Cincinnati Bell 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company determines its effective tax rate by dividing its income tax expense by its net income

before taxes as reported in its statement of operations. For reporting periods prior to the end of the Company’s

fiscal year, the Company records income tax expense based upon an estimated annual effective tax rate. This

rate is computed using the statutory tax rate and an estimate of annual net income adjusted for an estimate of

non-deductible expenses.

The Company has certain non-deductible expenses, including interest expense related to securities issued

to acquire its broadband business. During 2004 these non-deductible expenses were offset by benefits recorded

to reduce the state deferred tax valuation allowance due to changes in utilization estimates of state net

operating loss carryforwards. Excluding the effects of the reduction in the state valuation allowance, the

Company’s effective tax rate would exceed statutory rates and the effective rate will vary inversely with the

amount of its income before tax.

Allowances for Uncollectible Accounts Receivable — The Company estimates the allowances for

uncollectible accounts using both percentages of aged accounts receivable balances to reflect the historical

average of credit losses and specific provisions for certain large, potentially uncollectible balances. The

Company believes its allowance for uncollectible accounts is adequate based on the methods previously

described. However, if one or more of the Company’s larger customers were to default on its accounts

receivable obligations or general economic conditions in the Company’s operating area deteriorated, the

Company could be exposed to potentially significant losses in excess of the provisions established.

Substantially all of the Company’s outstanding accounts receivable balances are with entities located within its

geographic operating areas. Regional and national telecommunications companies account for the remainder of

the Company’s accounts receivable balances. No one entity or collection of legally affiliated entities represents

10% of the outstanding accounts receivable balances.

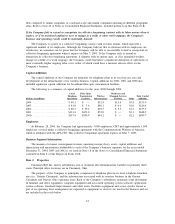

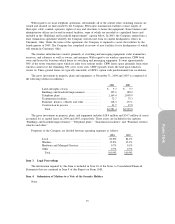

Estimated Useful Lives and Depreciation of Property, Plant and Equipment — The Company’s

provision for depreciation of telephone plant is determined on a straight-line basis using the whole life and

remaining life methods. Provision for depreciation of other property, other than leasehold improvements, is

based on the straight-line method over the estimated economic useful life. Depreciation of leasehold

improvements is based on a straight-line method over the lesser of the economic useful life or term of the

lease, including option renewal periods if renewal of the lease is probable. Repairs and maintenance expense

items are charged to expense as incurred.

The Company estimates the useful lives of plant and equipment in order to determine the amount of

depreciation and amortization expense to be recorded during any reporting period. The majority of the Local

segment plant and equipment is depreciated using the group method, which develops a depreciation rate

(annually) based on the average useful life of a specific group of assets rather than for each individual asset as

would be utilized under the unit method. The estimated life of the group changes as the composition of the

group of assets and their related lives changes. Such estimated life of the group is based on historical

experience with similar assets, as well as taking into account anticipated technological or other changes. If

technological changes were to occur more rapidly than anticipated or in a different form than anticipated, the

useful lives assigned to these assets may need to be shortened, resulting in the recognition of increased

depreciation and amortization expense in future periods. Likewise, if the anticipated technological or other

changes occur more slowly than expected, the life of the group could be extended based on the life assigned

to new assets added to the group. This could result in a reduction of deprecation and amortization expense in

future periods. A one-year decrease or increase in the useful life of these assets would increase or decrease

depreciation and amortization expense by approximately $16.2 million and $11.0 million, respectively. The

Company has reviewed these types of assets for impairment whenever events or circumstances indicate that

the carrying amount may not be recoverable over the remaining lives of the assets. In assessing impairments,

the Company follows the provisions of Statement of Financial Accounting Standards No. 144 “Accounting for

the Impairment or Disposal of Long-Lived Assets” (“SFAS 144”).

During the fourth quarter of 2003, the Company revised the estimated economic useful life of its wireless

TDMA network due to the expected migration of its TDMA customer base to its GSM/GPRS network. The

Company shortened its estimate of the remaining economic useful life of its TDMA network to December 31,

2006. This has resulted in a $20.6 million increase in accumulated depreciation during 2004. If the migration

21

Form 10-K