Cincinnati Bell 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

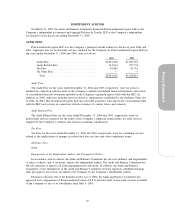

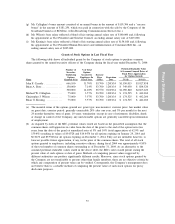

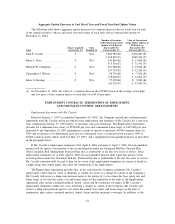

(a) Includes common shares subject to outstanding options under the Cincinnati Bell Inc. 1997 Long Term

Incentive Plan and the Directors Stock Option Plan that are exercisable by such individuals within 60

days. The following options are included in the totals: 34,000 common shares for Mr. Byrnes; 502,570

common shares for Mr. Callaghan; 1,908,670 common shares for Mr. Cassidy; 76,925 common shares for

Mr. Cox; 80,625 common shares for Ms. Hoguet; 81,620 common shares for Mr. Keating; 25,000

common shares for Mr. Mahoney; 70,000 common shares for Mr. Meyer; 34,000 common shares for

Mr. Morris; 61,000 common shares for Mr. Redfield; 247,970 common shares for Mr. Ross; 73,250

common shares for Mr. Sharrock; 64,520 common shares for Mr. Wilson; and 1,132,650 common shares

for Mr. Zrno.

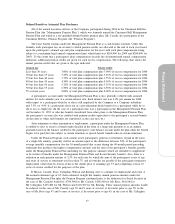

(b) As reported on a Schedule 13G/A filed on February 15, 2005, as of December 31, 2004, Legg Mason

Funds Management, Inc. owned 11,844,000 common shares, LLM, LLC owned 2,632,800 common

shares, and Legg Mason Capital Management, Inc. owned 1,348,200 common shares.

(c) As reported on Schedule 13G filed on February 14, 2005, as of December 31, 2004, Brandes Investment

Partners, LP and its affiliates, owned 16,719,209 common shares.

(d) As reported on Schedule 13G filed on January 25, 2005 by Shapiro Capital Management Company, Inc.,

as of December 31, 2004, owned 14,989,314 common shares.

(e) As reported on Schedule 13G filed on February 14, 2005 by Barclays Global Investors, NA, as of

December 31, 2004, Barclays Global Investors, NA owned 9,168,260 common shares, Barclays Global

Fund Advisors owned 4,505,176 common shares and Palomino Limited owned 157,100 common shares.

(f) As reported on Schedule 13F filed on February 11, 2005 by Gabelli Asset Management Company, as of

December 31, 2004, Gabelli Asset Management Company owned 10,044,200 common shares and Gabelli

Funds, LLC owned 3,935,000 common shares.

(g) As reported on Schedule 13G/A filed on February 14, 2005, Citadel Limited Partnership and its affiliates,

as of December 31, 2004, owned 13,356,950 common shares.

(h) These numbers are based upon 246,538,383 common shares outstanding as of the Record Date.

(i) These numbers represent 6

3

⁄

4

% Convertible Preferred Shares. In the aggregate, the 155,250 outstanding

6

3

⁄

4

% Convertible Preferred Shares are represented by 3,105,000 Depositary Shares and each 6

3

⁄

4

%

Convertible Preferred Share is represented by 20 Depositary Shares.

(j) As reported on Schedule 13F filed on February 11, 2005 by Gabelli Asset Management Company, as of

December 31, Gabelli Asset Management Company owned 3,042.5 6

3

⁄

4

% Convertible Preferred Shares

(which are represented by 60,850 Depositary Shares) and Gabelli Funds, LLC owned 6,400 6

3

⁄

4

%

Convertible Preferred Shares (which are represented by 128,000 Depositary Shares).

EXECUTIVE COMPENSATION

Any general statement that incorporates this Proxy Statement into any filing under the Securities Act of

1933 or under the Securities Exchange Act of 1934 shall not be deemed to incorporate by reference this

Compensation Committee Report on Executive Compensation and related disclosure. Except to the extent the

Company specifically incorporates such Report and related disclosure by reference, this information shall not

otherwise be deemed to have been filed under such Acts.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors administers Cincinnati Bell’s executive

compensation program. The Compensation Committee, which is composed of non-employee directors, is

responsible for approving and reporting to the Board on all elements of compensation for the Company’s

Chief Executive Officer and other executive officers. The Committee has a written charter that sets forth

its duties and responsibilities, including the requirement to conduct annually a self-assessment of the

Committee’s performance. The Compensation Committee Charter is available on the Company’s website,

www.cincinnatibell.com, in the Corporate Governance Section of the Corporate Information webpage. Further,

the Committee retains Mr. Charles Mazza, a consultant independent of the Company, to assist it in evaluating

matters presented to the Committee as well as the operation of the Committee itself.

29

Proxy Statement