Cincinnati Bell 2004 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

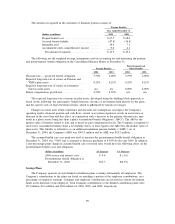

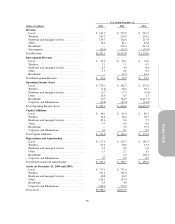

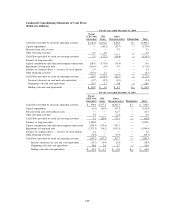

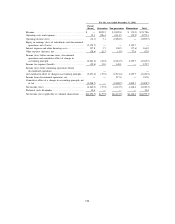

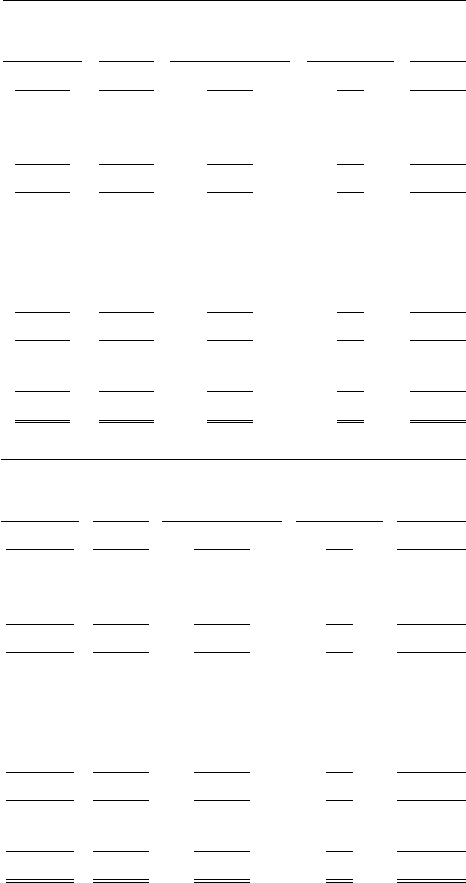

Condensed Consolidating Statements of Cash Flows

(dollars in millions)

For the year ended December 31, 2004

Parent

(CBT Note

Guarantor)

CBT

Issuer

Other

(Non-guarantors) Eliminations Total

Cash flows provided by (used in) operating activities .... $ (33.5) $ 251.2 $ 83.0 $— $ 300.7

Capital expenditures .................................. — (80.2) (53.7) — (133.9)

Proceeds from sale of assets ........................... — — 3.3 — 3.3

Other investing activities .............................. 3.3 3.0 — 6.3

Cash Flows provided by (used in) investing activities .... 3.3 (77.2) (50.4) — (124.3)

Issuance of long-term debt ............................. — — — — —

Capital contributions and other intercompany transactions 206.8 (173.4) (33.4) — 0.0

Repayment of long-term debt .......................... (169.5) (3.0) 0.7 — (171.8)

Issuance of common shares — exercise of stock options . 2.4 — — — 2.4

Other financing activities .............................. (10.2) 2.1 — — (8.1)

Cash Flows provided by (used in) financing activities .... 29.5 (174.3) (32.7) — (177.5)

Increase (decrease) in cash and cash equivalents ...... (0.7) (0.3) (0.1) — (1.1)

Beginning cash and cash equivalents ................. 23.5 1.7 0.8 — 26.0

Ending cash and cash equivalents .................... $ 22.8 $ 1.4 $ 0.7 $— $ 24.9

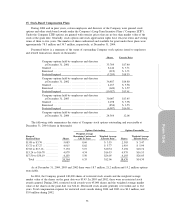

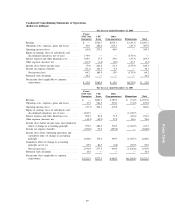

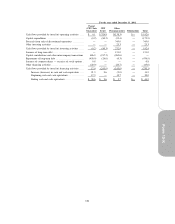

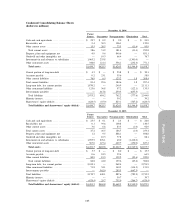

For the year ended December 31, 2003

Parent

(CBT Note

Guarantor)

CBT

Issuer

Other

(Non-guarantors) Eliminations Total

Cash flows provided by (used in) operating activities .... $ 339.0 $ 277.3 $(305.7) $— $ 310.6

Capital expenditures .................................. (0.1) (81.0) (45.3) — (126.4)

Proceeds from sale of broadband assets ................. — — 82.7 — 82.7

Other investing activities .............................. 3.2 — (2.3) — 0.9

Cash Flows provided by (used in) investing activities .... 3.1 (81.0) 35.1 — (42.8)

Issuance of long-term debt ............................. 1,390.0 — — — 1,390.0

Capital contributions and other intercompany transactions (299.3) (173.0) 472.3 — —

Repayment of long-term debt .......................... (1,371.3) (24.2) (195.1) — (1,590.6)

Issuance of common shares — exercise of stock options . 2.2 — — — 2.2

Other financing activities .............................. (78.8) — (9.5) — (88.3)

Cash Flows provided by (used in) financing activities .... (357.2) (197.2) 267.7 — (286.7)

Increase (decrease) in cash and cash equivalents .... (15.1) (0.9) (2.9) — (18.9)

Beginning cash and cash equivalents .............. 38.6 2.6 3.7 — 44.9

Ending cash and cash equivalents ................. $ 23.5 $ 1.7 $ 0.8 $— $ 26.0

100