information technology consulting, web-hosting, data center and computer system integration companies, many... -

Page 114

... the increase in power costs may impact additional sales of data center space. The long sales cycle for data center services may materially affect the data center business and results of its operations. A customer's decision to lease cabinet space in one of the Company's data centers and to purchase... -

Page 115

... on the Company's business, financial condition, results of operations, and cash flows. Future declines in the fair value of the Company's wireless licenses could result in future impairment charges. The market values of wireless licenses have varied dramatically over the last several years and may... -

Page 116

... to the Company's success as its industry is technologically driven, such that new technologies can offer alternatives to the Company's existing services. The development of new technologies and products could accelerate the Company's loss of access lines and increase wireless customer churn, which... -

Page 117

... business. The Company's collective bargaining agreement was renewed in February 2008 for three years and will expire in 2011. The Company could be required to take additional measures for its shares to remain listed on the New York Stock Exchange ("NYSE"). The Company's common stock and preferred... -

Page 118

... data center, power, environmental controls, and high-speed, high bandwidth point-to-point optical network connections. CBTS also has a leased office located in Kentucky. The Company's gross investment in property, plant, and equipment was $3,007.4 million and $2,808.5 million at December 31, 2008... -

Page 119

..., Related Stockholder Matters and Issuer Purchases of Equity Securities (a) Market Information The Company's common shares (symbol: CBB) are listed on the New York Stock Exchange. The high and low daily closing prices during each quarter for the last two fiscal years are listed below: First Quarter... -

Page 120

... regarding the Company's purchases of its common stock during the quarter ended December 31, 2008: Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs* Approximate Dollar Value of Shares that May Yet Be Purchased Under Publicly Announced Plans or Programs (in... -

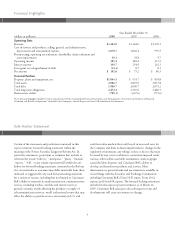

Page 121

...share amounts) 2008 2007 2006 2005 2004 Operating Data Revenue ...Cost of services and products, selling, general and administrative, depreciation and amortization expense ...Restructuring, operating tax settlement, shareholder claim settlement and asset impairments (a) ...Gain on sale of broadband... -

Page 122

...quarter of 2008, the Company launched 3G for commercial service. Wireline Wireline revenue decreased 2% to $803.6 million, as reductions in voice revenue due to ILEC access line loss more than offset growth in revenue from additional CLEC customers, data services, long distance and VoIP. The Company... -

Page 123

...due to increased postpaid service revenue; and • $18.1 million lower revenues in the Wireline segment due to lower voice revenue and the effect of a $9.5 million one-time business customer project in 2007 offset by increased data, long distance and VoIP revenue. Operating income for 2008 was $305... -

Page 124

... the Technology Solutions segment primarily due to increased data center and managed services revenue and telecom and IT equipment revenue; and • $32.5 million higher revenues in the Wireless segment primarily due to increased postpaid service revenue from additional subscribers. Operating income... -

Page 125

... voice telephone service, including enhanced custom calling features, and data services, including DSL, dial-up internet access, dedicated network access, Gig-E and ATM based data transport, to customers in southwestern Ohio, northern Kentucky, and southeastern Indiana. Cincinnati Bell Telephone LLC... -

Page 126

... services to residential and business customers in its CLEC territory. The Company had approximately 71,200 CLEC access lines at December 31, 2008, which is a 14% increase from December 31, 2007. Data revenue consists of data transport, high-speed internet access ("DSL"), dial-up internet access... -

Page 127

... was primarily due to higher minutes of use for both long distance and audio conferencing, as well as increased revenue from the Company's VoIP product, which the Company began offering in mid-2006. The Company had approximately 548,300 subscribed long distance access lines as of December 31, 2007... -

Page 128

...advanced digital, voice, and data communications services through the operation of a regional wireless network in the Company's licensed service territory, which surrounds Cincinnati and Dayton, Ohio and includes areas of northern Kentucky and southeastern Indiana. The segment offers service outside... -

Page 129

... new GSM network and a change in third party dealer compensation practice in the second quarter of 2006. As a result of this change, the Company now predominantly pays a commission, which is reported as a selling expense, rather than incurring a subsidy by selling handsets to dealers at a rate below... -

Page 130

... of increased equipment sales of $21.7 million partially offset by lower installation and maintenance services. Data center and managed services revenue consists of recurring collocation rents from customers residing in the Company's data centers, managed VoIP Solutions, and IT services that include... -

Page 131

..., to support this growth. Professional services revenue consists of long-term and short-term IT outsourcing and consulting engagements. Revenue for 2008 increased by $6.4 million compared to 2007. The Company has expanded its team of recruiting and hiring personnel in order to focus on selling these... -

Page 132

...to the termination of certain interest rate swaps by the counterparty. Uses of cash will include repayments and repurchases of debt and related interest, repurchases of common shares, dividends on preferred stock, and working capital. In February 2008, the Company's Board of Directors authorized the... -

Page 133

.... The decrease was due to payments of $56.0 million for operating taxes and early pension contributions partially offset by a customer prepayment of $21.5 million for data center services and increased operating cash generated by the Wireless segment due to service revenue growth. Cash flow utilized... -

Page 134

... number of business customers that disconnect from local wireline voice service will become Company VoIP customers in the future. Wireless Wireless revenue increases in the future are likely to come from ARPU increases, as more customers begin using data services and smart phones. The Company's data... -

Page 135

... deterioration in the economy and a temporary change to its customer credit policy. The Company has tightened its credit policy, but expects the high bad debt trend to continue into 2009. Technology Solutions Revenue from data center and managed services increased by 45% in 2008, 43% in 2007, and 28... -

Page 136

... primarily consist of amounts under open purchase orders. (4) Included in pension and postretirement benefit obligations are payments for the Company's postretirement benefits, qualified pension plans, non-qualified pension plan and other employee retirement agreements. Amount for 2009 includes $24... -

Page 137

... three-year labor contract. The new agreement, which covers approximately 1,200 members of the CWA locals 4400 and 4401, was ratified by the local CWA membership on February 27, 2008 and includes the following: • Retains the current call center work as local Cincinnati jobs, restructures base pay... -

Page 138

...the normal course of business, the Company makes certain indemnities, commitments, and guarantees under which it may be required to make payments in relation to certain transactions. These include (a) intellectual property indemnities to customers in connection with the use, sales, and/or license of... -

Page 139

... meet these levels, customers may be able to receive service credits for their accounts. The Company records these credits against revenue when an event occurs that gives rise to such credits. In multi-year data center and managed services arrangements with increasing or decreasing monthly billings... -

Page 140

... the installation services. The Company recognizes the IT equipment revenue upon completion of its contractual obligations, generally upon delivery of the IT equipment to the customer, and recognizes installation service revenue upon completion of the installation. Pricing of local voice services is... -

Page 141

... fair value. To satisfy increasing demand for existing voice minutes of use by customers as well as to provide enhanced data services such as streaming video, the Company constructed a 3G wireless network overlay to deploy on the AWS spectrum purchased in 2006. Due to this implementation, lives of... -

Page 142

... on the operating results of the Company. A one-year decrease or increase in the useful life of these assets would increase or decrease annual depreciation expense by approximately $20 million. Accounting for Business Combinations - In accounting for business combinations, the Company applies the... -

Page 143

...are presented in sales and cost of services on a gross basis because, while the Company is required to pay the tax, it is not required to collect the tax from customers and, in fact, does not collect the tax from customers in certain instances. The amount recorded as revenue for 2008, 2007, and 2006... -

Page 144

... increased equity by $47 million. As a result of the new union labor agreement and curtailment charge in the first quarter of 2008, the Company remeasured its union pension and postretirement obligations using revised assumptions, including modified retiree benefit payment assumptions and a discount... -

Page 145

... are recognized in the market-related value of plan assets over five years. Health care cost trend The Company's health care cost trend rate is developed on historical cost data, the near-term outlook, and an assessment of likely long-term trends. The health care cost trend rate used to measure the... -

Page 146

... opening up opportunities for new competitive entrants and new services with minimal regulation such as broadband services and VoIP providers. While Cincinnati Bell has expanded beyond its incumbent local exchange operations by offering wireless, long distance, broadband service, internet access... -

Page 147

...on telephone numbers and connections. Any such alteration could result in a change in the manner in which carriers recover their contributions from end users. Broadband Internet Access In an order adopted in 2005, the FCC provided wireline carriers the option of offering broadband internet access as... -

Page 148

...in Kentucky and the Company initiated discussions with local jurisdictions in March 2008. Four agreements were reached in 2008, and others are pending approval by the remaining local jurisdictions. Recently Issued Accounting Standards FASB Staff Position ("FSP") No. 132(R)-1, "Employers' Disclosures... -

Page 149

...value amounts of and gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative instruments. SFAS No. 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. As this statement... -

Page 150

... economy; changes in competition in markets in which the Company operates; pressures on the pricing of the Company's products and services; advances in telecommunications technology; the ability to generate sufficient cash flow to fund the Company's business plan and maintain its networks; the... -

Page 151

... in market interest rates at December 31, 2008 and 2007 would change the fair value of the long-term interest rate swap contracts by approximately $3 million and $12 million, respectively. In December 2008, three counterparties exercised their right to call $200 million notional amount of long-term... -

Page 152

... table sets forth the face amounts, maturity dates, and average interest rates for the fixed and variable-rate debt, excluding capital leases, net unamortized premiums, and the fair value adjustment related to the long-term interest rate swaps, held by the Company at December 31, 2008: (dollars... -

Page 153

... and Supplementary Data Index to Consolidated Financial Statements Consolidated Financial Statements: Management's Report on Internal Control over Financial Reporting ...Reports of Independent Registered Public Accounting Firm ...Consolidated Statements of Operations ...Consolidated Balance... -

Page 154

... reliable financial statements in conformity with accounting principles generally accepted in the United States. Management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2008. In making this assessment, management used the criteria set forth... -

Page 155

... opinion. A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other... -

Page 156

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareowners of Cincinnati Bell Inc. We have audited the accompanying consolidated balance sheets of Cincinnati Bell Inc. and subsidiaries (the "Company") as of December 31, 2008 and 2007, and the related consolidated statements of operations... -

Page 157

...on sale of broadband assets ...Total operating costs and expenses ...Operating income ...Interest expense ...Loss (gain) on extinguishment of debt ...Other expense (income), net ...Income before income taxes ...Income tax expense ...Net income ...Preferred stock dividends ...Net income applicable to... -

Page 158

... of long-term debt ...Accounts payable ...Unearned revenue and customer deposits ...Accrued taxes ...Accrued interest ...Accrued payroll and benefits ...Other current liabilities ...Total current liabilities ...Long-term debt, less current portion ...Pension and postretirement benefit obligations... -

Page 159

... of long-term debt ...Net change in credit facility with initial maturities less than 90 days ...Repayment of debt ...Debt issuance costs and consent fees ...Issuance of common shares - exercise of stock options ...Preferred stock dividends ...Common stock repurchase ...Other ...Net cash used in... -

Page 160

... of pension and postretirement liabilities and other, net of taxes of $39.8 ...Comprehensive income ...Shares issued under employee plans ...Shares purchased under employee plans and other ...Stock-based compensation ...Repurchase of shares ...Retirement of shares ...Dividends on preferred stock... -

Page 161

...telecommunications services through businesses in three segments: Wireline, Wireless, and Technology Solutions. See Note 14 for information on the Company's reportable segments. The Company generates a large portion of its revenue by serving customers in the Greater Cincinnati and Dayton, Ohio areas... -

Page 162

... assured. Service revenue - The Company recognizes service revenue as services are provided. Revenue from local telephone, special access and data and internet product services, which are billed monthly prior to performance of service, and from prepaid wireless service, which is collected in advance... -

Page 163

... meet these levels, customers may be able to receive service credits for their accounts. The Company records these credits against revenue when an event occurs that gives rise to such credits. In multi-year data center and managed services arrangements with increasing or decreasing monthly billings... -

Page 164

...installation services. The Company recognizes revenue from the sale of the IT equipment upon completion of its contractual obligations, generally upon delivery of the IT equipment to the customer, and recognizes installation service revenue upon completion of the installation. Pricing of local voice... -

Page 165

... fair value of stock options is determined using the Black-Scholes option-pricing model using assumptions such as volatility, risk-free interest rate, holding period and dividends. The fair value of stock awards is based on the Company's share price on the date of grant. For all share-based payments... -

Page 166

... and risks used to compute the fair value of each category of plan assets. FSP No. 132(R)-1 becomes effective for fiscal years ending after December 15, 2009. Early adoption is permitted. As this statement relates only to disclosure, it will not have a financial impact on the Company. In June 2008... -

Page 167

...value amounts of and gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative instruments. SFAS No. 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008. As this statement... -

Page 168

... charge of $37.5 million in 2007 and $28.3 million in 2008, composed of the following: • Employee separation obligations - In the fourth quarter of 2007, the Company determined a need to reduce its headcount over the next five years to conform its Wireline operations to the decreased access lines... -

Page 169

... its union workforce on a new three-year labor agreement. As part of this agreement, the Company offered and, by March 31, 2008, 284 union employees accepted special termination benefits totaling $25 million. The Company determined that $22.1 million of these benefits had been earned through March... -

Page 170

... to consolidate data centers, reduce the Company's expense structure, exit the network construction business, eliminate other non-strategic operations and merge the digital subscriber line ("DSL") and certain dial-up internet operations into the Company's other operations. Impairment charges of $148... -

Page 171

...the new useful life. The increase in depreciation due to this acceleration was approximately $1.3 million in the fourth quarter of 2006 and $5.2 million in 2007. Form 10-K 5. Acquisitions of Businesses and Wireless Licenses CenturyTel In June 2008, the Company purchased the Dayton, Ohio operations... -

Page 172

...in the Technology Solutions segment and were immaterial to the Company's financial statements for the year ended December 31, 2008. Local Telecommunication Business In March 2007, the Company purchased a local telecommunication business ("Lebanon"), which offers voice, data and cable TV services, in... -

Page 173

... for the years ended December 31, 2008 and 2007, are as follows: (dollars in millions) Wireless Wireline Technology Solutions Total Balance as of December 31, 2006 ...Acquired during the year ...Balance as of December 31, 2007 ...Acquired during the year ...Purchase price allocation adjustment... -

Page 174

...interest rate swaps classified as fair value derivatives at December 31, 2008 and 2007. Corporate Credit Facilities In February 2005, Cincinnati Bell Inc. ("CBI"), the parent company, entered into a corporate credit facility ("Corporate credit facility") which has a $250.0 million revolving line of... -

Page 175

...credit because the customer prepaid for data center services. Voluntary prepayments of the Corporate credit facility and voluntary reductions of the unutilized portion of the revolving line of credit are permitted at any time at no cost to the Company. The average interest rate charged on borrowings... -

Page 176

... Company's subsidiaries such that the subsidiaries are not permitted to enter into an agreement that would limit their ability to make dividend payments to the parent; issuance of indebtedness; asset dispositions; transactions with affiliates; liens; investments; issuances and sales of capital stock... -

Page 177

... has a term of five years, expiring in March 2012. Under the Receivables Facility, CBT, CBET, CBW, Cincinnati Bell Any Distance Inc., and Cincinnati Bell Complete Protection Inc. sell their respective trade receivables on a continuous basis to CBF, a wholly-owned limited liability company. In turn... -

Page 178

... discounted to the present value. The Company had $54.3 million and $29.4 million in total indebtedness relating to capitalized leases, of which $47.2 million and $25.8 million was long-term debt, at December 31, 2008 and December 31, 2007, respectively. The underlying leased assets generally secure... -

Page 179

...906.1 million and $1,979.7 million, respectively. The estimated fair values at December 31, 2008 and 2007 were $1,523 million and $1,919 million, respectively. These fair values were estimated based on the year-end closing market prices of the Company's debt and of similar liabilities. SFAS No. 157... -

Page 180

... for trading or speculative purposes. In 2004 and 2005, the Company entered into a series of fixed-to-variable long-term interest rate swaps with total notional amounts of $450 million that qualify for fair value hedge accounting ("long-term interest rate swaps"). Fair value hedges offset changes in... -

Page 181

... increased equity by $47 million. As a result of the new union labor agreement and curtailment charge in the first quarter of 2008, the Company remeasured its union pension and postretirement obligations using revised assumptions, including modified retiree benefit payment assumptions and a discount... -

Page 182

... further discussion. Also related to the 2007-2008 restructuring plan, the Company incurred special termination benefit charges of $8.2 million in the fourth quarter of 2007 due to 105 management employees accepting these benefits. In the first quarter of 2008, the Company incurred an additional $22... -

Page 183

... plans' funded status follows: Pension Benefits 2008 2007 Postretirement and Other Benefits 2008 2007 (dollars in millions) Change in benefit obligation: Benefit obligation at January 1, ...Service cost ...Interest cost ...Amendments ...Actuarial loss (gain) ...Benefits paid ...Special termination... -

Page 184

... amount of long-term growth and income without undue exposure to risk. This is provided by a balanced strategy using fixed income and equity securities. The pension plans' assets consist of the following: Target Allocation 2009 Percentage of Plan Assets at December 31, 2008 2007 Plan assets: Fixed... -

Page 185

... assumptions used in accounting for the pension and postretirement benefit cost: Pension Benefits 2008 2007 2006 Postretirement and Other Benefits 2008 2007 2006 Discount rate ...Expected long-term rate of return on pension and health and life plan assets ...Future compensation growth rate ... 6.28... -

Page 186

... at the option of the holder into common stock of the Company at a conversion rate of 1.44 shares of Company common stock per depositary share of 6 3â„ 4% convertible preferred stock. Annual dividends of $10.4 million on the outstanding 6 3â„ 4% convertible preferred stock are payable quarterly in... -

Page 187

... data processing, professional and consulting and technical support services for the Company within CBT's operating territory. In return, the Company will be the exclusive provider of local telecommunications services to Convergys. The 2008 contract extension eliminated the Company's minimum annual... -

Page 188

...those related to title and authorization. The title and authorization indemnification was capped at 100% of the purchase price of the broadband assets, approximately $71 million. In order to determine the fair value of the indemnity obligations, the Company performed a probabilityweighted discounted... -

Page 189

... income statement, other comprehensive income, and retained earnings consists of the following: (dollars in millions) Year Ended December 31, 2008 2007 2006 Income tax provision (benefit) related to: Continuing operations ...Other comprehensive income (loss) ...Excess tax benefits or stock option... -

Page 190

... valuation allowance in 2008 relates primarily to the write off of Ohio net operating loss carryforwards, which were fully reserved, pursuant to the elimination of the Ohio corporate income tax during 2008. The Company adopted the provisions of FASB Interpretation No. 48, "Accounting for Uncertainty... -

Page 191

... make its annual grant of stock options and time-based restricted awards in December and annual performance-based awards in the first quarter. In addition, the Company has also historically granted a smaller number of stock-based awards at various times during the year for new employees, promotions... -

Page 192

... compensation expense related to these shares was $1.0 million, which is expected to be recognized over a weighted average period of two years. Stock Option Awards Generally, stock options have ten-year terms and vesting terms of three years. The following table provides a summary of the Company... -

Page 193

... years. The fair values at the date of grant were estimated using the Black-Scholes option-pricing model with the following weighted-average assumptions: 2008 2007 2006 Expected volatility ...Risk-free interest rate ...Expected holding period - years ...Expected dividends ...Weighted-average grant... -

Page 194

...million and an asset impairment charge of $1.2 million in 2008. The Wireless segment provides advanced, digital wireless voice and data communications services and sales of related handset equipment to customers in the Greater Cincinnati and Dayton, Ohio operating areas. This segment consists of the... -

Page 195

...Company's business segment information is as follows: (dollars in millions) Year Ended December 31, 2008 2007 2006 Revenue Wireline ...Wireless ...Technology Solutions ...Intersegment ...Total revenue ...Intersegment revenue Wireline ...Wireless ...Technology Solutions ...Total intersegment revenue... -

Page 196

..., in connection with a fifteen year contract for 25,000 square feet of data center space between Cincinnati Bell Technology Solutions ("CBTS") and a data center customer, CBI has guaranteed the performance obligations of CBTS in relation to providing the data center space and managed services under... -

Page 197

... company, as the guarantor, (2) CBT, as the issuer, and (3) the non-guarantor subsidiaries on a combined basis: Condensed Consolidating Statements of Operations Parent (Guarantor) Year Ended December 31, 2008 Other CBT (Non-guarantors) Eliminations (dollars in millions) Total Revenue ...Operating... -

Page 198

..., plant and equipment, net ...Goodwill and other intangibles, net ...Investments in and advances to subsidiaries ...Other noncurrent assets ...Total assets ...Current portion of long-term debt ...Accounts payable ...Other current liabilities ...Total current liabilities ...Long-term debt, less... -

Page 199

... activities ...Capital expenditures ...Acquisition of businesses and wireless licenses ...Other investing activities ...Cash flows used in investing activities ...Funding between Parent and subsidiaries, net ...Issuance of long-term debt ...Increase in Corporate credit facility, net ...Repayment of... -

Page 200

..., in connection with a fifteen year contract for 25,000 square feet of data center space between CBTS and a data center customer, CBI has guaranteed the performance obligations of CBTS in relation to providing the data center space and managed services under that long-term contract. In addition... -

Page 201

... ...Operating income (loss) ...Interest expense ...Other expense (income) ...Income (loss) before equity in earnings of subsidiaries and income taxes ...Income tax expense (benefit) ...Equity in earnings of subsidiaries, net of tax ...Net income ...Preferred stock dividends ...Net income applicable... -

Page 202

..., plant and equipment, net ...Goodwill and other intangibles, net ...Investments in and advances to subsidiaries ...Other noncurrent assets ...Total assets ...Current portion of long-term debt ...Accounts payable ...Other current liabilities ...Total current liabilities ...Long-term debt, less... -

Page 203

... activities ...Capital expenditures ...Acquisition of businesses and wireless licenses ...Other investing activities ...Cash flows used in investing activities ...Funding between Parent and subsidiaries, net ...Issuance of long-term debt ...Increase in Corporate credit facility, net ...Repayment of... -

Page 204

... ...Acquisition of businesses and wireless licenses ...Other investing activities ...Cash flows used in investing activities ...Funding between Parent and subsidiaries, net ...Repayment of debt ...Other financing activities ...Cash flows provided by (used in) financing activities ...Increase in cash... -

Page 205

... with generally accepted accounting principles. Cincinnati Bell Inc.'s management, with the participation of the Chief Executive Officer and Chief Financial Officer, have evaluated any changes in the Company's internal control over financial reporting that occurred during the fourth quarter of 2008... -

Page 206

... Mobile Communications from 1990-1992; Vice President, Sales and Marketing, General Electric Company from 1988-1990. BRIAN A. ROSS, Chief Operating Officer of the Company since August 2008; Chief Financial Officer of the Company from 2004 to July 2008; Senior Vice President of Finance and Accounting... -

Page 207

...A. FREYBERGER, Vice President and Controller of the Company since March 2005; Assistant Corporate Controller of Chiquita Brands International, Inc. from 2000 to March 2005; various financial reporting roles at Chiquita from 1996-2000. Items 11 and 12. Executive Compensation and Security Ownership of... -

Page 208

... dated November 30, 1998 among Cincinnati Bell Telephone Company, as Issuer, Cincinnati Bell Inc., as Guarantor, and the Bank of New York, as Trustee (Exhibit (4)(c)(iii)(3) to Annual Report on Form 10-K for the year ended December 31, 2004, File No. 1-8519). Warrant Agreement, dated as of March 26... -

Page 209

... L.P., and any other affiliate purchasers of Senior Subordinated Notes due 2009 (Exhibit 4(c)(viii)(4) to Annual Report on Form 10-K for the year ended December 31, 2004, File No. 1-8519). Fourth Amendment to Purchase Agreement, dated January 31, 2005, by and among Cincinnati Bell Inc., GS Mezzanine... -

Page 210

...Report March 26, 2008, File No. 1-8519). Asset Purchase Agreement, dated November 30, 2007 among Cincinnati Bell Any Distance Inc. as Buyer, eGIX, Inc. and eGIX Network Services, Inc as Sellers, and the Seller's respective subsidiaries and principal shareholders (Exhibit (10)(ii)(A) to Annual Report... -

Page 211

... Employment Agreement effective as of January 1, 2009 between Cincinnati Bell Inc. and Brian A. Ross. Cincinnati Bell Inc. 2007 Long Term Incentive Plan (Appendix A to the Company's 2007 Proxy Statement on Schedule 14A filed March 14, 2007, File No. 1-8519). Cincinnati Bell Inc. 2007 Stock Option... -

Page 212

... Stock Agreement (2007 Long Term Incentive Plan). Cincinnati Bell Inc. Form of 2008-2010 Performance Share Agreement (2007 Long Term Incentive Plan). Code of Ethics for Senior Financial Officers, as adopted pursuant to Section 406 of Regulation S-K (Exhibit (10)(iii)(A)(15) to Annual Report... -

Page 213

... + * Filed herewith. Management contract or compensatory plan required to be filed as an exhibit pursuant to Item 15(a)(3) of the Instructions to Form 10-K. The Company's reports on Form 10-K, 10-Q, 8-K, proxy and other information are available free of charge at the following website: http://www... -

Page 214

... CINCINNATI BELL INC. VALUATION AND QUALIFYING ACCOUNTS (dollars in millions) Beginning of Period Charge (Benefit) to Expenses To (from) Other Accounts Deductions End of Period Allowance for Doubtful Accounts Year 2008 ...Year 2007 ...Year 2006 ...Deferred Tax Valuation Allowance Year 2008 ...Year... -

Page 215

... duly authorized. CINCINNATI BELL INC. February 26, 2009 By /s/ Gary J. Wojtaszek Gary J. Wojtaszek Chief Financial Officer By /s/ Kurt A. Freyberger Kurt A. Freyberger Chief Accounting Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by... -

Page 216

Signature Title Date JOHN M. ZRNO* John M. Zrno Director February 26, 2009 *By: /s/ John. F. Cassidy John F. Cassidy as attorney-in-fact and on his behalf as Principal Executive Officer, President and Chief Executive Officer, and Director February 26, 2009 116 -

Page 217

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 218

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 219

... President of Business Development and Investor Relations (513) 397-1118 Transfer Agent and Registrar Questions regarding registered shareholder accounts or the Stock Purchase Plan should be directed to Cincinnati Bell's transfer agent and registrar: Computershare Investor Services, LLC Shareholder... -

Page 220

221 East Fourth Street P.O. Box 2301 Cincinnati, Ohio 45202 513.397.9900 www.cincinnatibell.com